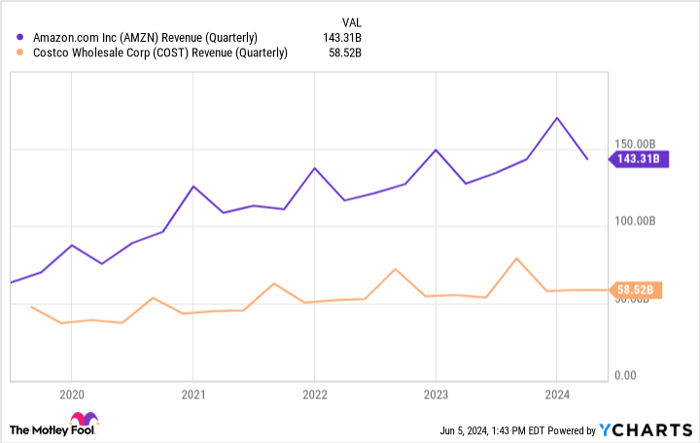

In the first quarter of 2024, Amazon (NASDAQ: AMZN) reported net sales of $143.3 billion, marking a year-over-year increase of 12.5%, while Costco Wholesale (NASDAQ: COST) reported net sales of $57.4 billion, up 9.1%. Looking ahead, Amazon’s management forecasts second-quarter sales between $144 billion and $149 billion, while Costco’s monthly sales in May reached $19.64 billion, a rise of 8.1% from the previous year.

Amazon also generated $46.1 billion in free cash flow over the past year, a sharp rebound from -$10.1 billion a year prior. In comparison, Costco’s free cash flow was $7.4 billion, a 10% increase. Both companies maintain strong balance sheets, with Amazon housing $27.4 billion in net cash versus Costco’s $4.6 billion. Costco offers a quarterly dividend of $1.16 per share, while Amazon has no current plans for dividends.

Amazon is positioning itself for growth in generative AI, projecting AWS revenue to reach a $100 billion annual run rate. Conversely, Costco aims for expansion through international locations and membership fee increases, with management hinting at a fee hike in the future. As of now, Amazon appears to be the better investment, trading at 42.8 times free cash flow, compared to Costco’s 50.5 times.