https://www.youtube.com/watch?v=xpg033SpcN8[/embed>

D.R. Horton, Inc. (DHI) has seen its stock decline by 10% since the company released its financial results for the first quarter of fiscal 2025 on January 21. The outlook for D.R. Horton’s earnings is dimming as the housing market experiences a slowdown.

Both Wall Street analysts and D.R. Horton are anticipating changes in market conditions that could potentially revive the housing and home-building sectors.

Understanding D.R. Horton’s Recent Challenges

Since the early 2000s, D.R. Horton has held the title of the largest homebuilder in the U.S. The Arlington, Texas-based company operates in 36 states and nearly 130 markets.

The company offers a variety of home brands catering to diverse buyer needs, with prices ranging from $200,000 to over $1 million. Additionally, D.R. Horton provides mortgage financing and title services.

Between 2012 and 2022, D.R. Horton enjoyed significant growth, including a 21% increase in revenue in 2022 and a remarkable 37% growth in 2021. However, the housing market has substantially cooled since then, as high property prices and rising mortgage rates may dampen demand for some time.

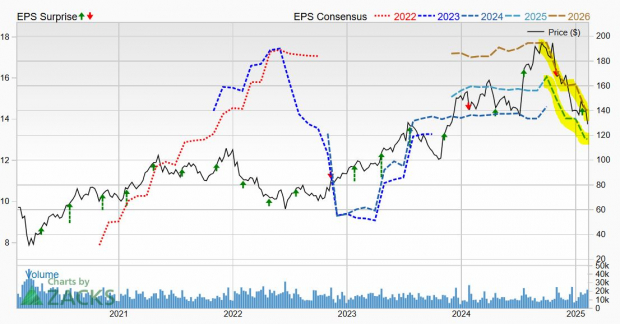

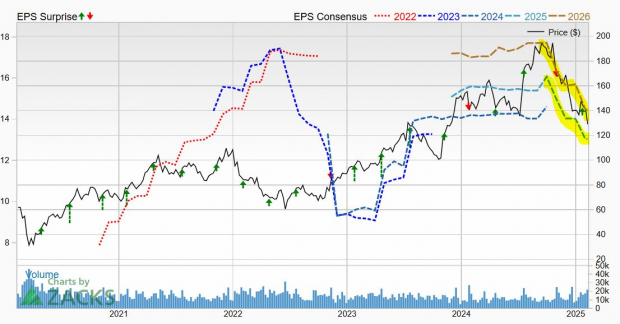

Image Source: Zacks Investment Research

For demand in home construction to recover, prices and interest rates may need to decrease further. Following its Q1 FY25 report on January 21, D.R. Horton’s earnings outlook revised lower, with projections for FY25 down by 7% and FY26’s consensus falling 8%. These downward adjustments are part of a negative trend that began last fall.

D.R. Horton’s negative adjustments earned it a Zacks Rank #5 (Strong Sell), with an anticipated 9% decrease in adjusted earnings for FY25 due to slightly lower sales.

The Future of DHI Stock

DHI shares are down approximately 31% from their highs in the fall, suggesting that investors may wish to observe further developments within D.R. Horton and the broader industry before purchasing stocks.

Despite current challenges, D.R. Horton’s long-term outlook remains positive. Millennials are increasingly influencing the housing market, and builders did not overextend during the COVID-19 pandemic, leaving supply well below demand levels.

“D.R. Horton Executive Chairman David Auld noted, ‘The supply of homes at affordable price points is generally still limited, and the demographics supporting housing demand remain favorable.’

He added, ‘Despite ongoing affordability challenges, tools like mortgage rate buydowns have helped address these issues and stimulate demand. Additionally, our focus on affordable home designs has allowed us to continue starting and selling homes with smaller floor plans to meet buyer preferences.’

For now, investors should keep D.R. Horton on their radar while exploring other potential stock options.

Get All of Zacks’ Buys and Sells for Only $1

No catch!

In a surprising offer, we allow our members to access all our picks for just $1 for 30 days. There’s no obligation to spend more.

Thousands have taken advantage of this deal, while many remain skeptical. Our goal is to familiarize you with our portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and more, all of which achieved double- and triple-digit gains in 2024 alone.

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.