Apple Inc. Shows Signs of Potential Breakout

Calm Trading Day for Apple Inc. AAPL is experiencing quiet trading on Friday, with minimal price movement. However, recent patterns suggest a potential upward breakout in the near future.

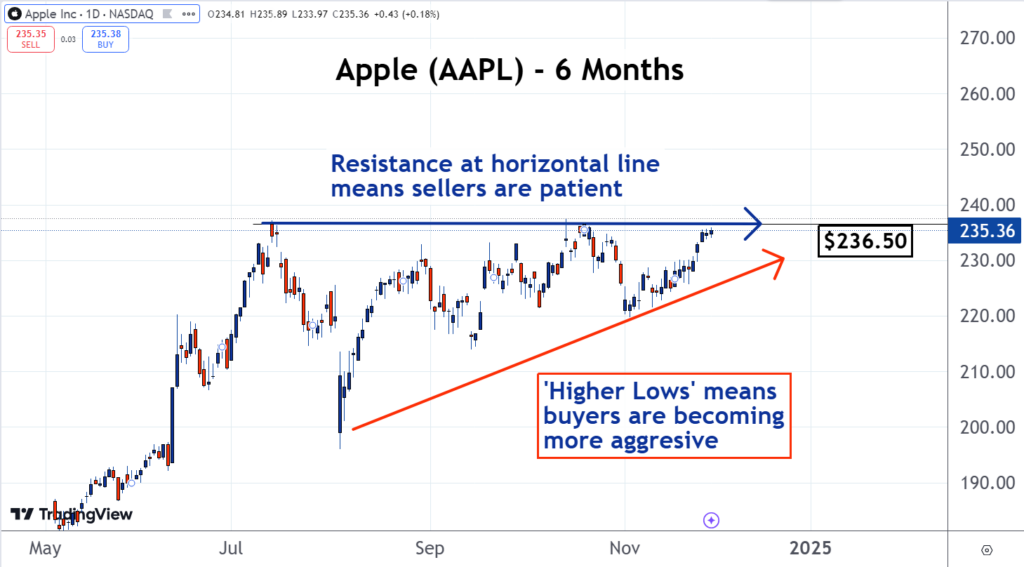

Technical Indicators Favor an Upswing A classic Ascending Triangle Pattern has emerged on the chart, typically signaling bullish behavior. Our team of expert analysts has designated Apple as our Stock of the Day.

The Role of Technical Analysis Technical analysis is often viewed with skepticism. This skepticism arises from analysts who identify chart patterns without fully grasping the underlying price dynamics.

Nevertheless, when employed effectively, technical analysis examines supply and demand dynamics along with the investment psychology at play in the markets. These insights enable knowledgeable traders to capitalize on market movements.

Understanding Market Behavior An Ascending Triangle Pattern occurs due to two opposing market behaviors: aggressive buyers and passive sellers.

As illustrated in the chart, the $236.50 level has acted as a resistance point since July, with similar resistance noted in late October. Currently, this price level is acting as a barrier once more.

Investor Sentiment and Market Dynamics The large number of traders and investors who previously placed sell orders at this resistance level have shown patience, waiting for buyers to step up before making any moves. They are not inclined to lower prices at this stage.

In contrast, buyers have grown increasingly impatient, willing to pay higher prices to acquire shares.

Market movements rarely occur in straight lines; instead, they form fluctuating peaks and valleys. When a valley forms higher than the previous one, it indicates a “higher low,” underscoring a crucial aspect of price action.

Over time, this trend reveals that buyers have consistently entered the market at higher prices, demonstrating their growing aggressiveness. This mix of patient sellers and assertive buyers sets up a potential scenario for Apple to overcome its resistance barriers.

Should this breakout occur, it would imply that the sellers who created the resistance have either completed or abandoned their orders. This shift could compel buyers to pay increasingly higher prices to secure sales, potentially driving Apple’s stock into an uptrend.

Stay Informed: What’s Next for Apple?

• Will Apple or Nvidia emerge as the world’s most valuable company by the conclusion of 2024? Traders on Polymarket appear to have a favorite.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs