Guess Stock Surges on $13 Takeover Offer from WHP Global

[Note: Guess’ FY’25 ended Feb 2025]

Guess Stock (NYSE: GES) rose an impressive 30% on March 17 after the company announced a $13.00 per share takeover bid from WHP Global. This proposed acquisition is currently under review by a special committee. The deal aims for WHP Global to acquire all outstanding shares, excluding those held by Guess’ co-founders, Paul and Maurice Marciano, and CEO Carlos Alberini, who own about 43% of the company. This surge in stock price comes as a welcome relief for investors, who have witnessed steep declines in Guess’ stock over recent months.

Stock Performance and Market Context

Guess has experienced a significant downturn, with stock prices dropping 37% since the beginning of 2024. In contrast, the broader S&P 500 index has shown a 14% increase. This decline can be attributed to various factors, including disappointing results in the Americas segment, increased inventory levels, and markdowns which have all negatively impacted profitability. Additionally, market volatility linked to tariff changes and trade tensions has exacerbated the situation. Key factors influencing this downward trend include:

- A 42% decrease in the company’s price-to-sales (P/S) ratio, now at 0.22, compared to 0.38 in FY 2023.

- A 10% increase in revenue, growing from $2.7 billion in FY 2023 to $3 billion in the last twelve months.

- A 6% decrease in total shares outstanding, currently at 54 million.

For more in-depth analysis, the Why Guess Stock Moved dashboard offers comprehensive details.

European Revenue Growth and Strategic Shifts

Guess has gained traction in European markets, where sales have been strong, contributing over 50% of total revenues. However, declines in North American retail have posed a challenge. The acquisition of Rag & Bone in April 2024 has also enhanced revenue, bolstering overall growth.

For years, the company has faced declining foot traffic in its physical stores, particularly in North America, where it generates over 33% of its revenues. Management aims to decrease this figure to approximately 25% through strategic measures, including closing underperforming locations, improving product lines, and enhancing online sales through targeted marketing efforts and celebrity endorsements.

Financial Performance and Future Outlook

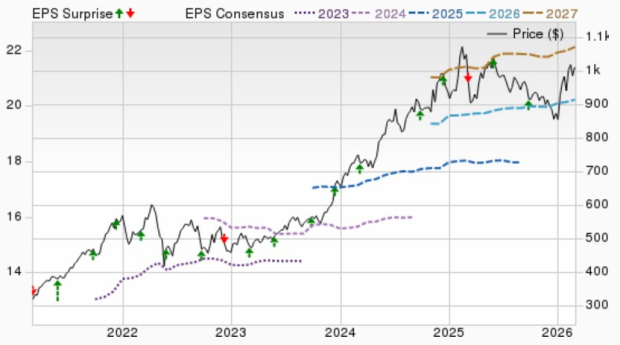

In FY 2024, Guess saw its operating margin rise to 9.5%, slightly up from 9.2% in FY 2023, which helped drive adjusted earnings from $2.74 to $3.14 per share. Nevertheless, the company expects a year-over-year decline in EPS for FY 2025 due to heightened marketing expenditures related to international expansion and integrating Rag & Bone. Ongoing downward revisions to guidance this year have also raised investor caution, reflected in the drop in the P/S ratio from 0.4x in FY 2023 to 0.2x currently.

Volatility and Market Predictions

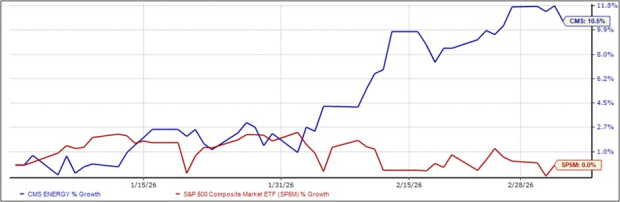

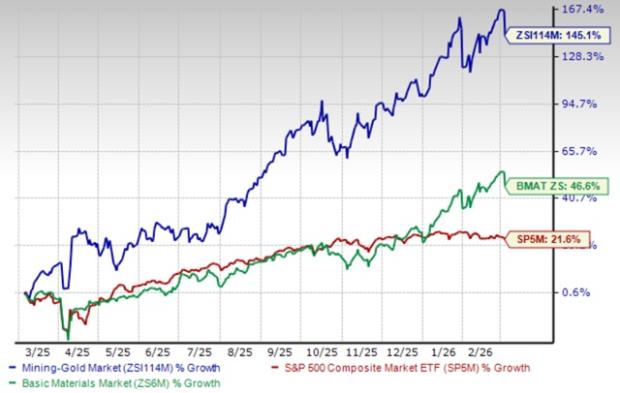

Over the past four years, the performance of GES stock has been highly volatile, reflecting broader market trends. The returns were 7% in 2021, -9% in 2022, 18% in 2023, and -30% in 2024. In comparison, the Trefis High-Quality (HQ) Portfolio, comprised of 30 stocks, exhibited less volatility and significantly outperformed the S&P 500 over the same timeframe.

Given the current economic uncertainty due to interest rate considerations and ongoing trade issues, the question remains: will GES stock continue to lag behind the S&P 500 in the next year, or will it rebound? From a valuation standpoint, we see considerable upside potential.

Valuation Insights

We estimate Guess’ valuation to be $17 per share, indicating a potential 33% upside from current trading levels of $13. The current P/S ratio of 0.22x is below the four-year average of 0.4x. Additionally, the average analyst price target of $18 also suggests a nearly 40% upside, highlighting robust growth potential.

| Returns | Mar 2025 MTD [1] |

2025 YTD [1] |

2017-25 Total [2] |

| GES Return | 24% | -10% | 59% |

| S&P 500 Return | -5% | -4% | 153% |

| Trefis Reinforced Value Portfolio | -6% | -8% | 552% |

[1] Returns as of 3/18/2025

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.