“Crypto is going to become the 12th sector of the S&P 500. It’s going to happen over the next few years, watch.” ~ Kevin O’Leary, AKA “Mr. Wonderful”

If you repeated the above quote to friends a few years ago, most would think you’ve lost your mind. After all, Bitcoin was once an obscure, illiquid, and untrusted digital currency started on the internet. In its infancy, the world’s first digital currency was used to buy illicit drugs on the illegal and now defunct “dark web” website “The Silk Road.” Later, many early adopters fell prey to crypto fraud and exchange hacks. However, as the kids like to say today, “The Internet Remains Undefeated!”

The ascent of Bitcoin from its humble beginnings has been nothing short of spectacular, with its momentum now reaching a crescendo in 2024. Indeed, as highlighted earlier this month, Bitcoin finds itself in the midst of the Perfect Bull Storm. Here are five compelling reasons why crypto is poised to become the 12th sector of the S&P 500 in the coming years:

Bitcoin is a Global Phenomenon

In a world plagued by political turmoil and rampant fiat currency printing by central banks, Bitcoin stands out as an oasis with its decentralized network, limited supply, and transparent ledger. These qualities only hold significance when embraced by the masses, and Bitcoin’s adoption has been nothing short of remarkable, surpassing all-time highs in thirty countries and on the cusp of achieving the same in the U.S.

Stablecoin Adoption

Stablecoins, designed to maintain a steady value by pegging it to a reserve of assets like the US Dollar, have revolutionized the cryptocurrency space. USDC, a notable stablecoin, launched five years ago through a collaboration between Coinbase (COIN) and Circle. With a market cap exceeding $28 billion, USDC is now accepted by Visa (V) for transaction settlements.

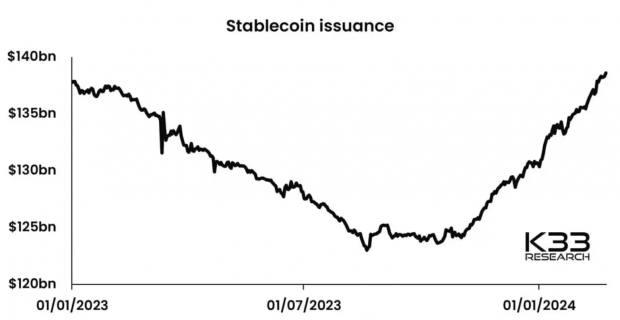

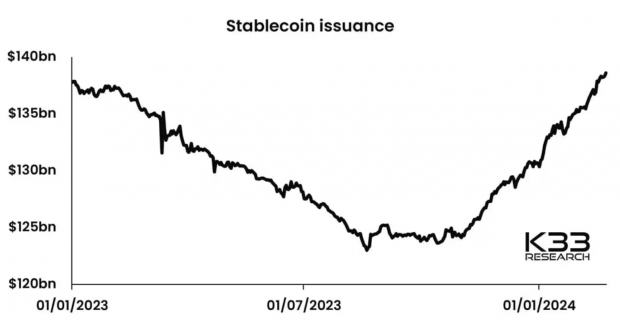

The stablecoin market now stands at $140 billion, with projections indicating that stablecoin issuers could rank among the top five holders of U.S. Treasuries by 2030.

Image Source: K33 Research

Political Snowballing Effect

Change is often spearheaded by a new generation. In 2019, Nayib Bukele, now 42, assumed the presidency of El Salvador after winning 50% of the vote. In a bold move in 2021, Bukele declared bitcoin as legal tender, with El Salvador acquiring 400 Bitcoins. Subsequently, Bukele’s landslide victory in the 2024 election, securing 84.65% of the vote, underscores the growing acceptance of Bitcoin globally.

Bukele’s success is not only resonating in the U.S. but is also encouraging politicians worldwide to consider Bitcoin adoption with open minds.

MicroStrategy’s Success Story: A Blueprint for Fortune 500 Companies

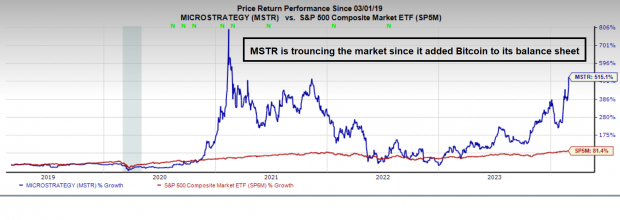

MicroStrategy (MSTR) was transformed under the visionary leadership of Michael Saylor. Despite being a profitable public company for years, a strategic shift towards Bitcoin as a treasury reserve asset and hedge against inflation propelled MSTR into the limelight. Despite initial setbacks, MicroStrategy’s unwavering conviction in Bitcoin saw the accumulation of billions in the digital asset. Today, the bet on Bitcoin is reaping massive rewards, with MSTR’s Bitcoin holdings generating $500 million in gains in a single day, eclipsing its yearly software business profits.

Given this astounding success, it’s only a matter of time before other cash-heavy corporations follow suit and explore the potential of the “Bitcoin rail.”

Image Source: Zacks Investment Research

ETF Approval: Institutional Adoption Floodgates Swing Wide Open

The long-awaited launch of Bitcoin ETFs is poised to live up to its billing. With the begrudging approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC), the floodgates to institutional adoption have been thrown open. Industry giants like Fidelity are allocating a percentage of their All-In-One ETF products to crypto, with the Bitwise Bitcoin ETF (BITB) securing approval on several wealth management platforms managing assets exceeding $100 billion.

The surging demand has pushed Bitcoin closer to the $60,000 mark and its previous all-time highs as of early Wednesday.

The Potential Rise of Cryptocurrency in the Stock Market

Unlocking the Hidden Gem

The global cryptocurrency market, with a burgeoning market cap now exceeding $2 trillion, seems poised to stake a claim in the mainstream investing landscape. Projections hint at the possibility of it becoming the 12th sector to make an entry into the coveted S&P 500 over the next five years.

Diving Into the Semiconductor Sector

Amidst the rapidly evolving tech landscape, the semiconductor industry is witnessing a seismic shift. A top semiconductor stock, currently only 1/9,000th the size of industry giant NVIDIA, has been making waves by displaying substantial growth. While NVIDIA has soared by over 800%, this lesser-known gem appears to have a vast runway for expansion.

Positioned for Success

With a robust track record of earnings growth and an ever-expanding customer base, this stock is strategically positioned to meet the escalating demands in Artificial Intelligence, Machine Learning, and the Internet of Things. Forecasts indicate a looming surge in global semiconductor manufacturing, set to catapult from $452 billion in 2021 to an impressive $803 billion by 2028.