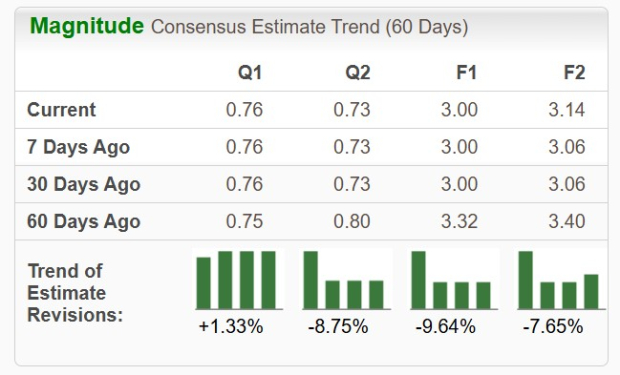

HP Inc. is facing a challenging outlook for fiscal 2026, with management forecasting a decline in PC unit volumes due to changes in customer purchasing behavior and macroeconomic pressures. As of now, analysts expect earnings per share for FY2026 to be $3.00, reflecting a negative growth rate of 3.9% compared to the previous year. The stock has underperformed the market, trading near a 52-week low, while the company has missed earnings estimates in four of the past six quarters, with a trailing average miss of 2.6%.

In the latest quarter, HP’s print revenues fell by 4% year-over-year, attributed to declining office demand in North America and Europe. The company is grappling with stiff competition from major players like Apple and Dell. HP’s stock has experienced a “death cross,” indicating sustained downtrends, now down over 30% in the past year. Consequently, HP holds a Zacks Rank of #5 (Strong Sell) and belongs to one of the lowest-performing industry groups, heightening concerns over its growth prospects.