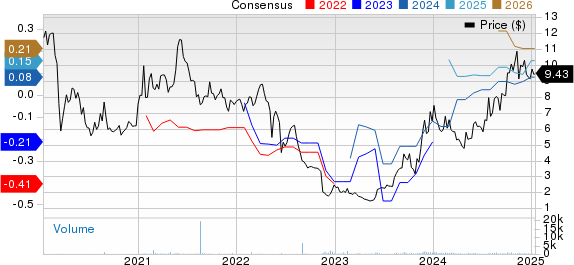

Shares of CSP Inc. (CSPI) declined by 15.1% following the release of its fourth-quarter fiscal 2025 results on September 30, 2025, contrasting with a slight decrease of 0.2% in the S&P 500. This decline was mitigated by a subsequent 16.2% rise in stock price over the past month, indicating recent positive trading activity. The company reported revenues of $14.5 million for the quarter, an 11% increase from $13 million a year ago, while gross profit rose to $5.3 million, resulting in a gross margin of 37%, up from 28%.

For the entire fiscal year 2025, revenues reached $58.7 million, a 6% increase, with the net loss narrowing to $91,000, or 1 cent per share, compared to a net loss of $326,000, or 4 cents per share, in fiscal 2024. Service revenues surged by 63% year over year, accounting for 44% of total revenues in Q4, bolstered by the company’s focus on high-margin offerings. CSP ended the fiscal year with $27.4 million in cash and equivalents. The board declared a quarterly cash dividend of 3 cents per share, payable on January 15, 2026.