Datadog Strengthens Cloud Monitoring with Metaplane Acquisition

Datadog (DDOG) has expanded its cloud monitoring services by acquiring Metaplane, a firm specializing in end-to-end data observability. The machine learning-powered tools developed by Metaplane assist businesses in detecting, preventing, and addressing data quality issues throughout their data stacks. This integration enhances trust in the data that drives AI models and modern applications.

This acquisition complements Datadog’s earlier initiatives, such as Data Jobs Monitoring and Data Streams Monitoring, as the company deepens its presence in the burgeoning data observability market. With platforms like Snowflake and Databricks becoming integral to business operations, Datadog’s new features provide customers with comprehensive visibility across the entire data lifecycle, from production to final use, rather than monitoring just after data is stored in a warehouse.

As companies increasingly depend on AI and data-driven products, the demand for full-stack data observability grows. The inclusion of Metaplane’s technology enables data teams to identify issues earlier, enhancing reliability and fostering faster innovation within their organizations. This move solidifies Datadog’s status as a comprehensive observability platform suited for the modern cloud landscape.

Significance of Datadog’s Acquisition

This acquisition aligns with a broader trend as Datadog’s clientele expands their reliance on cloud services, AI, and data-centric applications. As of the end of 2024, DDOG had approximately 30,000 customers, including 45% of the Fortune 500. Additionally, over 3,600 customers contributed $100,000 or more in annual recurring revenue (ARR). Although Datadog excelled in observability for infrastructure, applications, and logs, it lacked a complete view of data quality and flow. The addition of Metaplane addresses this critical shortcoming as organizations seek deeper data monitoring capabilities.

By incorporating Metaplane’s features into its platform, Datadog aims to boost overall product adoption. In the fourth quarter, 50% of customers utilized four or more products, while 12% engaged with eight or more. Introducing end-to-end data observability should enhance customer retention, increase cross-selling opportunities, and support long-term revenue growth—especially as businesses look for integrated solutions for their cloud and data needs.

Financial Performance and Future Outlook

Datadog’s financial performance shows resilience, with estimates for first-quarter 2025 revenues projected between $737 million and $741 million, translating to a year-over-year growth rate of 20-21%. For the entirety of 2025, the revenue forecast is between $3.175 billion and $3.195 billion, with non-GAAP earnings expected to be in the range of $1.65 to $1.70 per share.

The Zacks Consensus Estimate places 2025 revenues at $3.19 billion, with earnings at $1.68 per share. This indicates an 18.7% increase in revenue but a projected decrease of 7.69% in earnings. Notably, earnings estimates were recently revised downward by a penny over the past month.

Image Source: Zacks Investment Research

Stock Performance and Valuation

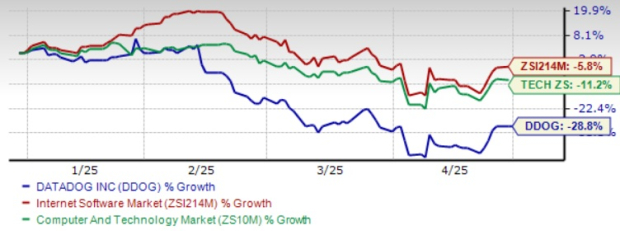

Year-to-date, DDOG shares have fallen by 28.8%, underperforming both the Zacks Computer and Technology sector, which has seen an 11.2% decline, and the Zacks Internet – Software industry’s drop of 5.8%.

DDOG’s Year-to-Date Price Performance

Image Source: Zacks Investment Research

In terms of valuation, Datadog currently has a forward 12-month price-to-sales (P/S) ratio of 10.33, significantly higher than the Zacks Internet – Software industry average of 4.84. This disparity suggests that investors hold high growth expectations for the company, casting doubt on its appeal to value investors. Furthermore, a value score of F indicates that DDOG is not seen as an attractive option at this time.

Datadog Trading at a Premium

Image Source: Zacks Investment Research

Challenges from Competition and Rising Costs

Datadog encounters increasing pricing pressures from competitors in the observability and cloud monitoring markets. Significant players include IBM, Microsoft, and Broadcom in on-premise monitoring, while Datadog contends with cloud providers’ native solutions like Amazon Web Services, Google Cloud Platform, and Microsoft Azure, along with rivals such as Cisco Systems, Dynatrace, and Splunk in application performance monitoring.

Moreover, Datadog has faced rising costs due to escalating research and development, sales, marketing, and administrative expenses, which increased by 29.4%, 31.3%, and 29.6% year-over-year, reaching $211.6 million, $173.3 million, and $38.7 million, respectively, in the fourth quarter of 2024. This trend may negatively impact the company’s financials in the near term.

Why Holding DDOG Stock Remains a Sound Strategy

While Datadog currently faces challenges from rising costs and competition, its long-term growth potential remains strong. The incorporation of Metaplane enhances the platform and paves the way for future cross-selling opportunities. Strong customer growth and favorable market trends for cloud and AI, alongside promising revenue forecasts for 2025, position Datadog well for the future. Given its premium valuation and 28.8% decrease year-to-date, investors might find it prudent to hold DDOG stock for now.

Datadog currently holds a Zacks Rank of #3 (Hold).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.