CRISPR Therapeutics Partners with Sirius on New siRNA Therapies

CRISPR Therapeutics (CRSP) has announced a collaboration with privately held Sirius Therapeutics, based in San Diego, to develop and commercialize innovative siRNA therapies.

This strategic partnership will broaden CRISPR Therapeutics’ pipeline by introducing Sirius’s lead candidate, SRSD107. This next-generation, long-acting siRNA therapy is currently in early to mid-stage studies targeting thromboembolic disorders.

SRSD107 specifically targets Factor XI, a crucial factor in thromboembolic events that impact millions globally.

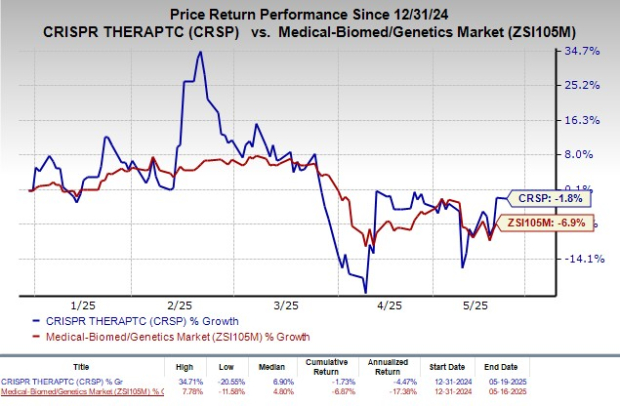

As of now, CRISPR Therapeutics’ shares have declined by 1.8% year-to-date, outperforming the industry’s overall decline of 6.9%.

Image Source: Zacks Investment Research

Details of the CRSP and Sirius Collaboration

According to the latest agreement, CRISPR Therapeutics will provide an upfront cash payment of $25 million and an additional $70 million in equity to Sirius Therapeutics. The partnership involves joint development of SRSD107, with shared costs and profits. Upon approval, CRSP will handle commercialization in the United States, while Sirius will manage this aspect in Greater China.

Moreover, CRISPR Therapeutics will have the option to exclusively license up to two siRNA programs. The company will completely fund the research activities and retain rights to lead clinical development and commercialization for each respective target. Sirius will also receive milestone payments, along with tiered royalties on net sales.

Initial phase I studies indicated that SRSD107 treatment resulted in peak reductions of over 93% in FXI levels and activity, alongside more than a twofold increase in activated partial thromboplastin time compared to baseline metrics.

If developed successfully, SRSD107 could become a best-in-class therapy for patients at risk of life-threatening thromboembolic events caused by conditions such as malignancy, cardiovascular disease, and hyper-coagulability.

A phase II study evaluating the safety and efficacy of SRSD107 for preventing venous thromboembolism in patients undergoing total knee arthroplasty has commenced, aiming to validate the anticoagulant advantages of SRSD107.

Recent Approval of Casgevy Enhances CRSP’s Position

CRISPR Therapeutics and its partner Vertex Pharmaceuticals (VRTX) secured approval for Casgevy, a CRISPR/Cas9 gene-edited therapy, targeting two blood disorders: sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT). This approval marks a significant achievement in medical science as the first approval for a CRISPR-based gene-editing therapy worldwide, addressing an essential unmet medical need.

Vertex plays a leading role in global development, manufacturing, and commercialization of Casgevy, splitting program costs and profits in a 60:40 ratio with CRISPR Therapeutics.

Moreover, CRISPR Therapeutics is advancing several next-generation gene-edited cell therapy programs, including allogeneic chimeric antigen receptor T cell (CAR T) candidates aimed at treating hematological cancers, solid tumors, and various autoimmune diseases.

CRISPR Therapeutics’ Zacks Rank and Stock Comparisons

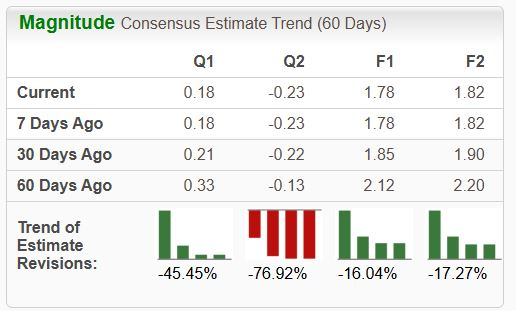

Currently, CRISPR Therapeutics holds a Zacks Rank #3 (Hold).

Comparatively, Halozyme Therapeutics (HALO) and Amarin Corporation (AMRN) boast better rankings with a Zacks Rank #2 (Buy) each. Recent earnings estimates have shown growth for both companies. Halozyme’s earnings per share estimates for 2025 have risen from $4.75 to $4.95, and 2026 estimates increased from $6.27 to $6.47, with HALO shares climbing 11.5% year-to-date.

For Amarin, estimates for losses per share have narrowed, moving from $5.33 to $3.48 for 2025 and from $4.13 to $2.67 for 2026. AMRN shares have also increased by 12.4% year-to-date.

Amarin has surpassed earnings estimates in two of the last four quarters, while meeting expectations once and falling short once, averaging a surprise of 24.11%.