CVS Health Experiences Significant Gains Amid Strong Q1 Performance

CVS Health is enjoying a nearly 38% rise in its shares this month, driven by solid first-quarter 2025 results that exceeded expectations. While there are concerns over the company’s plan to close multiple stores due to new Pharmacy Benefit Management (PBM) legislation, the overall sentiment in the market remains favorable. Investors are particularly encouraged by the performance of CVS’s Health Care Benefits segment, which has seen advantages from favorable prior-year adjustments and enhanced Medicare outcomes. Additionally, margin improvements in the first quarter contribute to this optimistic outlook. The company has also raised its full-year EPS guidance, indicating strong performance across all operational sectors.

This PBM and pharmacy retail leader has significantly outperformed the S&P 500, which saw a 0.8% decline, along with competitors like Walgreens Boots (WBA) and Herbalife Ltd. (HLF), which posted gains of 21.9% and 1.8%, respectively, during the same timeframe.

Month-to-Date Price Comparison

Image Source: Zacks Investment Research

Key Q1 Takeaways

CVS Health’s first-quarter 2025 results showed adjusted earnings per share (EPS) of $2.25 and adjusted operating income of $4.6 billion, surpassing market expectations. The company has revised its full-year adjusted EPS guidance upward to between $6 and $6.20, an increase from the previous $5.75 to $6 target. This revision signals confidence in the sustained strength and effective management of its core operations—Health Care Benefits, Pharmacy Services, and Retail/LTC.

A key highlight from this quarter includes the appointment of Brian Newman as chief financial officer and Amy Compton-Phillips as chief medical officer. CVS believes that a complete management team places the company in a better position to realize its long-term vision of becoming America’s most trusted healthcare entity.

Moreover, the CVS Health app is emerging as a significant digital tool, granting customers enhanced visibility into their care and providing real-time AI suggestions. These features promote higher engagement and aim to improve health outcomes through personalized insights.

Streamlining Access and Lowering Costs

CVS Health is improving care accessibility by streamlining prior authorization processes, achieving a 95% turnaround within 24 hours for Aetna’s requests. The introduction of its bundled cancer care model is reducing delays and minimizing provider burdens, with plans for expansion into cardiology and musculoskeletal care.

Additionally, CVS’s pharmacy segment stands out in the industry, fulfilling over 1.7 billion prescriptions each year and ensuring high medication adherence, particularly among Medicare Advantage participants. Investments in technology and operational efficiency are driving this success.

On affordability, CVS is enhancing access to essential therapies. It has partnered with Novo Nordisk to offer Wegovy at reduced costs through its weight management program and maintains a leading position in the U.S. market with its low-cost Humira biosimilar, Cordavis, yielding over $1 billion in savings for clients.

Portfolio Optimization and Strategic Focus Areas

CVS Health announced it will exit the ACA individual exchange markets by 2026 due to ongoing losses, despite efforts to improve performance over several years. The company plans to concentrate on segments where it holds a competitive advantage, specifically Medicare, commercial, and Medicaid plans.

PBM Reform Sparks Controversy as CVS Closes Pharmacies in Arkansas

CVS Health is poised to close 23 pharmacies in Arkansas after the enactment of HB1150, a groundbreaking law that prohibits PBMs from owning or operating pharmacies in the state. Signed by Governor Sarah Huckabee Sanders in April 2025, this legislation comes amid increased scrutiny of PBMs and their impact on drug pricing.

PBMs, including those associated with CVS Health, Cigna (CI), and UnitedHealth (UNH), manage nearly 80% of U.S. prescriptions. A January 2025 FTC report indicated significant price markups on essential generics for conditions like heart disease, cancer, and HIV treatments.

Governor Sanders stated that the law seeks to prevent PBMs from exploiting weak regulations. Conversely, CVS cautioned that this decision will restrict pharmacy access, raise drug costs, and result in job losses, labeling HB1150 as “bad policy” and initiating a campaign for its veto.

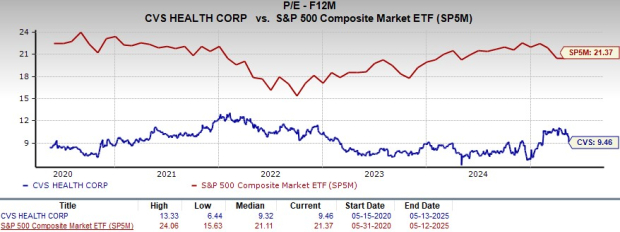

CVS Health Offers Relative Value Amid Mixed Peer Comparisons

Regarding valuation, CVS Health’s forward 12-month price-to-earnings (P/E) ratio stands at 9.46X, considerably lower than the S&P 500’s 21.37X.

Image Source: Zacks Investment Research

However, CVS is trading at a premium compared to competitors such as Walgreens Boots Alliance, which averages 7.52X, and Herbalife at 3.32X. This premium for CVS may be warranted due to its scale, operational efficiency, and focus on digital health and value-based care. The discount relative to the S&P 500 presents an attractive opportunity for long-term investors seeking stable growth in the healthcare sector.

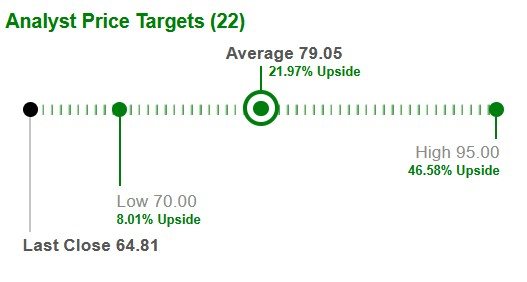

Target Price Reflects Strong Upside

Current short-term price targets from 22 analysts indicate that CVS Health is presently trading about 22% below its average Zacks price target.

Image Source: Zacks Investment Research

CVS Health – A Buy Now

Despite facing regulatory challenges and pharmacy closures related to PBM reform, CVS Health, now rated as a Zacks Rank #2 (Buy), continues to be a solid long-term investment option. The company’s diverse portfolio across retail, insurance, and pharmacy benefits helps mitigate short-term risks. CVS is advancing in digital health, enhancing prior authorizations, and improving medication adherence, particularly for Medicare Advantage members. With its low P/E ratio compared to the S&P 500 and a justified premium over competitors, CVS presents a stable, scalable, and promising investment in an evolving healthcare landscape.

# Innovative Financial Firm Poised for Major Growth Potential

This top pick is soaring as one of the most innovative financial firms. With a rapidly expanding customer base of over 50 million and a diverse array of cutting-edge solutions, this stock is positioned for significant gains. While not all elite selections turn into successes, this one may outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged by +129.6% in just over nine months.

Investors seeking growth should pay attention to this promising option in the market. Its innovative approach and customer-centric model could lead to strong future performance.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.