Datadog Shines in Q3 2024: Earnings and Revenue Surge

Datadog DDOG reported third-quarter 2024 non-GAAP earnings of 46 cents, marking a 27.8% increase from the same quarter last year and exceeding the Zacks Consensus Estimate by 17.95%.

With revenues totaling $690 million, an increase of 26% year over year, the company also surpassed the consensus estimate by 4.15%.

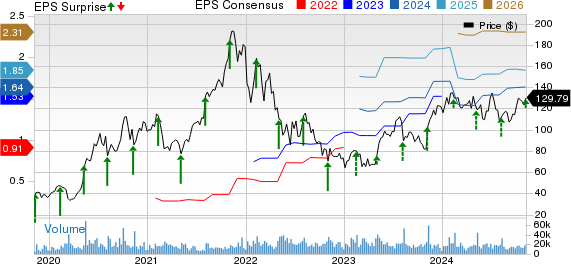

In reaction to these results, DDOG shares rose 1.12% in pre-market trading. Although Datadog’s stock has gained 6.9% this year, it trails the Zacks Computer and Technology sector, which has risen 28.5% year-to-date.

Price Performance and Shareholder Insights

Datadog, Inc. price-consensus-eps-surprise-chart | Datadog, Inc. Quote

Customer Growth in Q3

Datadog ended the third quarter with 29,216 customers, up from 26,800 the previous year.

During this quarter, the company had 3,490 customers with an annual run rate (ARR) of $100,000 or more, a 12% increase year over year. These customers contributed to about 88% of the total ARR.

By the end of the quarter, 83% of customers were using two or more products, slightly up from 82% a year earlier. Moreover, 49% of customers utilized four or more products, compared to 46% last year.

Datadog’s net revenue retention remained strong, sitting in the mid-110s as customers expanded their usage and product adoption.

Operating Results Overview

In Q3, DDOG’s adjusted gross margin fell by 120 basis points (bps) year-over-year to 81.1%.

Research and development expenses rose by 25.2% to $195 million, driven by increased investment. Research and development costs, as a percentage of revenue, decreased by 20 bps to 28.3%.

Meanwhile, sales and marketing expenses increased by 22.1% to $155.8 million. These expenses, as a portion of revenue, shrank by 70 bps to 22.6%.

General and administrative expenses dipped 1.9% year over year, totaling $36.1 million. This represented 5.2% of revenues, a decline of 150 bps.

Datadog reported a non-GAAP operating income of $173 million, up from $130.8 million a year prior. The operating margin improved by 120 bps to 25.1%.

Balance Sheet and Cash Flow Highlights

As of September 30, 2024, Datadog held cash, cash equivalents, and marketable securities amounting to $3.2 billion, up from $3.0 billion on June 30, 2024.

Operating cash flow reached $228.7 million for the quarter, an increase from $164.4 million in the previous quarter.

Free cash flow amounted to $203.6 million, compared to $143.8 million the prior quarter.

Future Guidance for Q4 & 2024

For Q4 of 2024, DDOG anticipates revenues between $709 million and $713 million. Non-GAAP operating income is expected to range from $163 million to $167 million, with non-GAAP earnings targeted at 42 to 44 cents per share.

For the full year 2024, Datadog forecasts revenues between $2.656 billion and $2.660 billion, with non-GAAP operating income likely between $658 million and $662 million. Non-GAAP earnings per share are projected in the range of $1.75 to $1.77.

Stock Ratings and Performance Comparison

Currently, Datadog holds a Zacks Rank #4 (Sell).

Stocks performing better in the broader Zacks Computer & Technology sector include StoneCo STNE, NVIDIA NVDA, and Bilibili BILI. StoneCo has a Zacks Rank #1 (Strong Buy), while NVIDIA and Bilibili both carry a Zacks Rank #2 (Buy).

StoneCo shares have declined by 37% year-to-date and are set to announce their Q3 fiscal 2025 results on November 12.

NVIDIA shares have soared by 200.3% this year and are slated to report Q3 fiscal 2025 results on November 20.

Bilibili shares have risen 98.3% in the same timeframe, with their third-quarter results expected on November 14.

5 Stocks to Watch as Infrastructure Spending Rises

With trillions of federal dollars allocated for infrastructure improvements, significant investments will flow into AI data centers, renewable energy, and more.

This report reveals five promising stocks positioned to benefit from this burgeoning spending trend.

Download now and learn how to profit from the trillion-dollar infrastructure boom.

Get the latest recommendations from Zacks Investment Research and discover 5 stocks set to double.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

To read this complete article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.