On December 24, 2025, D. Boral Capital maintained a Buy recommendation for Omeros Corporation (NasdaqGM: OMER). Analyst projections indicate a significant potential upside of 123.86%, with an average one-year price target of $34.34 per share, compared to its latest closing price of $15.34.

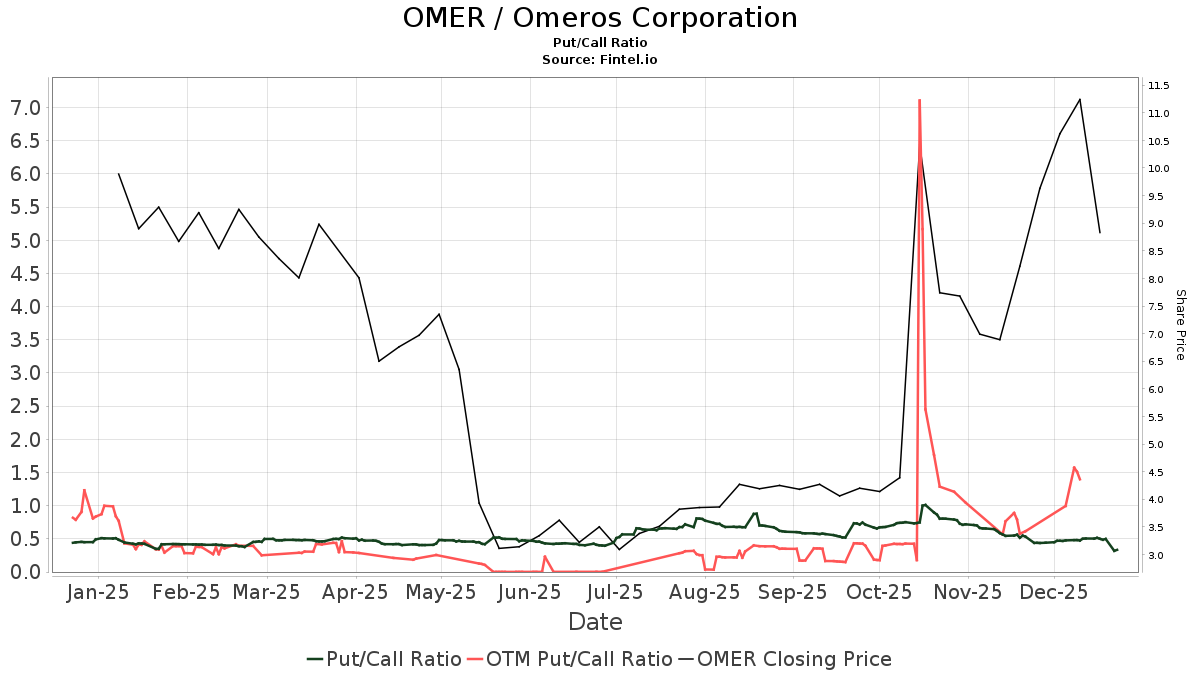

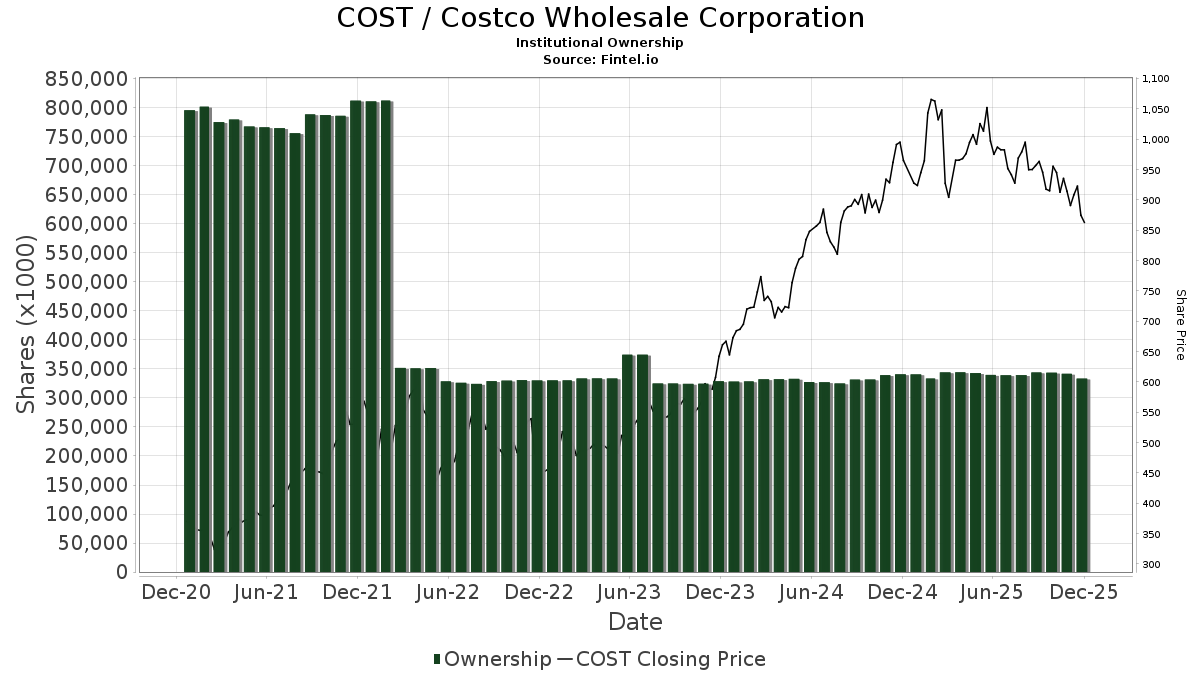

Omeros is expected to generate projected annual revenue of $122 million. Institutional ownership has seen an increase of 11.02% in shares over the last three months, totaling 35,802K shares. Currently, 247 funds are reported to hold positions in Omeros. The stock has a put/call ratio of 0.33, reflecting a bullish market sentiment.

Ingalls & Snyder has increased its holdings by 3.01% to 4,107K shares, while Stifel Financial has decreased its allocation by 64.37%, holding 1,812K shares. Other notable shareholders include Vanguard Total Stock Market Index Fund (1,733K shares) and Geode Capital Management (1,535K shares), both reflecting recent increases in their portfolio allocations.