Understanding the Power of Compound Interest in Wealth Building

In 1976, The Wall Street Journal published an opinion piece attributing a remarkable statement to one of history’s greatest thinkers, Albert Einstein. When asked about man’s greatest invention, he reportedly replied: “Compound interest.”

Although the authenticity of this quote is debated, its essence remains true—compound interest is a vital concept for investors, yet many misunderstand it.

Compounding, Part 1: Interest on Your Interest

Compound interest acts like a perpetual motion machine. You earn interest not only on your principal but also on the interest that accrues over time. This process can significantly grow your investment—if you allow it to do so.

However, many investors become preoccupied with chasing higher returns. While outperforming the market might feel like a win, true wealth building is about maximizing portfolio growth according to your risk tolerance and emotional resilience.

Consider this: Would you prefer to beat the market on occasion and end up with $1 million, or underperform some years but reach $1.2 million in the end? Remember, bragging rights won’t fund your retirement.

Compounding, Part 2: Time—The Hidden Superpower

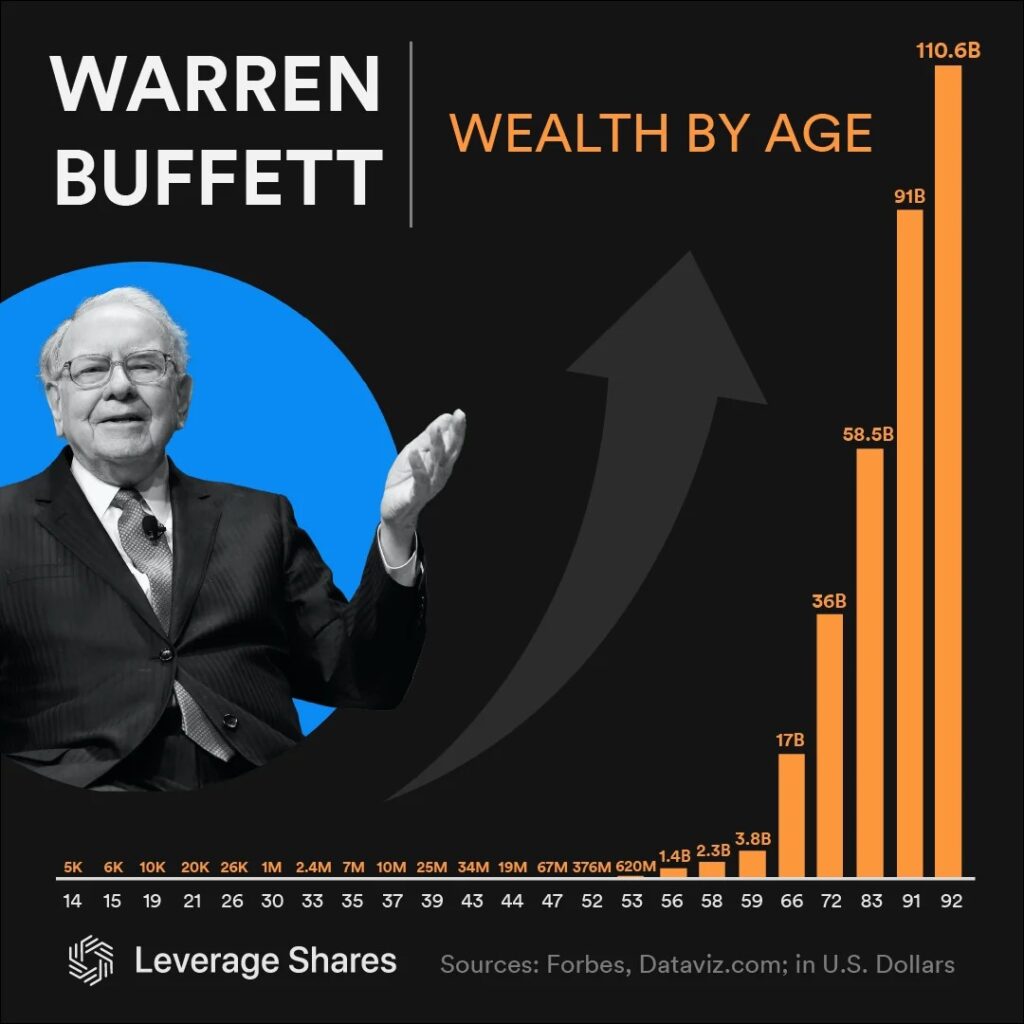

The longer your money remains invested, the more potent compounding becomes in generating wealth. Warren Buffett exemplifies this principle. After eight decades of investing, he recognized time as his most significant asset. A staggering 97% of his wealth materialized after his 65th birthday.

Charlie Munger succinctly stated, “The first rule of compounding is to never interrupt it unnecessarily.” Sadly, many investors impede growth by pursuing higher returns, akin to cutting a bonsai tree because its growth feels slow.

For example, Peter Lynch managed Fidelity’s Magellan Fund from 1977 to 1990, achieving an impressive 29.2% average annual return—nearly double the S&P 500. Yet, the average investor reportedly lost money during this period due to poor timing and emotional decision-making.

Their approach transformed a compounding machine into a vending machine, depleting their investments. This scenario isn’t unique; it is common for investors to struggle due to similar patterns.

Compounding, Part 3: New Money—The Force Multiplier

When it comes to building wealth, the most important variable isn’t necessarily returns or timing; it’s you—specifically, your monthly contributions.

Consider this: Starting with $1,000 and earning an annual return of 10% will grow your investment to just over $1,600 after five years. However, if you add $100 each month, your portfolio could reach nearly $10,000 in the same time. This demonstrates the power of consistent, ordinary contributions rather than extraordinary performance.

In the first 10-15 years of building wealth, what you invest matters more than how you invest.

Imagine if you could double your return. Here’s how the math works out:

- Save 20% of your income and achieve a 5% annual return, and your portfolio will exceed your salary in about 4.5 years.

- Double your return to 10%? You’ll reach that milestone just five months sooner.

In the early years, success comes from habits and consistent investing—not market timing. Only after your portfolio gains substantial weight do returns start to have more influence.

The Wealth Accumulation Trifecta

While chasing the highest returns often seems like the fastest way to increase wealth, it’s essential to recognize that maximizing annual returns and maximizing wealth are inherently different.

To build lasting wealth, focus on three fundamental practices:

- Achieve steady, reasonable returns

- Allow time to work quietly on your behalf

- Consistently contribute new funds each month

This combination forms the trifecta of successful investing—no gimmicks, no flashy trades. Just the consistent magic of compounding.

Patience is key. The initial years of compounding may seem slow and unnoticeable, but that’s the nature of growth—it begins quietly, eventually leading to remarkable outcomes.

This week, revisit your investment strategies while keeping these principles in mind. As markets fluctuate and headlines grab attention, prioritize steadfastness over drama.

While others may be frantically pursuing gains, you can quietly build sustainable momentum. Crossing the wealth accumulation finish line doesn’t require haste—embracing all three aspects of compounding increases the likelihood that you will reach it.

Invest wisely and consistently. Thank you for reading.

The content is for informational purposes only and does not constitute legal, tax, investment, or financial advice.

© 2025 Benzinga.com. All rights reserved.