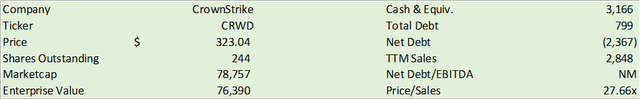

CrowdStrike Holdings (NASDAQ:CRWD) is poised to ride a powerful wave of IT and cybersecurity spending as companies prepare their budgets for the upcoming fiscal year. With a robust 13.8% growth in software spending predicted by Gartner and 80% of CIOs looking to increase cybersecurity budgets in CY24, corporate leaders are on the lookout for projects that can drive cost-efficiency without compromising effectiveness. CrowdStrike, with its Falcon Go, Cloud Service Suite, and Charlotte AI, appears well-positioned to capitalize on this trend across both small and large-scale enterprises. Their performance in q3’24, amidst economic uncertainty, underscores their resilience. As CEOs gain confidence, the sales pipeline for CrowdStrike is likely to strengthen, painting a promising picture for their eFY25. With this in mind, I recommend a BUY rating for CRWD shares, setting a price target of $482.86/share at 30x eFY25 sales.

Operational Performance

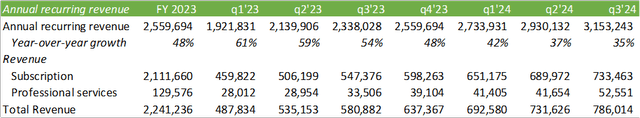

CrowdStrike’s q3’24 results surpassed expectations, achieving $3.15 billion in Annual Recurring Revenue (ARR), marking a 35% year-on-year growth with a quarterly ARR addition of $233 million.

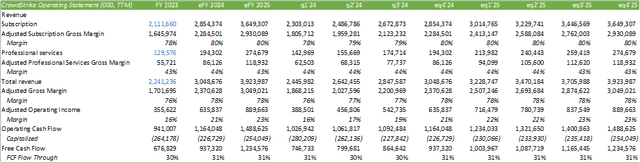

Looking ahead, the company aims to grow their ARR to $10 billion in the next 5-7 years. Considering CrowdStrike’s current growth trajectory, this target seems within reach. Bolstering their position further is the excitement surrounding GenAI and the integration of Large Language Models (LLMs), alongside the increasing threat of malicious actors using AI-related methods to breach systems. CrowdStrike’s operational goals appear attainable in the context of an above-par growth trajectory, the promise of GenAI and LLMs, and the mounting AI-driven cybersecurity threats. The company’s long-term objectives include subscription gross margins of 82-85%, operating margins of 28-23%, and a free cash flow through of 34-38%, all of which seem achievable with scaling. Management’s “rule of 60” metric, representing the sum of free cash flow margin and top-line growth, hit 66% in the last quarter, suggesting that the company is normalizing at a higher rate.

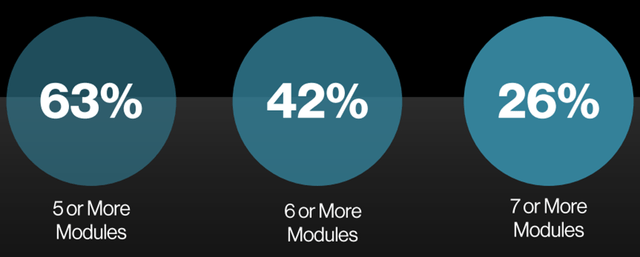

Module adoption has surged, with customer adoption rates reaching 63%/42%/26% for 5/6/7+ modules. As businesses transition from disparate products to a unified platform approach, it’s reasonable to expect these figures to continue growing. CrowdStrike’s platform suite seems well-equipped to integrate and secure data across both on-premises and public cloud environments. The newly introduced DLP feature, Falcon Data Protection, can monitor data flow and ensure security across all platforms. Notably, these features are expected to gain momentum as more companies embrace and unleash the potential of GenAI and LLMs. Against the backdrop of IT projects in 2024 emphasizing cost-saving measures, these features are poised to elevate operational efficiency. The addressable market for AI-native security platforms is projected to reach $100 billion in CY24 and $225 billion in CY28. Much like Palantir’s AI-driven narrative for 2024, CrowdStrike is well-positioned for accelerated growth in the AI cybersecurity domain.

CrowdStrike’s no-code application development platform, Falcon Foundry, is expected to enhance technical capabilities and bridge the skills gap in cybersecurity departments, making different platform offerings more accessible. According to CrowdStrike’s website, the average security team manages over 45 tools, and the ability for these tools to communicate effectively is crucial. With 51% of organizations facing budget constraints for their cybersecurity needs, the Falcon Foundry platform has the potential to drive cost savings, automation, and improved threat detection.

On the SMB front, CrowdStrike’s Falcon Go platform, available through Amazon Marketplace, offers a suite of products for small businesses. Priced at a competitive $4.99/device/month with a 5-device minimum, Falcon Go, an AI-powered antivirus tool, is tailor-made for smaller customers looking to safeguard their data. Although it may not result in multimillion-dollar deals for CrowdStrike, it has the capacity to scale and capture a sizable share of the vast SMB market.

The beta testing of Charlotte AI, CrowdStrike’s generative AI-powered SOC feature, has received positive feedback. Anticipated as a game-changer, Charlotte AI is designed to empower a tier 1 SOC analyst to operate at the level of a tier 3 analyst. As a result, customers are leaning towards CrowdStrike’s AI-native Falcon XDR platform, a comprehensive security solution. This platform harnesses advanced AI/ML and custom LLMs to swiftly and effectively detect malicious behavior.

Overall, CrowdStrike’s operations are highly profitable, boasting an adjusted gross subscription margin of over 80%, tallying up to a total adjusted gross margin of 78%. The foreseeable future holds the promise of further increasing gross margins as the company expands its AI-enabled tool set, aligning with the mounting focus on AI-driven solutions in the corporate landscape. I anticipate robust and consistent revenue growth combined with improving margins as the company steers towards long-term profitability goals.

The Future of Cybersecurity: Analyzing CrowdStrike’s Market Potential

Positive Growth Indicators

CrowdStrike (CRWD) has exhibited remarkable growth, with a surge in revenues of 86% year-over-year in Q1 FY22. With consistent expansion and an estimated increase in margins by eFY25, the company is on a promising trajectory. This growth momentum may be sustained through eFY27, denoting a compelling growth narrative for the firm.

Negative Risk Factors

Despite the promising growth story, negative catalysts such as a premium valuation compared to peers and potential signs of a slowdown in hiring within cybersecurity departments pose risks. Additionally, challenges at the CISO level due to new SEC disclosure rules might create headwinds for sales growth. However, CrowdStrike’s involvement in the NIST AISIC consortium and its pioneering role in developing AI security standards may mitigate some of these risks.

Valuation & Shareholder Value

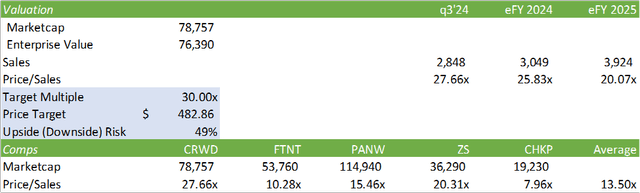

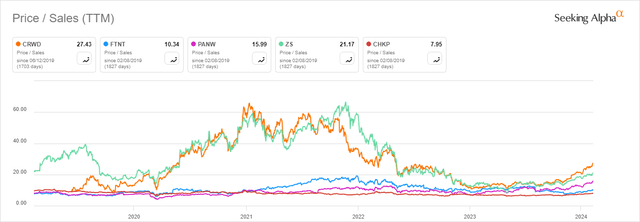

CRWD shares currently trade at a significant premium to its peer cybersecurity companies at 27.66x sales. While this is substantially expensive, its strong growth and ability to generate strong free cash flow may justify the valuation. Projecting forward to eFY25, the company has potential for further price appreciation. With a price target of $482.86/share and a BUY recommendation at 30x eFY25 sales, CRWD holds promise for investors.

Historically, CRWD has traded at a higher premium compared to its peer group of cybersecurity firms, emphasizing the company’s strong market position.

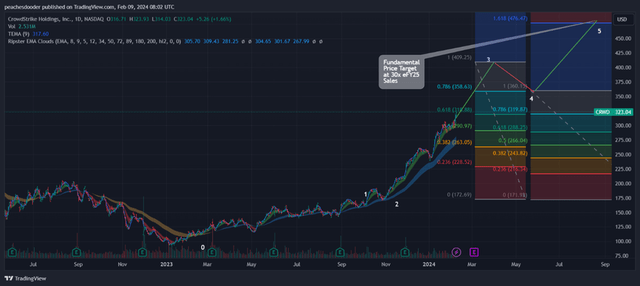

Tactical Trading

From a technical standpoint, it is anticipated that CRWD shares will experience a run-up to around $400/share, followed by a retracement before potentially reaching the $480/share mark. This growth is underpinned by the positive macro outlook for the cybersecurity and GenAI space, which is expected to drive increasing business interest in CrowdStrike’s product suite.