Goosehead Insurance (GSHD): A Tough Sell Amid Rising Risks

Goosehead Insurance GSHD, currently holding a Zacks Rank #5 (Strong Sell), is becoming a stock to avoid due to its high valuation and weak balance sheet.

Since its IPO in 2018, Goosehead has shown impressive growth. However, with shares priced over $100, it now appears overpriced, especially with potential industry challenges looming in key markets like Los Angeles.

Image Source: Zacks Investment Research

Impact of California Wildfires on Finances

Underwriting margins have been good lately for property and multi-line insurers due to inflation, but the recent wildfires in Los Angeles have caused a surge in claims, increasing financial pressure on insurers.

Goosehead operates not only in Los Angeles but also in San Diego and Sacramento. While some smaller competitors are withdrawing from the California market, Goosehead remains.

Established companies like Progressive (PRG), are likely to weather these storms. However, newer firms such as Goosehead face more significant risk due to rising expenses and limited financial strength.

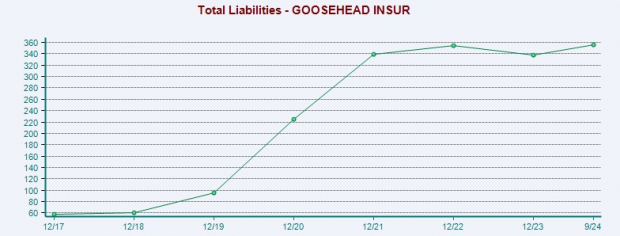

Goosehead’s financial situation is worrisome, with only $50 million in cash and equivalents and total assets of $358 million set against $356 million in liabilities, indicating a barely solvent position.

Image Source: Zacks Investment Research

Concerns over Valuation

Despite its growth, Goosehead’s stock trades at a staggering 55.4X forward earnings, while earnings per share (EPS) estimates have dropped 10% in the past month for fiscal 2025.

Image Source: Zacks Investment Research

GSHD’s valuation is significantly higher than its peers, with the Zacks Insurance-Multi Line Industry average at 9.9X forward earnings and the S&P 500 at 22.5X. Goosehead also trades at over 10X sales compared to an industry average of 1.5X and a benchmark of 5.6X.

Image Source: Zacks Investment Research

Conclusion

With its Q4 results set to be released on February 19, Goosehead may face further risk. The outlook for FY25 could also be disappointing.

Currently, the risk-to-reward ratio does not look appealing, especially as GSHD has surged nearly +200% in the past two years, indicating a possible pullback.

Explore Top Stocks for Short-Term Gains

Recently released: Experts have identified 7 promising stocks from a pool of 220 Zacks Rank #1 Strong Buys, known for their potential for early price increases.

Since 1988, this list has outperformed the market more than twice, averaging gains of +24.3% per year. These 7 stocks are worth your immediate attention.

Goosehead Insurance (GSHD): Free Stock Analysis Report

Chubb Limited (CB): Free Stock Analysis Report

The Allstate Corporation (ALL): Free Stock Analysis Report

Aaron’s Holdings Company, Inc. (PRG): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.