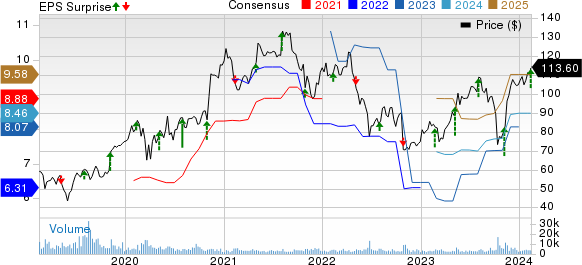

DaVita Inc. (DVA) delivered adjusted earnings per share (EPS) of $1.87 in the fourth quarter of 2023, down 36.4% sequentially. However, the figure topped the Zacks Consensus Estimate by 22.2%. GAAP EPS from continuing operations for the quarter was $1.62, reflecting a surge of 174.6% year over year.

Full-year adjusted EPS was $8.47, up 28.3% compared with that at the end of the comparable 2022 period. The figure surpassed the Zacks Consensus Estimate by 4.9%.

Revenues Triumph

Revenues of $3.15 billion in the fourth quarter increased 4.6% year over year, surpassing the Zacks Consensus Estimate by 4.8%. The top line was driven by solid performances of DaVita’s dialysis patient service revenues and Other revenues. Full-year revenues were $12.14 billion, reflecting a 7.9% improvement from the comparable 2022 period and topping the Zacks Consensus Estimate by 1.2%.

Segments outperform

DaVita generates revenues via Dialysis patient service revenues and Other revenues. The dialysis patient service revenues stood at $2.97 billion, with an increase of 6% year over year. Other revenues were $173.5 million, up 53.1% from the year-ago quarter’s figure.

As of Dec 31, 2023, DaVita provided dialysis services to around 250,200 patients at 3,042 outpatient dialysis centers. During the fourth quarter of 2023, the company opened two new dialysis centers, closed 21 centers in the United States, and acquired eight centers while closing one outside the United States in the same period.

Margin Boost

In the quarter under review, DaVita’s gross profit rose 21.6% to $1.01 billion. The gross margin expanded 363 basis points (bps) to 32%.

Adjusted operating profit totaled $605.9 million, reflecting a 35.1% uptick from the prior-year quarter’s level. Adjusted operating margin in the fourth quarter expanded 389 bps to 19.3%.

Guidance and Conclusion

DaVita has initiated its adjusted EPS outlook for 2024. Adjusted EPS for the full year is projected to be in the range of $8.70-$9.80. The Zacks Consensus Estimate currently stands at $8.46.

DaVita ended the fourth quarter of 2023 with better-than-expected results. The uptick in the company’s overall top line and dialysis patient service and Other revenues during the period was impressive. The opening of dialysis centers within the United States and acquiring centers overseas were promising. The expansion of both margins bodes well for the stock. The per-day increase in total U.S. dialysis treatments for the fourth quarter on a sequential basis was another positive. However, the sequential decline of DaVita’s adjusted EPS was discouraging. The company faced continued labor challenges during the reported quarter, which was further concerning.

Rank and Picks

DaVita currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical space that have announced quarterly results are Cencora, Inc. (COR), Elevance Health, Inc. (ELV), and Cardinal Health, Inc. (CAH).

Cencora, carrying a Zacks Rank of 2 (Buy), reported first-quarter fiscal 2024 adjusted EPS of $3.28, beating the Zacks Consensus Estimate by 14.7%. Revenues of $72.25 billion outpaced the consensus mark by 5%.

Elevance Health reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%. It currently carries a Zacks Rank #2.

Cardinal Health reported second-quarter fiscal 2024 adjusted EPS of $1.82, beating the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion surpassed the Zacks Consensus Estimate by 1.1%. It currently carries a Zacks Rank #2.

Zacks Investment Research