Daiwa Capital Downgrades Daqo New Energy: What You Need to Know

Recent Changes in Fund Sentiment

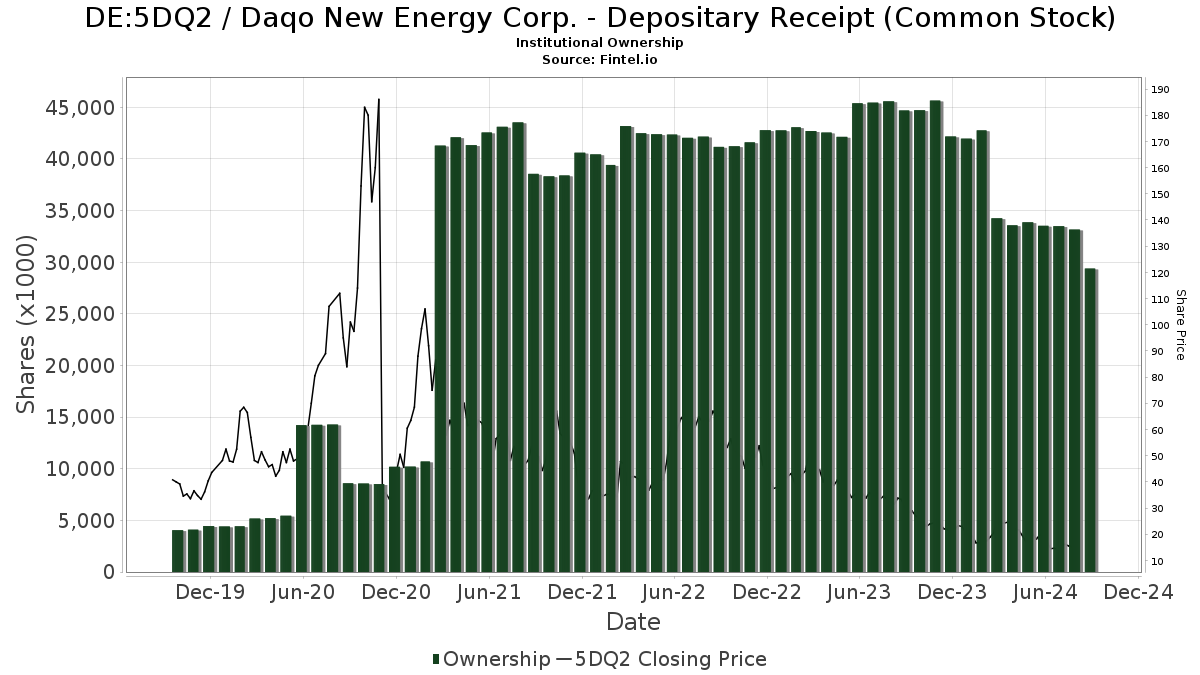

On October 9, 2024, Daiwa Capital revised its outlook for Daqo New Energy – Depositary Receipt (MUN:5DQ2) from Outperform to Hold. Currently, 209 funds or institutions report holding positions in Daqo New Energy, showing a decline of 54 owners or 20.53% from last quarter. The average portfolio weight across all funds in 5DQ2 is 0.31%, which is a rise of 4.85%. Over the past three months, total shares owned by institutions dropped by 10.70%, totaling 29,329K shares.

Insights from Other Shareholders

Continental General Insurance increased its shares held to 5,135K from 4,735K, marking a 7.79% rise. However, the firm reduced its portfolio allocation in 5DQ2 by 15.59% in the last quarter.

FIL has reduced its holdings slightly from 2,729K shares to 2,723K, a 0.24% decrease. Their allocation in 5DQ2 fell significantly by 71.12% during the same period.

Franklin Resources reported a decrease in shares from 2,730K to 2,672K, which is a 2.18% drop. The firm cut back its portfolio allocation in 5DQ2 by a substantial 91.76% last quarter.

Mackenzie Financial saw an increase in shares from 2,347K to 2,497K, representing a rise of 5.99%. Nonetheless, their portfolio allocation in 5DQ2 was reduced by 43.11%.

Invesco reported an increase in shares held from 1,305K to 1,627K, reflecting a 19.79% uplift. Still, the portfolio allocation in 5DQ2 decreased by 36.34% during the last quarter.

Fintel offers a comprehensive investing research platform designed for individual investors, traders, financial advisors, and small hedge funds.

The platform provides extensive data, including fundamentals, analyst reports, ownership statistics, and much more. Its exclusive stock picks utilize advanced, backtested quantitative models to enhance investment performance.

This article was initially published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.