Crypto Market Update: Bitcoin Surges, Ethereum Follows Suit

Current Prices for Bitcoin and Ethereum

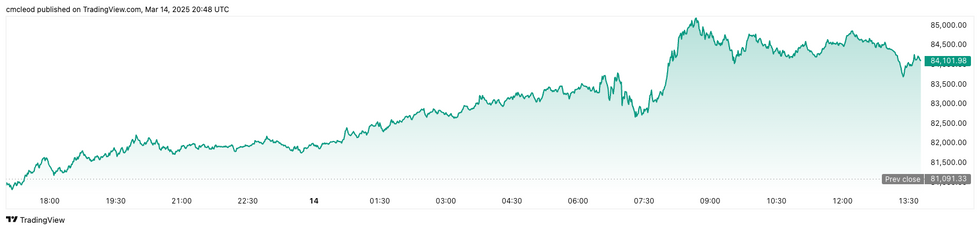

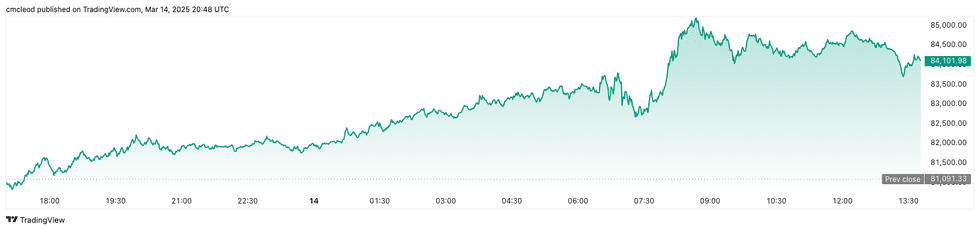

Bitcoin (BTC) is presently trading at US$84,601.01, marking a 5.5% rise in the last 24 hours. This trading day saw Bitcoin reach a high of US$85,139.55 and drop to a low of US$82,705.87. Bitcoin’s performance continues to be swayed by macroeconomic elements, regulatory changes, and market sentiment. Factors like US-China tariffs, US Federal Reserve policies, and the crypto-friendly stance of Donald Trump have significantly influenced prices. Notably, Bitcoin broke a support trend line against gold, which had been stable for over 12 years.

Chart via TradingView.

Bitcoin performance, March 14, 2025.

Ethereum (ETH) has a current price of US$1,935.01, reflecting a 4.8% increase in the same period. Ethereum’s trading yesterday saw highs of US$1,941.99 and lows of US$1,893.58.

Altcoin Market Performance

- Solana (SOL) is valued at US$134.17, up 10.6% over the past 24 hours, reaching a high of US$134.61 and a low of US$126.41.

- XRP stands at US$2.36, a 5.3% increase, with an intraday high of US$2.39 and a low of US$2.31.

- Sui (SUI) trades at US$2.35, marking a 10.5% gain. Its daily high was US$2.38, with a low of US$2.24.

- Cardano (ADA) is priced at US$0.7364, also reflecting a 5.3% increase, experiencing highs of US$0.7484 and lows of US$0.7188.

Key Cryptocurrency News

Senate Banking Committee Approves GENIUS Act

On Thursday, the Senate Banking Committee approved the GENIUS Act, introduced by Republican Senator Bill Hagerty (R-TN), with an 18-6 vote. The legislation is now set for full chamber discussions. However, notable opposition has come from Senator Elizabeth Warren (D-MA) and several Democrats, who argue that the bill fails to protect users in the event of stablecoin failures. They claim the bill could enable tech billionaires to gain influence by issuing their own dollar-backed tokens. During her remarks, Warren criticized potential connections between the Trump family and Binance founder Changpeng Zhao concerning regulatory favors. Both Zhao and Trump have denied any wrongdoing. The current version of the bill includes rigorous standards for foreign stablecoin issuers, particularly regarding reserve requirements and anti-money laundering checks.

BNY Mellon Partners with Circle for Stablecoin Services

BNY Mellon is enhancing its service offerings by collaborating with Circle, a leading stablecoin provider. This partnership will enable select clients to transact using Circle’s USDC stablecoins. This development reflects the growing acceptance of stablecoins in traditional financial systems and emphasizes BNY Mellon’s commitment to innovation in meeting client demands.

BlackRock’s Bitcoin ETF Sees Substantial Inflows

As reported by Arkham Intelligence, BlackRock, the world’s largest asset manager, received 268 Bitcoin worth over US$22 million transferred to its iShares Bitcoin ETF wallet from a Coinbase Prime wallet on Friday. The transaction brings BlackRock’s total Bitcoin holdings to over 567,000 Bitcoin, valued at more than US$47.8 billion, solidifying its position as one of the largest Bitcoin holders globally.

For real-time updates, be sure to follow us on @INN_Technology.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.