Industry Overview

The Zacks Utility – Water Supply industry caters to the critical need for clean drinking water and wastewater services for a broad range of customers, including residential, commercial, and military facilities across America. As the lifelines of healthy living, these companies must deliver an uninterrupted flow of clean water and reliable sewer services every day, amidst a pressing need for infrastructure upgrades.

Investing in Utility Water Supply

To meet the ever-growing demand for potable water, utility operators manage storage tanks, treatment facilities, and an extensive network of pipelines. The Environmental Protection Agency estimates nearly $896 billion is necessary to modernize and expand water services in the next two decades, emphasizing the pressing need for ongoing investment in infrastructure.

Financial Snapshot

Two notable companies in this sector are Consolidated Water Co. Ltd. (CWCO), with a market cap of $429.6 million, and Global Water Resources Inc. (GWRS), with a market cap of $303.4 million. Both currently hold a Zacks Rank #2 (Buy), reflecting market optimism about their future prospects.

Growth Projections

Analysts project CWCO’s 2024 earnings at $1.24 per share, with revenues of $141.05 million, indicating a decline in both bottom-line and top-line figures. Conversely, GWRS is forecasted to experience growth, with estimated earnings of 31 cents per share on revenues of $53.05 million.

Return on Equity (ROE)

Comparing ROE metrics, Consolidated Water and Global Water Resources boast impressive 13.39% and 13.64% respectively, surpassing the industry average of 9.6%. This highlights their efficiency in utilizing shareholders’ funds.

Debt Position & Liquidity

Current debt-to-capital ratios reveal that Consolidated Water has a conservative 0.14%, while Global Water Resources carries more debt at 68.86%. A higher current ratio for CWCO (4.14) compared to GWRS (0.82) indicates better financial flexibility in meeting near-term obligations.

Dividend Yield

Both companies offer dividend yields above the S&P 500 Composite average of 1.32%, with Consolidated Water at 1.39% and Global Water Resources at 2.4%. This signals their commitment to shareholder value and financial stability.

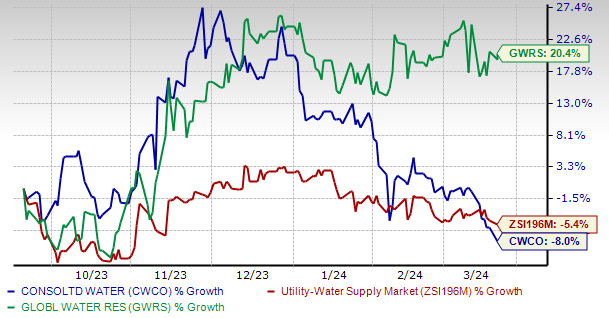

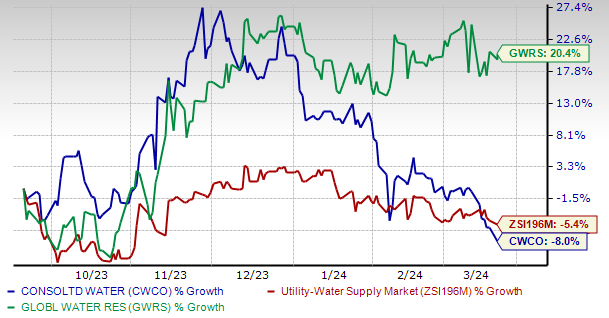

Price Performance

Investors have witnessed diverging trends in share prices, with GWRS gaining 20.4% in the past six months while CWCO has declined by 8%. Notably, these performances have outpaced the industry’s 5.4% decline during the same period.

Conclusion

In assessing CWCO and GWRS, both companies exhibit strengths in their respective financial metrics and market positioning. However, considering factors such as growth projections, ROE, dividend yield, and recent price performance, Global Water Resources (GWRS) emerges as a promising choice for investors seeking exposure to the utility water supply sector.

Image Source: Zacks Investment Research

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.