Cryptocurrency Market Faces Tough Start in 2025 Amidst Volatility

The first quarter of 2025 proved challenging for the cryptocurrency market. Bitcoin, the sector’s flagship cryptocurrency, recorded its worst Q1 performance in seven years, marked by significant volatility and a consistent downward trend. This decline was mirrored by other major altcoins, including Ethereum, which also experienced considerable losses.

At the beginning of Q1, the market was buoyed by optimistic sentiment following the recent US presidential election.

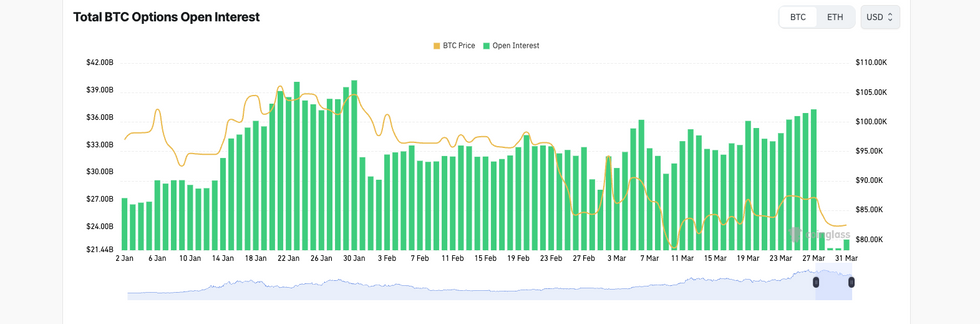

President Donald Trump’s anticipated crypto-friendly policies initially spurred enthusiasm, pushing Bitcoin to an all-time high of US$108,786 on January 20, the day of his inauguration. This bullish sentiment was further indicated in options trading, where open interest exceeded the Bitcoin spot price.

Chart via Coinglass.

Total Bitcoin options open interest vs. the Bitcoin price, January 2 to March 31, 2025.

Despite this early positivity, low trading volumes indicated weak support for high prices, setting the stage for subsequent volatility. According to Q1 data from Coinglass, Bitcoin decreased 11.82 percent, while Ethereum plummeted 45.41 percent during this timeframe. February was particularly harsh, with Bitcoin losing 17.39 percent and Ethereum sinking 31.95 percent.

By the end of Q1, Bitcoin’s price hovered around US$80,000, whereas Ethereum struggled to stay above US$2,000 and closed at about US$1,800. This retreat was prompted by proposed economic policies, the threat of a trade war, and disappointing economic data, all of which shifted investor attention from riskier assets like cryptocurrencies and tech stocks to traditional safe havens such as bonds and gold.

Institutional Momentum and Stablecoin Growth Signal a New Era

Even amid these challenges, certain sectors within the cryptocurrency landscape reported notable advancements during Q1.

Chris O’Brien, a partner at Venable, discussed at Benzinga’s Fintech & FODA Event in December 2024 how the conviction of Sam Bankman-Fried heralded the end of a speculative phase for cryptocurrencies. He stressed that the future of cryptocurrencies and blockchain technology depends on moving beyond speculation and addressing real-world challenges with practical applications.

A key trend identified early in the quarter by Matthew Hougan of Bitwise was the rise of institutional involvement in the cryptocurrency market. Firms like Strategy (NASDAQ:MSTR) and BlackRock made strategic investments, securing significant holdings of Bitcoin during Q1. Major financial institutions, such as BNY Mellon, have also expanded cryptocurrency services, enabling clients to transact using Circle’s USDC.

Bank of America (NYSE:BAC) CEO Brian Moynihan noted in a January CNBC interview that the banking sector is keen on integrating cryptocurrencies into traditional financial systems as soon as regulatory frameworks permit.

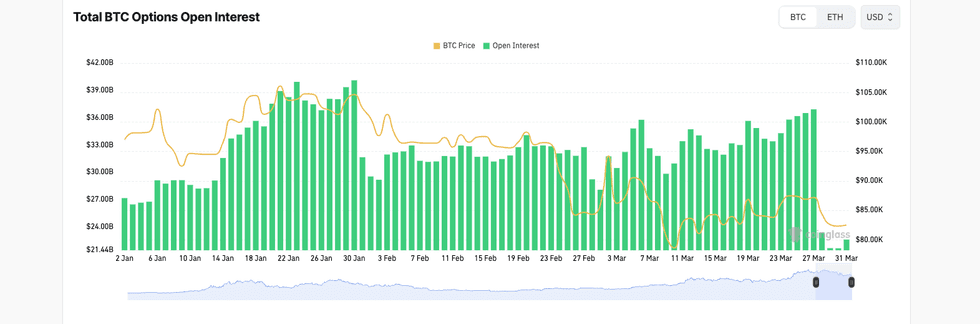

Parallel to institutional interest, the stablecoin sector witnessed significant growth, with its total market capitalization surpassing US$200 billion, moving ahead of Bitcoin’s price movements.

Chart via Coinglass.

Total stablecoin market cap vs. the Bitcoin price, Q1 2025.

A notable shift occurred in February following the US imposition of tariffs affecting Canada and Mexico, leading to downturns in both the cryptocurrency and traditional markets.

In light of these developments, lawmakers have begun focusing on stablecoin regulation, with Senator Bill Hagerty’s (R-Tenn.) GENIUS Act currently awaiting a full House vote. During the 2025 Digital Asset Summit, Kristin Smith, CEO of the Blockchain Association, remarked that the pace is set for legislation establishing operational rules for stablecoins and the cryptocurrency market structure by August.

Divestment into altcoins persisted from Q4 2024, but the rate of this activity slowed. This trend was compounded by speculative trading in meme coins and controversies surrounding initiatives like TRUMP, MELANIA, and LIBRA.

Despite these challenges, Bitcoin reaffirmed its dominant market position, even as interest in other cryptocurrencies like SOL and XRP continued. An increasing number of firms are pursuing spot ETF applications, which may see approval bolstered by the recent exit of former US Securities and Exchange Commission Chair Gary Gensler. Additionally, applications for ETFs tracking SUI and AVA have been submitted.

Ethereum’s Q1 Challenges Amidst Regulatory Developments and Market Volatility

Ethereum’s first quarter of 2025 illustrated a multifaceted landscape, showcasing both advancements and hurdles. The network successfully increased its gas limit to improve throughput, facilitating the operation of complex DeFi applications. Yet, stiff competition from other blockchain platforms, notably Solana, led to an underperformance. Additionally, the anticipated Pectra upgrade faced issues during testing on the Holesky and Sepolia testnets, resulting in delays.

Declining network activity played a role in suppressing Ethereum’s price. Despite this, the tripling in total value of BlackRock’s BUIDL fund leading up to the end of Q2 suggests sustained confidence in Ethereum’s long-term outlook. This trend is further mirrored by the growth of the real-world asset (RWA) market, which saw a market cap increase of around US$5 billion in Q1, nearing US$20 billion as tokenization spread across various assets and blockchains.

Regulatory Steps Forward Under Trump Administration

The first quarter of 2025 delivered notable developments in the regulation and policy surrounding cryptocurrency in the United States. Following his inauguration, President Trump signed an executive order which established the President’s Working Group on Digital Asset Markets. This initiative aims to create a national stockpile of digital assets and develop a dollar-backed stablecoin. Concurrently, working groups in Congress are focused on creating comprehensive regulatory frameworks for digital assets.

Although significant aspects of regulation remain under negotiation, lawmakers and regulators have indicated a more collaborative stance towards cryptocurrencies under the Trump administration during Q1. The SEC has dropped several longstanding cases against crypto exchange facilitators, created a crypto-specific taskforce led by Commissioner Hester Peirce, and repealed SAB 121, thus enabling banks to hold cryptocurrencies for their clients without the necessity of balancing assets against liabilities.

On March 7, industry leaders participated in the inaugural Digital Asset Summit, a federal initiative aimed at gathering input on proposed crypto regulations. Prior to the summit, Trump also signed an executive order to establish a Bitcoin reserve of around 200,000 BTC, contributing to the US government’s total holdings of 213,246 BTC, according to CoinGecko. Legislative proposals to allow the government to hold Bitcoin in reserve are advancing in both the House and Senate, while the order also calls for the creation of a reserve for altcoins, a move some analysts find debatable.

Michael Terpin, CEO of Transform Ventures and author of Bitcoin Supercycle, opposed the inclusion of anything but Bitcoin, viewing it as the only truly decentralized and consistently performing digital asset. He compared the addition of other cryptocurrencies to integrating stocks into traditional reserves. Furthermore, state-level initiatives to establish Bitcoin reserves advanced in Arizona, Oklahoma, Texas, and Utah alongside pension fund investment measures in digital assets in North Carolina and other states.

Market Volatility and Concerns Over Manipulation

The early part of the year experienced notable market volatility, with both Bitcoin and altcoins undergoing substantial price fluctuations. These swings were not solely due to typical market trends but were increasingly influenced by real-world events, evolving policies, and speculative movements driven by social media.

Challenges persisted as opposition to proposed legislation in the US emerged, alongside worries about insider trading and market manipulation, particularly concerning meme coin launches. Suspicious trading activity was noted prior to Trump’s strategic crypto reserve executive order, where a significant deposit was made to Hyperliquid, followed by heavily leveraged trades in Bitcoin and Ethereum, resulting in profits exceeding US$6.8 million. This raised suspicions of insider trading within the community.

On March 20, Material Indicators reported the presence of spoofing among whales, affecting Bitcoin’s capacity to maintain a rally beyond US$87,500 in March. Hacking incidents also plagued the crypto industry; a prominent hack of the Bybit exchange on February 23 resulted in a loss of US$195 million, although the firm successfully replenish its reserves within 72 hours through a combination of loans and substantial deposits from the industry.

According to Glassnode Insights, the correction following this hack, combined with a US$5.7 billion withdrawal from user wallets, led to a 13.6 percent decline in Bitcoin’s performance over the month. The losses were even greater for altcoins and meme coins, causing a reset in market momentum to levels last seen in April 2024.

Forecasts for Bitcoin Prices in 2025

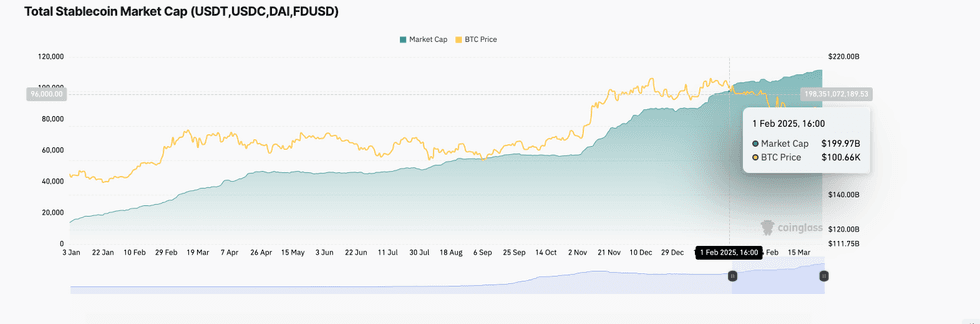

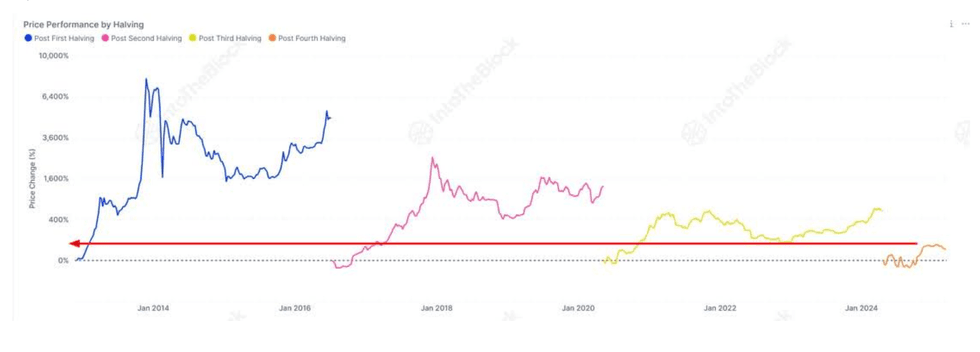

According to analysis provided to the Investing News Network by the intelligence platform IntoTheBlock, price growth for Bitcoin typically diminishes following each halving, signifying market maturation. Moderate growth and price appreciation are anticipated in mid- to late 2025, driven by advancements in stablecoins and DeFi.

Chart via Investing News Network

Bitcoin Price Predictions and Market Trends Ahead of 2025

Assessing Bitcoin’s trajectory following its impending halving event.

Bitcoin’s price targets for this year show significant variation. Network economist Timothy Peterson anticipates that Bitcoin might reach approximately US$126,000 in the second half of 2025. Additionally, a meta-analysis conducted by Ashwin on Polymarket estimates suggests a bullish target price of US$138,617 while predicting a bearish price of US$59,040.

Market analysts point to a potential supply shock due to declining Bitcoin reserves on exchanges. This situation may lead to an upward price movement. Factors such as a weakening US dollar and the anticipated termination of quantitative tightening by the US Federal Reserve are expected to act as positive catalysts. Furthermore, historical data indicates that April often serves as a pivotal month for market shifts.

As the market evolves, stablecoins and Real-World Assets (RWAs) are set to play an increasing role in integrating decentralized finance (DeFi) with traditional finance. Moreover, initiatives such as the Digital Chamber’s US Blockchain Roadmap, which suggests the introduction of BitBonds—Bitcoin-backed US Treasuries—could invigorate debt markets and attract international capital.

Key figures in the industry, including Mike Novogratz from Galaxy Digital and Dan Tapiero from 10T Holdings, project that several new crypto companies may go public on major exchanges such as the NYSE and Nasdaq in the second quarter. Companies like eToro, Circle, Gemini, Bullish, and BitGo have also filed for initial public offerings, reinforcing this sentiment.

Nevertheless, this promising outlook exists within a challenging economic context. Analysts highlight a possible deceleration in US economic growth and uncertainties regarding inflation and trade policies that could affect investor sentiment and capital movement.

During her virtual appearance at the Digital Asset Summit in New York on March 18, Cathie Wood, CEO of ARK Invest, raised alarms about a potential recession, noting a substantial decrease in the velocity of money. She stated, “If we do have a recession, declining GDP will afford the president and the Fed more flexibility in implementing tax cuts and monetary policy.”

Despite these concerns, Wood maintains a positive stance on long-term innovation, asserting that “long-term innovation wins,” and emphasized that crypto assets are vital to ARK’s investment philosophy.

Stay informed by following us @INN_Technology for real-time updates!

Securities Disclosure: I, Meagen Seatter, have no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.