“`html

Trump’s Tariffs Create Turbulence in US Stock Market

Trump’s Trade Policies Impact Market Sentiment

Since leaving the White House, Donald Trump has voiced concerns about foreign countries like Japan, China, and Germany benefiting from lax U.S. trade policies. Now, during his second presidential term, he plans to impose retaliatory tariffs to address trade imbalances, combat fentanyl trafficking, and revitalize American manufacturing.

As a result, Wall Street appears skeptical about the tariff approach. The S&P 500 Index ETF (SPY) has dropped 5% in the past month. Increasing market volatility, coupled with intraday comments from Trump and his economic advisors, has led to abrupt market shifts. Investors now question whether their reactions to the tariffs are overblown.

Market Corrections Are Expected, Even in Bullish Trends

The S&P 500 Index has surged roughly 40% since hitting bottom in October 2022. However, seasoned investors recognize that market movements are rarely linear. Historically, the current bull market has seen multiple 5% corrections. It is possible that investors were simply waiting for an impetus to sell, and the tariff announcement provided that spark.

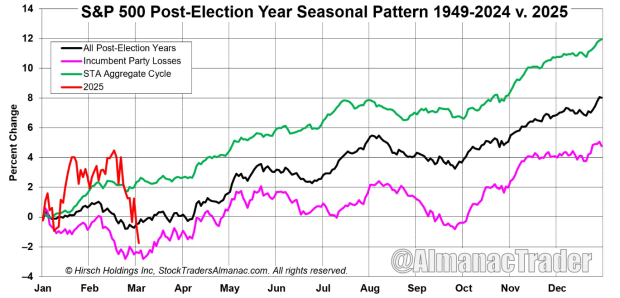

Anticipated Market Corrections Linked to Election Cycles

In recent years, historical seasonality trends have shown considerable accuracy in predicting market fluctuations. Even before the tariffs were declared, seasonal patterns indicated that weakness in equities during the first quarter was likely. However, this downturn usually dissipates, with markets often finding a bottom in late March.

Image Source: Hirsch Holdings, (@almanactrader)

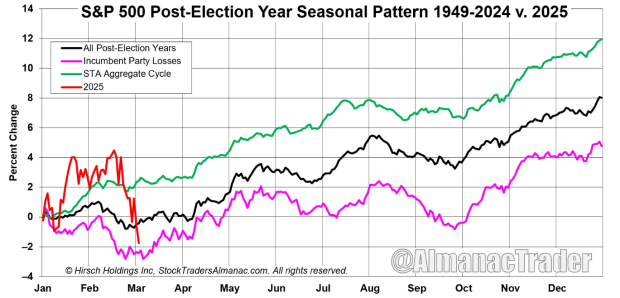

Historical Context: A Familiar Scenario

Investors can draw on historical examples. Tariffs were previously implemented during Trump’s presidency, setting a precedent for the current situation.

Image Source: Zacks Investment Research

Staying Above the 200-Day Moving Average

Since the lows of 2022, the market has consistently remained above the 200-day moving average. While the Nasdaq 100 Index ETF (QQQ) has tested this average multiple times, it has consistently found support. Investors now wonder if this trend will continue.

Image Source: TradingView

Positive Volatility Above the 200-Day MA

Ryan Detrick, Chief Market Strategist at Carson Investment Research, noted a potential upside:

“Historically, when the S&P 500 experiences five consecutive days of 1% changes while staying above its 200-day MA, it tends to perform well in the following six months, averaging an 11.0% gain and rising 91.7% of the time.”

Likelihood of Interest Rate Cuts Increases

The Trump Administration has been advocating for lower interest rates for some time. Although the Federal Reserve operates independently, current market signals indicate that tariffs may influence Fed Chair Jerome Powell’s decisions. The probability of rate cuts in May is already at 54% and appears to be on the rise.

Prospects for a Tariff Resolution

While Trump claims he intends to maintain these tariffs indefinitely, it’s important to observe actions rather than words. It is likely that he views tariffs as a negotiating tool for more favorable trade agreements. Positive signs of resolution are beginning to surface; Trump recently stated:

“After speaking with President Claudia Sheinbaum of Mexico, I have agreed that Mexico will not be required to pay tariffs on anything that falls under the USMCA Agreement. This agreement lasts until April 2nd. I made this decision in respect for President Sheinbaum. Our relationship has been very productive as we work to address border issues and curb fentanyl trafficking.”

This softer tone between nations offers some reassurance to investors.

Market Valuations Reflecting Caution

Investors have long expressed concerns over tech stocks, particularly Tesla (TSLA) and Microsoft (MSFT), which have recently shown signs of lower valuations amid market uncertainty.

“`

Market Pullback: Opportunities for Attractive Stock Valuations

Recent market fluctuations have raised concerns about valuations in major stocks like Microsoft Corporation (MSFT) and Nvidia Corporation (NVDA). Analysts believe that, while valuations may appear inflated, the current market pullback could create more attractive investment opportunities. Notably, Nvidia is currently experiencing its lowest price-to-earnings (P/E) ratio since the onset of the bull market.

Image Source: Zacks Investment Research

Market Corrections and Tariff Impacts

The market correction may have been triggered by the Trump administration’s tariffs, which have led to increased volatility. Nevertheless, multiple indicators suggest that this pullback might be brief, and concerns surrounding tariffs could be overstated. Investors should remain vigilant and informed, as opportunities often arise in turbulent markets.

Investment Opportunities for $1

For those looking to explore investment strategies further, Zacks Investment Research is currently offering a unique opportunity. For just $1, you can gain 30 days of access to their research picks, with no obligation to pay more afterward. This initiative has attracted many participants, although some remain skeptical about the offer.

This promotional move aims to familiarize investors with Zacks’s portfolio services, including programs like Surprise Trader, Stocks Under $10, and Technology Innovators, all of which have delivered impressive returns, closing 256 positions within double- and triple-digit gains in 2024 alone.

Recent Analyses and Recommendations

Interested in the latest stock strategies from Zacks Investment Research? They are currently offering a report on the 7 Best Stocks for the Next 30 Days. To access this free report, click here.

To further your research, consider the free stock analysis reports available for major companies:

Explore ETF opportunities as well, including:

- Invesco QQQ (QQQ): ETF Research Reports

- SPDR S&P 500 ETF (SPY): ETF Research Reports

This article was originally published by Zacks Investment Research, available at zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.