Riding the Wave of Dividends

CVR Energy made waves on February 20, 2024, as its board of directors unfurled a regular quarterly dividend of $0.50 per share ($2.00 annualized), mirroring the previous quarter’s distribution. Shares must be clenched before the ex-dividend date of March 1, 2024, to sink teeth into this feast. Those anchored as shareholders of record by March 4, 2024, will sail forth with payments on March 11, 2024.

Dividends: Weathering the Storm

At the current share price of $33.43 per share, the stock’s dividend yield bobs at 5.98%. Setting the course back five years and sampling weekly, the dividend yield has breezed through an average of 9.07%, with the lowest dip recorded at 3.97% and the highest cresting at 22.80%. Enveloped by this historical tale, the standard deviation of yields dances at 4.50 with n=150. Notably, the present dividend yield stands firm at 0.69 standard deviations below the historical average.

The Enigmatic Payout Ratio

Resting at 0.59, CVR Energy’s dividend payout ratio indexes a landscape where prudent financial stewardship meets the shareholder’s bounty. This ratio whispers how much of the company’s income spills into dividends. Hovering near one signifies a company pouring 100% of its earnings into dividends; an intrepid journey rarely recommended. A ratio above one hints at digging into treasure troves to sustain dividends, mirroring a parched terrain. Firms nurturing growth prospects harbor earnings, limiting the payout ratio between zero and 0.5, a tale of shrewd investment for the ages.

Sailing the Seas of Fund Sentiment

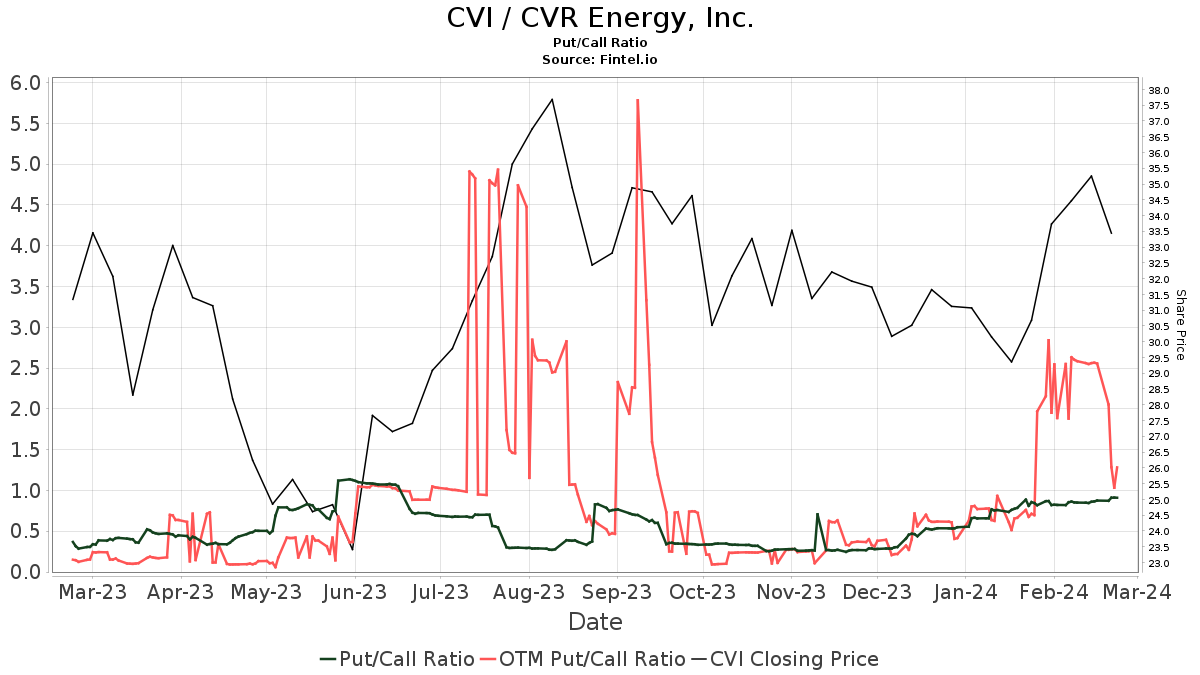

A flotilla of 561 funds or institutions now charts a course with CVR Energy. In the last quarter, this number swelled by 23, marking a 4.28% increase. On this voyage, the average portfolio weight of all funds dedicated to CVI slackened to 0.15%, a downshift of 4.22%. Institutions hoisted their holdings by 3.60%, now anchoring 112,785K shares in the past three months. The put/call ratio, marking the sentiment towards CVI, stands at 0.91, a bullish wind in the sails.

Forecasting Tomorrow’s Weather

Steering towards the future, analysts predict a 2.36% downside for CVR Energy. As of February 24, 2024, the average one-year price target settles at 32.64. The spectrum flickers from a low of 25.25 to a high of $38.85, with the average price target signaling a subtle retreat of 2.36% from the latest closing price of 33.43. Despite the forecasted fog, the projected annual revenue casts a shadow of 8,356MM, down by 9.64%, while the projected annual non-GAAP EPS whispers at 2.17.

The Shareholders’ Mosaic

Unveiling the tapestry of shareholders, Icahn Carl C grips 66,692K shares, staking a claim of 66.34% ownership unmoved in the last quarter. Pacer Advisors graze on 4,080K shares, bulking up their ownership to 4.06%, an uptick of 53.03%. On the flip side, CALF – Pacer US Small Cap Cash Cow 100 ETF nibbles 2,234K shares, representing 2.22% ownership and a 12.49% rise. Meanwhile, IJR – iShares Core S&P Small-Cap ETF grasps 1,969K shares to crown 1.96% ownership, a slight decrease of 3.82%. Lastly, XOP – SPDR(R) S&P(R) Oil & Gas Exploration & Production ETF clings to 1,376K shares, unmoving amidst the tides of change.

A Glimpse of CVR Energy’s Roots

Springing forth from Sugar Land, Texas, CVR Energy blooms as a diversified holding company. Its essence entwines with petroleum refining and marketing through CVR Refining and nitrogen fertilizer manufacturing via CVR Partners, LP. Holding the reins as general partner, CVR Energy’s subsidiaries cradle 36% of the common units of CVR Partners, a legacy etched in the annals of industry lore.