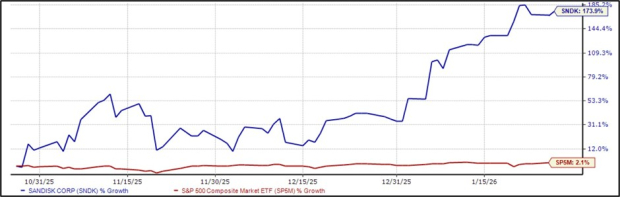

SanDisk (SNDK) shares have surged more than 170% in the past three months as demand for storage solutions driven by AI escalates. The company’s upcoming earnings report, scheduled for this week, is highly anticipated, particularly after recent shifts in its earnings per share (EPS) outlook, with estimates rising over 70% since last November, reaching $3.54.

In the latest quarter, SanDisk reported revenues of $2.3 billion, showing a 22% year-over-year increase. For the fiscal year ending in June, revenue estimates have increased nearly 20% to $11.2 billion. With a favorable demand environment and a Zacks Rank of #1 (Strong Buy), investors are keenly watching for guidance following the earnings release, as significant volatility is expected post-report.

Currently, SanDisk trades at a forward price-to-earnings ratio of 22.8, well below its 2025 high of 42.1, suggesting room for growth amid an increasing reliance on high-speed storage in AI data centers.