DA Davidson Initiates “Buy” on ChoiceOne Financial Services Amid Price Target Forecast

On October 18, 2024, DA Davidson began coverage of ChoiceOne Financial Services (NasdaqCM:COFS) with a strong Buy recommendation.

Analyst Price Forecast Indicates Potential Drop

The average one-year price target for ChoiceOne Financial Services stood at $27.54 per share as of July 24, 2024. Predictions ranged from a low of $27.27 to a high of $28.35. Notably, this average target reflects a 13.51% decrease from the latest closing price of $31.84 per share.

Explore our leaderboard highlighting companies with the greatest price target upside.

Expected Earnings and Fund Sentiment

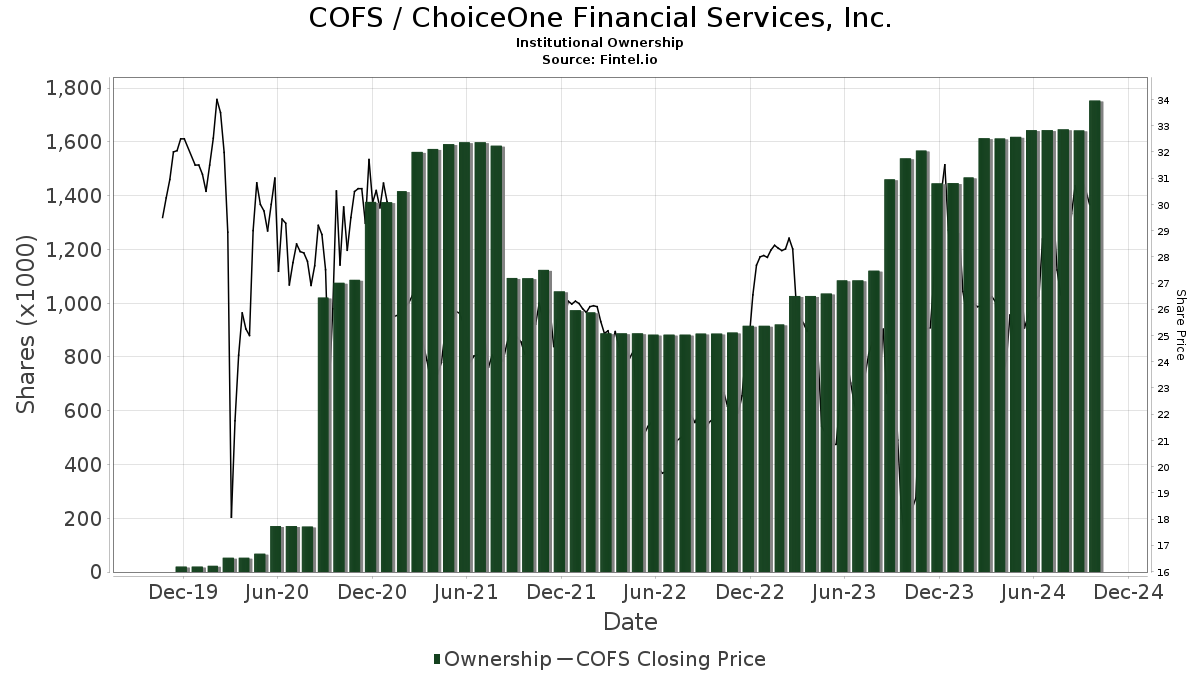

The projected annual non-GAAP EPS is estimated at 2.96. Currently, 140 funds or institutions hold positions in ChoiceOne Financial Services, marking an uptick of six owners, or 4.48%, over the last quarter. The average weight of portfolios dedicated to COFS is 0.01%, representing a significant increase of 27.10%. Total institutional shares rose by 6.92% in the last three months, reaching 1,743,000 shares.

Key Institutional Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) maintains 211,000 shares, which equates to 2.36% ownership of ChoiceOne. There was no change in its holdings over the last quarter.

iShares Russell 2000 ETF (IWM) holds 165,000 shares, or 1.84% of the company. Previously, it reported 174,000 shares, reflecting a 5.23% decrease. Nonetheless, its COFS portfolio allocation increased by 8.61% in the past quarter.

Geode Capital Management owns 155,000 shares, representing 1.73%. This shows an increase from 149,000 shares in its prior filing, which is a 3.81% rise. However, this firm has reduced its portfolio allocation in COFS by 46.04% over the last quarter.

The Regional Bank Fund (FRBAX) holds 105,000 shares, demonstrating 1.17% ownership. Similarly, the Vanguard Extended Market Index Fund Investor Shares (VEXMX) has 92,000 shares, representing 1.03% ownership, with no changes reported in the last quarter.

Company Background

ChoiceOne Financial Services Background Information

(This description is provided by the company.)

ChoiceOne Financial Services, Inc. serves as the holding company for ChoiceOne Bank, which is based in Sparta, Michigan. The company is known for delivering innovative services and technology to its customers. The bank has built a reputation for its digital banking options, which include mobile banking, mobile deposits, innovative payroll solutions, online loan applications, online account opening, and digital mobile savings tools.

Fintel is recognized as one of the most exhaustive investment research platforms available, catering to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses fundamental insights, analyst reports, ownership information, fund sentiment, options trading, and much more. Our exclusive stock picks are also driven by advanced quantitative models designed to enhance profitability.

Click to Learn More

This story initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.