DaVita Inc. Faces Earnings Decline Ahead of Q1 2025 Release

DaVita Inc. (DVA), with a market capitalization of $11.2 billion, specializes in providing kidney dialysis services for individuals suffering from chronic kidney failure. Based in Denver, Colorado, the company is set to announce its Q1 2025 earnings on Thursday, May 1.

Projected Earnings Drop for Q1 2025

Analysts project that DaVita will report adjusted earnings of $1.75 per share. This figure marks a sharp decline of 26.5% compared to the $2.38 per share reported in the same quarter last year. Although DaVita has met or exceeded Wall Street’s earnings expectations in three of the last four quarters, it fell short on one occasion.

2025 and 2026 Earnings Forecasts

Looking ahead to the fiscal year 2025, analysts anticipate DaVita’s adjusted EPS to rise to $10.76, representing a gain of 11.2% from $9.68 in fiscal 2024. Projections for fiscal 2026 indicate a further increase of 18.1% year-over-year, with earnings expected to reach $12.17 per share.

Stock Performance and Market Comparison

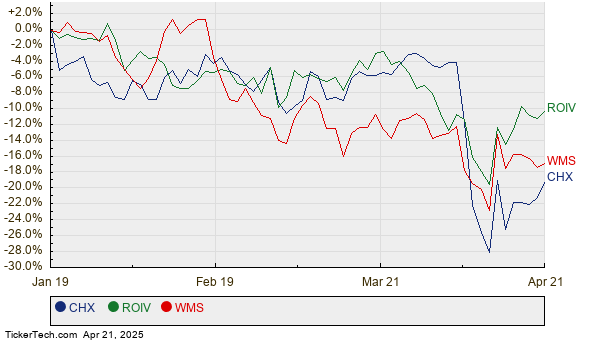

DVA shares have increased by 9.7% over the past 52 weeks, surpassing the S&P 500 Index’s ($SPX) gain of 5.4% and the Health Care Select Sector SPDR Fund’s (XLV) decline of 2.1% in the same period.

Recent Q4 Results and Investor Sentiment

Following the release of its Q4 2024 results on February 13, DVA stock saw a decline of 11.1%. In that quarter, the company reported revenue of $3.3 billion, reflecting a year-over-year increase of 4.7%, mainly attributed to seasonal adjustments such as flu vaccines. DaVita’s adjusted EPS of $2.24 exceeded Wall Street’s expectations and was a 1.4% improvement over estimates.

Despite these positive results, investor sentiment has been tempered due to DaVita’s cautious outlook for 2025. The company expects adjusted operating income between $2.01 billion and $2.16 billion, with adjusted EPS projected between $10.20 and $11.30, factors that have raised concerns among investors.

Analyst Ratings and Price Targets

Currently, analysts maintain a cautious outlook, issuing an overall “Hold” rating for DVA. Among eight analysts monitoring the stock, one recommends a “Strong Buy,” six endorse a “Hold,” and one suggests a “Moderate Sell.” The average price target stands at $169.14, indicating a potential upside of 20.8% compared to current trading levels.

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.