NVIDIA Shares Surge Following Positive Economic Data and U.S.-China Optimism

NVIDIA Corp NVDA shares rose on Thursday, buoyed by the overall strength in the market. This positive momentum came after U.S. economic data surpassed expectations and optimism regarding U.S.-China relations improved.

Key Economic Indicators: The semiconductor sector saw gains following the U.S. Census Bureau’s report showing durable goods orders climbed 9.2% in March. This marked the highest monthly increase since July 2024 and significantly outstripped the forecasted 2% increase.

Transportation equipment orders were the primary driving force behind this surge, increasing by 27%. Notably, nondefense aircraft orders skyrocketed by 139%. However, despite this headline growth, demand “under the hood” in other sectors showed weakness. For instance, new orders excluding transportation remained stagnant, while the category of computers and electronic products—important to Nvidia’s supply chain—fell by 1.2%. Within this category, computers and related products noted a 2.9% drop in new orders, pointing to a continuing decline in hardware demand.

Nevertheless, Nvidia shares experienced an upswing along with other technology and chip stocks. Investors reacted positively to the strong economic data and remarks from President Donald Trump, who announced plans for a meeting with Chinese officials. This development has sparked hopes for improved trade relations between the U.S. and China, which is crucial for companies like Nvidia that rely heavily on international sales and supply chains.

The rise in Nvidia’s stock reflects a broader investor sentiment rather than being propelled by company-specific news. As economic signals hint at potential near-term industrial growth and geopolitical factors contribute to increased risk appetite, Nvidia has benefitted from this favorable market shift, even amid signs of subdued demand in parts of the tech industry.

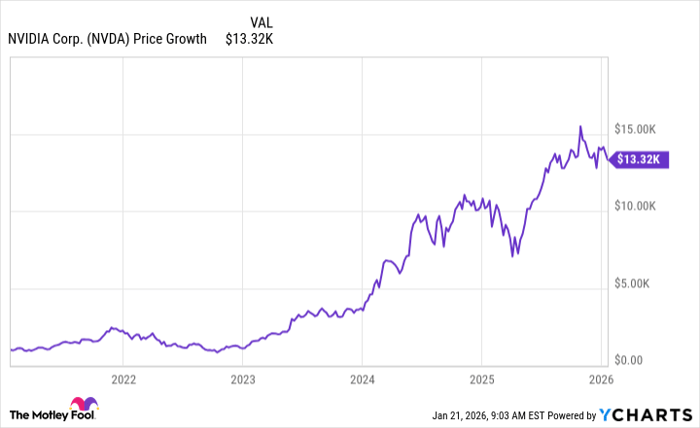

NVDA Price Summary: Nvidia shares closed at $106.43 on Thursday, marking an increase of 3.62%, according to Benzinga Pro.

Looking Ahead: Market reactions will continue to hinge on economic developments and geopolitical movements that can affect global trade dynamics.

Photo: Shutterstock.