Why Crocs Clogs Make for a Valuable Stock Investment

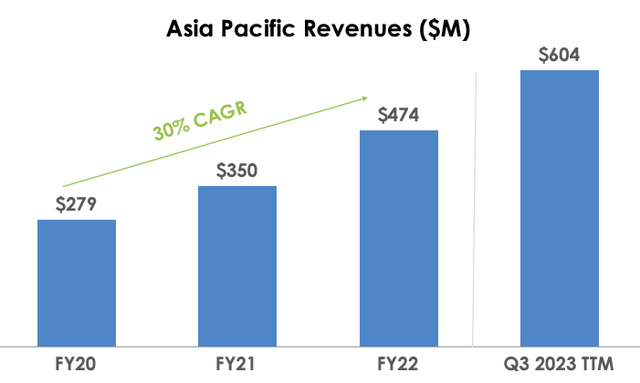

As a consumer who values the durability and comfort provided by Crocs (NASDAQ:CROX) clogs at a reasonable price, my belief in the product extends to the stock’s investment potential. The company has exhibited significant pricing power, resulting in a remarkable twofold increase in operating margin from pre-pandemic levels, despite the unparalleled inflation of 2021 and 2022. While North American revenue growth is slowing, Crocs has promising growth prospects in Asia, home to 60% of the global population. Additionally, the stock’s current undervaluation of around 40% presents a compelling investment opportunity, meriting a “Strong Buy” recommendation.

Crocs: A Snapshot

Crocs, along with its subsidiaries, specializes in designing, developing, marketing, distributing, and selling casual lifestyle footwear and accessories for women, men, and children. The company’s fiscal year ends on December 31. Crocs disaggregates its revenues by brands and geographic areas. Notably, the recent acquisition of the HEYDUDE brand in February 2022 signifies the company’s strategic expansion.

Crocs’ Financial Performance

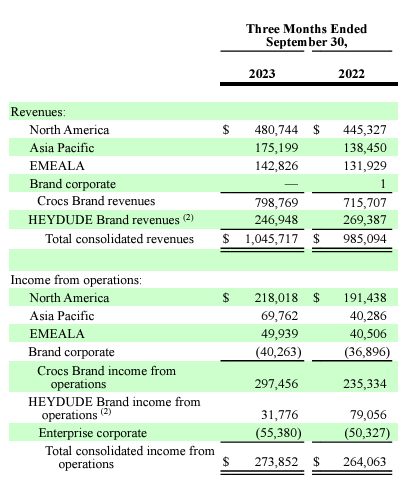

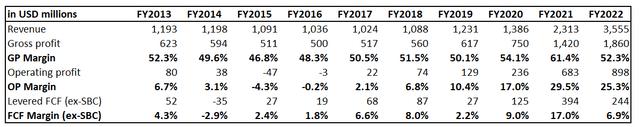

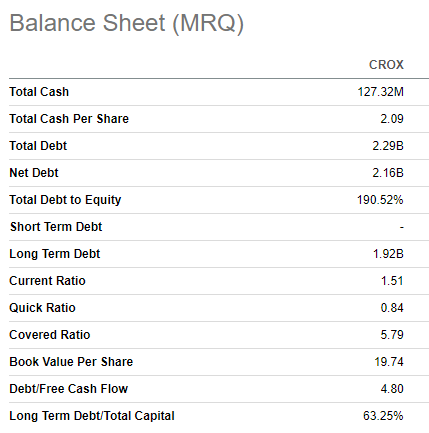

Over the past decade, Crocs has delivered solid financial performance, with revenue compounding at an impressive 13% CAGR. As the business has scaled up, Crocs has demonstrated strong operating leverage, with the operating margin expanding from 6.7% to 25.3%. The company is not very capital intensive and does not pay dividends, which enables it to generate a wide free cash flow (FCF) margin, even in the wake of significant investments such as the $2 billion acquisition of the HEYDUDE footwear brand. The consistently positive FCF margin and widening operating profitability allow Crocs to maintain a healthy balance sheet, with strong liquidity and an advantageous leverage structure.

The latest quarterly earnings report released on November 2 exceeded consensus estimates, with a 6% year-over-year growth in revenue and an expanded adjusted EPS. Looking ahead, while there are pessimistic forecasts for Q4, the company’s solid financial performance, resilient operational margins, and a history of positive surprises provide a rationale for optimism.

As the company gears up to release its upcoming quarter’s earnings, it is worth noting that its recognized brand strength, best-in-class profitability, and substantial global recognition provide a solid foundation for future international expansion. Despite decelerating growth in North America, Crocs is experiencing significant traction in Asia, positioning the region as a critical long-term growth driver. With Asia being home to nearly 60% of the global population, the company’s strategic focus on this dynamic market aligns with its growth ambitions.

Crocs: A Potential Surge in Digital Sales and Global Expansion

A significant catalyst for potential revenue growth and enhanced profitability at CROX could stem from the increased penetration of digital sales in the overall revenue mix. According to the latest earnings presentation, digital sales currently account for 38% of the total revenue, indicating considerable room for further improvement and expansion. The anticipated compound annual CAGR of 12.2% in the global e-commerce market by 2030 presents a substantial tailwind. Crocs is well-positioned to capitalize on this trend, given its proven track record of success. Furthermore, the e-commerce platform is a potent tool for Crocs to extend its presence beyond North America without spending on opening its stores.

Beyond the massive brand and promising growth opportunities in the Asia Pacific region, it’s crucial to highlight the strategic and marketing agility of Crocs’ management. The proficiency in securing numerous collaborations with popular franchises and celebrities is stellar. A glance at the company’s official website reveals a diverse array of partnerships, showcasing the brand’s adaptability and broad appeal. From Russian pop band Little Big to South Korean sensation PSY, Hollywood icon Drew Barrymore, and collaborations with entities like Pixar’s Cars and Levi’s, Crocs has successfully navigated varied markets and demographics, solidifying its position as a versatile and globally recognized brand.

Potential for Enhanced Valuation

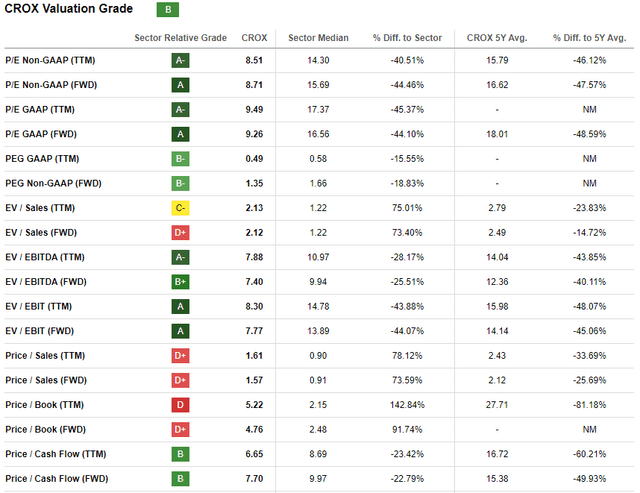

CROX price plunged by 12% over the last twelve months, substantially lagging behind the broader U.S. stock market. The stock has an attractive “B” valuation grade from Seeking Alpha Quant. Indeed, most of the valuation ratios are substantially lower than the sector median and the company’s historical averages.

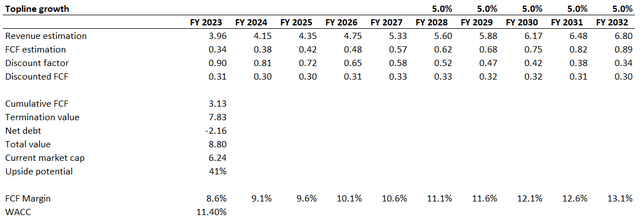

The company does not pay out dividends, so the discounted cash flow [DCF] simulation looks like the only option to proceed with. I use an 11.4% rate for discounting, which is a WACC recommended by Gurufocus. Consensus revenue estimates are available up to FY2027. For the years beyond, I have used a 10% revenue CAGR, which looks fair enough given the acquisition of the HEYDUDE brand, growth prospects in Asia Pacific, and the ability to demonstrate marketing flexibility with a wide array of collaborations with well-known names and brands. Moreover, I want to emphasize that the mix of consensus estimates and my revenue growth projection after FY2027 gives a 6% CAGR for the whole decade, which is very conservative compared to the past decade’s 13% CAGR. I use a TTM 8.6% FCF ex-SBC margin and expect a half-a-percentage point yearly expansion.

My simulation shows the business’s fair value is $8.8 billion. This is 41% higher than the current market cap and looks like a very attractive valuation to me.

Risks and Bottom Line

Crocs has enjoyed notable success in recent years; however, its prosperity is tightly linked to prevailing fashion trends. Given the dynamic nature of consumer preferences, any shift away from the current priority on comfort-focused footwear could significantly undermine the brand’s positioning, adversely affecting the company’s financial performance. This vulnerability can be proactively mitigated if the management can efficiently diversify the portfolio with complementary brands that will not directly compete with Crocs. Such a strategic move would help safeguard against fluctuations in fashion trends and contribute to a more resilient position within the ever-evolving fashion industry.

While the popularity of Crocs presents a clear advantage, it simultaneously poses a potential risk. The brand’s widespread popularity makes its products susceptible to illegal replication, often sold at much cheaper prices by smaller manufacturers in regions with lower labor costs. This might undermine Crocs’ market position and popularity in countries producing these unauthorized replicas.

Significant uncertainty surrounds Crocs’ ability to fully unlock the potential synergies from the HEYDUDE acquisition. The substantial $2 billion investment, particularly notable for a company of Crocs’ scale, raises concerns about the successful integration. The failure to absorb all planned benefits could potentially result in a massive disappointment among investors. Such an outcome may have prolonged implications, requiring several quarters for Crocs to rebuild investor confidence in the stock.

To conclude, Crocs’ stock is a “Strong Buy”. The company has a massive brand recognition, which results in solid pricing power. This helps expand and sustain comprehensive operating profitability, ultimately likely improving the company’s FCF. I like the capital allocation approach with a fortress balance sheet and long-term debt repayable only in 2029 and after that. Furthermore, my valuation analysis suggests that the stock is massively undervalued.