Cognizant Partners with Omron to Enhance Manufacturing Efficiency

Cognizant Technology Solutions (CTSH) is expanding its reach by partnering with Omron (OMRNY), focusing on the integration of Information Technology (IT) and Operational Technology (OT) in the manufacturing sector.

As the engineering partner for Omron’s Industrial Automation Business (IAB), Cognizant plans to blend its expertise in cloud AI, IoT, and digital twin technologies with Omron’s advanced OT solutions. These solutions include sensors, controllers, and robotics.

This collaboration aims to deliver a comprehensive solution that enhances operational efficiency, sustains productivity, and fosters improvements across sectors such as automotive, semiconductor, and life sciences. The partnership will also focus on delivering continuous IT-OT enhancements to optimize manufacturing processes and minimize environmental impact.

Cognizant’s Diverse Partnerships Drive Future Potential

Cognizant has seen its shares drop by 13.6% year-to-date, which contrasts with the broader Zacks Computer & Technology sector decline of 20.8%. However, the company’s expanding clientele and robust partner network provide a silver lining. A favorable mix of business renewals and new opportunities is expected to be significant for Cognizant in 2025.

Stock Performance and Market Consensus

The expanding partner ecosystem for Cognizant, which includes notable names like NVIDIA (NVDA), ServiceNow (NOW), Boehringer Ingelheim, CrowdStrike, Zscaler, IBM, Palo Alto Networks, and Amazon, is anticipated to boost its growth in 2025. In Q4 2024, Cognizant secured 10 significant deals, a rise from seven deals in the previous year, making a total of 29 large deals secured for the year.

In March, Cognizant unveiled an AI-powered dispute management solution alongside ServiceNow. This solution utilizes ServiceNow’s advanced technology to enhance dispute resolution for mid-market banks in North America.

Additionally, Cognizant and NVIDIA announced advancements in AI technology that focus on enterprise AI agents, industry-specific large language models, smart manufacturing digital twins, AI infrastructure, and integrating NVIDIA’s AI technology within Cognizant’s Neuro AI platform to facilitate business transformation.

Cognizant Provides Strong Revenue Guidance for 2025

Cognizant’s strong portfolio, coupled with an expanding partner base, positions it for substantial top-line growth in the long term.

For Q1 2025, Cognizant anticipates revenues in the range of $5 billion to $5.1 billion, reflecting a growth rate of 5.6-7.1%, and a projected increase of 6.5-8% on a constant currency basis.

In 2025, revenues are projected to be between $20.3 billion and $20.8 billion, indicating growth of 2.6-5.1% on a reported basis and growth of 3.5-6% on a constant currency basis.

The adjusted operating margin for 2025 is expected to reach between 15.5% and 15.7%, representing an increase of 20-40 basis points.

Adjusted earnings for 2025 are forecasted to be between $4.90 and $5.06 per share.

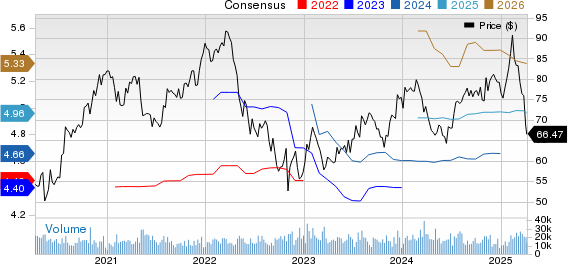

Earnings Estimates Reflect Positive Trends for CTSH

The Zacks Consensus Estimate for Q1 2025 revenues is set at $5.07 billion, suggesting a year-over-year growth of 6.47%.

The consensus for earnings stands at $1.19 per share, a figure that has not changed in the past 30 days and represents a 6.25% year-over-year increase.

For 2025, the Zacks Consensus Estimate for revenues is positioned at $20.56 billion, representing a year-over-year growth of 4.16%.

The earnings consensus mark for 2025 is at $4.96 per share, reflecting a minor decline of 0.4% over the previous month, although this still indicates a 4.42% year-over-year increase.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Should Investors Consider CTSH Stock?

While Cognizant is gradually expanding its clientele, it faces several challenges. Ongoing macroeconomic pressures and cost optimization issues across various sectors are burdensome. In addition, the broader technology sector is experiencing market weaknesses, alongside concerns related to potential government tariffs.

CTSH is experiencing adverse impacts from unfavorable foreign currency exchange rates, which may hinder revenue growth and affect other financial metrics.

Furthermore, Cognizant anticipates a slight margin decline in Q1 2025 due to seasonal factors, impacting near-term profitability.

Currently, Cognizant holds a Zacks Rank #4 (Sell), suggesting that investors may want to exercise caution regarding the stock for the time being.

For further insight, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each of these stocks was handpicked by a Zacks expert as a top favorite, expected to gain +100% or more in 2024. While not every recommendation is guaranteed success, historical picks have surged with increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks outlined in this report are below Wall Street’s radar, presenting an excellent opportunity to invest early.

Today, see These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

ServiceNow, Inc. (NOW) : Free Stock Analysis report

Omron Corp. (OMRNY) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.