Brunswick’s Future Looks Dim Amidst Market Challenges

Brunswick (BC) is a leading global manufacturer and marketer of recreational marine products, known for its diverse range of brands in boating, engines, and marine technology. Their offerings include boats, marine engines, and advanced navigation systems for both leisure and professional boating enthusiasts.

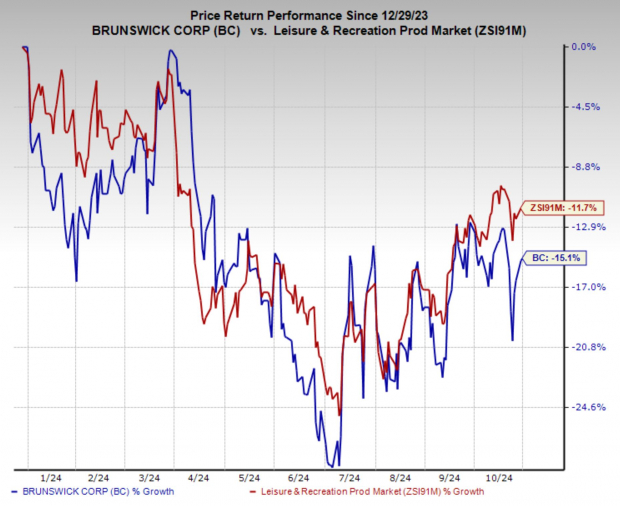

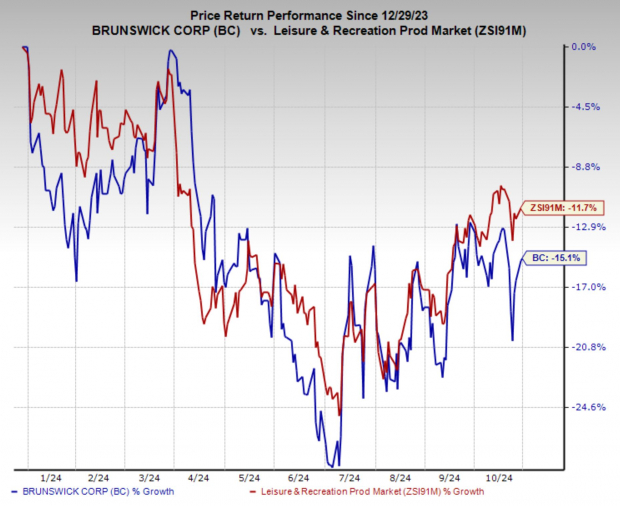

Despite its standing as a top player in the industry, the outlook for the boating market appears bleak, with expectations of stagnant sales and earnings. Currently, Brunswick has a Zacks Rank #5 (Strong Sell) rating, reflecting its poor performance alongside the broader sector this year.

Adding to the concerns, Brunswick’s valuation remains significantly above its historical averages. Given this unfavorable situation, investors may want to consider avoiding Brunswick stock until more positive data emerges.

Image Source: Zacks Investment Research

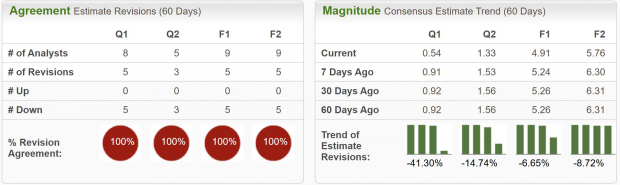

Alarming Decline in Brunswick Earnings Estimates

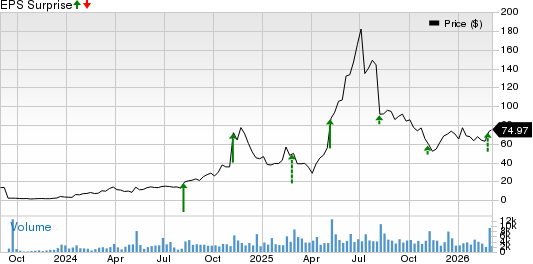

The recreational boating sector is facing serious challenges for the coming year, likely due to a surge in purchases following the post-COVID boom. Earnings estimates for the current quarter have been lowered by 41.3% and are expected to drop 62.7% year-over-year. Additionally, estimates for FY24 have decreased by 6.7% and project a decline of 44.2% compared to last year.

Brunswick’s Earnings ESP is particularly troubling, forecasting a miss of 45.56% on earnings in the upcoming quarterly report. On average, Brunswick has missed earnings estimates by 4.88% over the past four reports.

Image Source: Zacks Investment Research

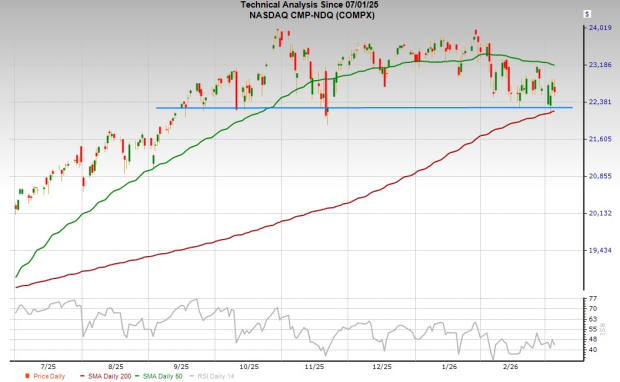

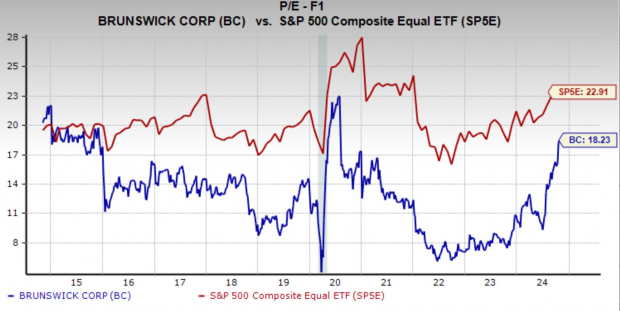

Brunswick Maintains High Valuation Despite Challenges

Despite its declining stock price and grim future outlook, Brunswick holds a premium valuation. Currently trading at a one-year forward earnings multiple of 18.2x, this figure is below the market average but significantly above its ten-year median of 13.1x.

With anticipated decreases in both sales and earnings for the year, maintaining such a high valuation heightens the risk for shareholders.

Image Source: Zacks Investment Research

Is Now the Time to Buy Brunswick Stock?

Taking into account the significant downward revisions in earnings estimates and the elevated valuation compared to its historical performance, Brunswick presents a notable risk for investors. The surge in demand post-COVID seems to have led to earlier-than-expected boat purchases, resulting in stagnation in growth for the foreseeable future. Brunswick’s Zacks Rank #5 reinforces this precarious situation, as earnings are expected to decline sharply compared to last year.

Until there are meaningful signs of improvement in the industry and Brunswick’s valuation becomes more aligned with its growth prospects, it may be prudent for investors to explore more stable investment opportunities.

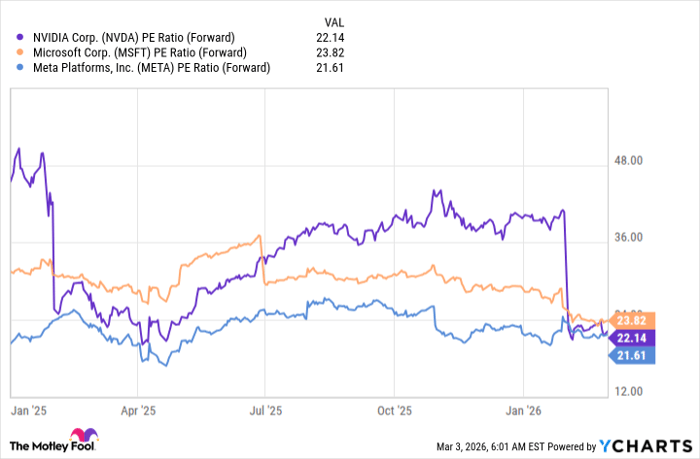

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Brunswick Corporation (BC): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.