CSX Corporation Reports First-Quarter Results: Earnings and Revenue Miss Estimates

CSX Corporation (CSX) has released its first-quarter 2025 results, falling short of expectations for both earnings and revenue. The company reported earnings per share (EPS) of 34 cents, missing the Zacks Consensus Estimate of 37 cents and marking a 26% decline compared to the same quarter last year, largely due to lower revenue streams.

Total revenues reached $3.42 million, also missing the Zacks Consensus Estimate of $3.47 million, and reflecting a 7% decrease year-over-year. The decline stemmed primarily from reduced coal revenues, dip in fuel surcharge income, and lower merchandise volume. However, increases in merchandise pricing and growth in intermodal volume partially offset these losses.

Operating Performance Snapshot

CSX’s operating income for the first quarter fell 22% year-over-year to $1.04 billion. Total expenses increased by 2% year-over-year, totaling $2.38 billion. Overall volumes experienced a modest decline of 1% year-over-year.

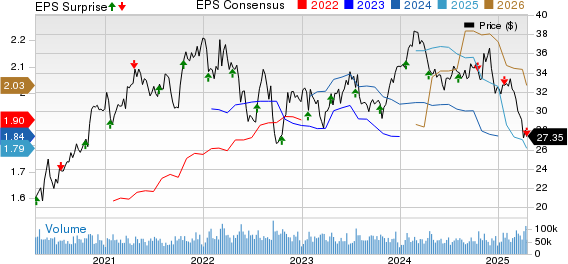

CSX Corporation Price, Consensus, and EPS Surprise

CSX Corporation price-consensus-eps-surprise-chart | CSX Corporation Quote

Joe Hinrichs, the president and CEO of CSX, noted that the company faced operational challenges early in the year, leading to disappointing results. He emphasized that the dedicated team is actively addressing network constraints associated with major infrastructure projects and is committed to enhancing performance during this uncertain market situation.

Segmental Revenue Breakdown

Merchandise revenue declined by 2% to $2.15 billion in this reporting period, below the anticipated figure of $2.20 billion. Merchandise volumes also decreased by 2% year-over-year, totaling $630 million. However, segment revenue per unit saw a slight increase of 1% year-over-year.

Intermodal revenues fell 3% year-over-year to $493 million, not meeting the projected $498 million. While segment volumes rose by 2%, revenue per unit decreased by 5% over the past year.

Coal revenues experienced a significant 27% drop to $461 million, well below the estimated $472.8 million. Coal volumes were down by 9%, and revenue per unit in this segment declined by 20% year-over-year.

Trucking revenues reached $202 million, reflecting a 6% decrease year-over-year, while other revenues fell 20% to $115 million in the quarter.

Liquidity Position and Future Guidance

At the end of the first quarter of 2025, CSX had cash and cash equivalents amounting to $1.14 billion, up from $933 million at the previous quarter’s end. Long-term debt rose to $18.5 billion compared to $17.8 billion in the prior quarter.

CSX generated $1.25 billion in cash from its operating activities during the reported quarter.

Looking ahead, CSX anticipates total volume growth for 2025 despite ongoing market uncertainties and changes in trade policy. The company’s full-year revenues are expected to be influenced by declining coal benchmarks, diesel prices, and volume mix, especially in the first half of the year. CSX will continue to focus on improving operational fluidity, efficiency initiatives, and labor productivity, with capital expenditures projected to remain flat year-over-year, excluding hurricane rebuild costs.

CSX’s Zacks Rank

Currently, CSX holds a Zacks Rank #3 (Hold). To view a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, please click here.

Upcoming Q1 Earnings from Other Railroad Companies

Several companies in the Zacks Transportation-Railroad industry, including Norfolk Southern Corporation (NSC) and Union Pacific Corporation (UNP), are expected to announce their first-quarter earnings later this month. To stay updated on market news, refer to the Zacks Earnings Calendar.

Norfolk Southern

NSC is set to report its first-quarter 2025 results on April 23, prior to market opening. The company’s performance may have been impacted by inflation, high interest rates, tariff uncertainties, weak freight demand, and supply-chain issues, potentially leading to challenges in freight revenues and volumes.

In the previous four quarters, NSC’s earnings have lagged the Zacks Consensus Estimate once, while exceeding expectations in the other three, averaging a 2.94% rise.

Union Pacific Corporation

UNP is scheduled to announce its first-quarter results on April 24, also before market opening. Weakness in freight revenues and volumes, along with general economic uncertainty, poses a potential challenge for UNP.

UNP’s earnings have also lagged the Zacks Consensus Estimate once in the previous four quarters while surpassing in the other three, achieving an average increase of 3.35%.

Access Zacks’ Investment Recommendations

Take advantage of our limited-time offer for valuable insights.

Years ago, we surprised our members by granting them one-month access to all our market picks for just $1. No obligation for additional costs.

Thousands have seized this chance. While others hesitated, fearing a catch. Our aim is simple: to introduce you to premium portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which saw 256 positions with double- and triple-digit gains in 2024.

Explore Our Stock Recommendations >>

CSX Corporation (CSX): Free Stock Analysis Report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Norfolk Southern Corporation (NSC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.