Conagra Brands, Inc. (CAG) reported earnings of $0.45 per share for the second quarter of fiscal 2026 on December 19, 2025, surpassing analysts’ expectations by a penny. However, the company faced a 6.8% decline in net sales and a 3.0% decrease in organic net sales, indicating ongoing challenges due to a slowdown in consumer spending and elevated inflation.

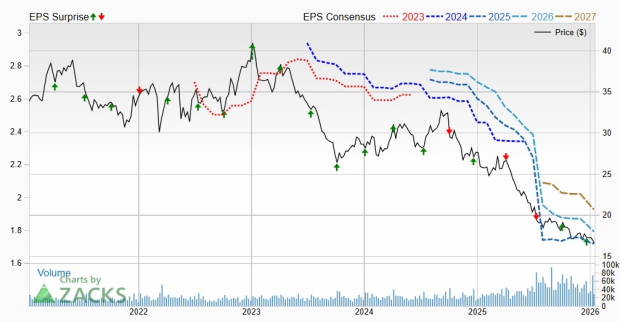

Conagra reaffirmed its fiscal 2026 guidance, expecting a decline of 1% to earnings between $1.70 and $1.85 per share. Total cost of goods inflation is projected at 7% for the year, influenced by tariffs anticipated to raise costs by 3%. Despite affirmations, analysts cut earnings estimates; the Zacks Consensus fell to $1.72 from $1.75, reflecting a 25.2% decline year-over-year.

Conagra shares have plummeted to near five-year lows, trading at a forward P/E ratio of 9.6, indicating a potentially undervalued position, while maintaining a dividend of $1.40 per share—a yield of 8.5%—despite cash flow reductions from $754 million the previous year to $331 million in the first half of fiscal 2026.