Crypto Market Daily Recap: Bitcoin and Altcoins Surge on April 4

Bitcoin and Ethereum Price Movements

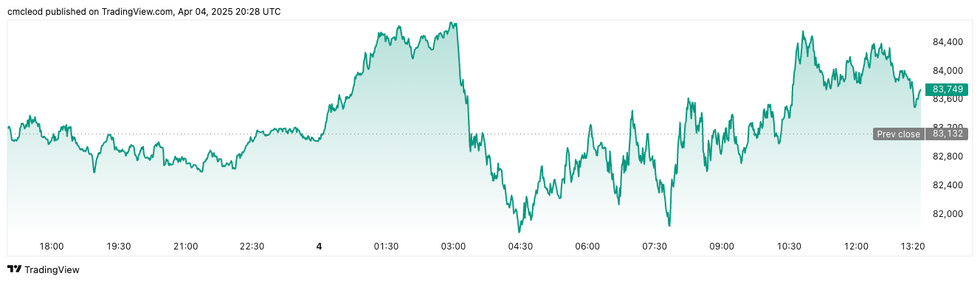

As of 9:00 p.m. UTC, Bitcoin (BTC) has risen to US$83,879.15, marking a 2.3 percent increase in the last 24 hours. On this trading day, Bitcoin’s price varied between a low of US$81,950.04 and a high of US$84,497.52.

Chart via TradingView.

Bitcoin performance, April 4, 2025.

The cryptocurrency market displayed signs of recovery as Friday’s trading session closed. Recent announcements by US President Donald Trump regarding new global tariffs have caused instability in financial markets, particularly affecting risk assets.

Ethereum (ETH) is currently priced at US$1,808.88, reflecting a 1.3 percent increase over 24 hours. During this period, Ethereum’s price fluctuated between an intraday low of US$1,772.16 and a peak of US$1,823.14.

Recent Altcoin Developments

- Solana (SOL) is valued at US$122.36, having increased by 6.2 percent in the past 24 hours, with fluctuations from a low of US$114.16 to a high of US$123.31.

- XRP is trading at US$2.12, representing a 3.5 percent rise over the last day, with an intraday range of US$2.04 to US$2.15.

- Sui (SUI) is priced at US$2.27, up 2.4 percent in the same timeframe, reaching a low of US$2.18 and a high of US$2.30.

- Cardano (ADA) is currently trading at US$0.6606, with a 3.5 percent increase since yesterday, saw a low of US$0.6325 and a high of US$0.6667 today.

Key Cryptocurrency News

Trump’s Family Ventures into Crypto Following Business Challenges

Eric Trump disclosed to CNBC that the Trump Organization is transitioning into the cryptocurrency space due to what he terms “unprecedented financial deplatforming.”

Facing significant legal issues and banking restrictions—including the shuttering of over 300 accounts by Capital One Financial (NYSE:COF)—the Trump brothers opted to explore digital asset investments.

This pivot resulted in the establishment of World Liberty Financial, a stablecoin project tied to the US dollar, and American Bitcoin, a Bitcoin-mining enterprise co-founded with Hut 8 (NASDAQ:HUT) CEO Asher Genoot.

Eric Trump elaborated that the shift toward cryptocurrency was motivated by financial prospects as well as a response to regulatory pressures. He criticized major banks for closing accounts that simply held Bitcoin and pointed to legal actions targeting crypto companies.

With Donald Trump potentially returning to the presidency, there’s an expectation of a more favorable stance towards cryptocurrency, highlighted by an executive order aimed at establishing a strategic Bitcoin reserve and the pardon of Silk Road founder Ross Ulbricht.

Paul Atkins Advances Toward SEC Chair Confirmation

The Senate Committee on Banking voted on Thursday (April 3) to advance Paul Atkins’ nomination as chair of the US Securities and Exchange Commission (SEC), passing with a close 13 to 11 vote.

If confirmed, Atkins will succeed Gary Gensler, who stepped down on January 20, with Gensler’s term running until June 2026. Atkins will serve a second consecutive term that ends in 2031.

The nomination will proceed to a full Senate vote at an undetermined future date, with experts forecasting a positive outcome. Mark Uyeda currently holds the interim chair position.

Coinbase Seeks to Launch XRP Futures Contracts

Coinbase Global (NASDAQ:COIN) filed with the US Commodity Futures Trading Commission (CFTC) on Thursday to introduce futures contracts based on Ripple’s token, XRP.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures, providing a regulated, capital-efficient means to access one of the most liquid digital assets,” Coinbase stated in an X post. The contracts are expected to go live by April 21.

These monthly-settled, margined contracts will be designated under the symbol XRP, with each contract representing 10,000 XRP, roughly valued at US$20,000 at current rates. Trading will halt if the spot XRP price deviates by more than 10 percent within one hour.

In related news, Grayscale submitted an S-1 application to the SEC on Friday, seeking to convert its Grayscale Solana Trust into a spot SOL exchange-traded fund identified under the ticker symbol GSOL.

Possible Delays for IPOs from Tech Firms

A report from the Wall Street Journal indicates that stablecoin entity Circle may postpone its IPO initially set for April 11, as per its S-1 filing.

“Circle had been approaching the final stages of its public offering but may reconsider amid ongoing market instability,” the report suggests. It also notes that fintech companies Klarna and Chime may similarly delay their IPOs in light of current market conditions exacerbated by the global trade war.

For timely news updates, follow us on @INN_Technology.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.