Ford’s Q1 2025 Earnings Show Signs of Struggle Amid Industry Changes

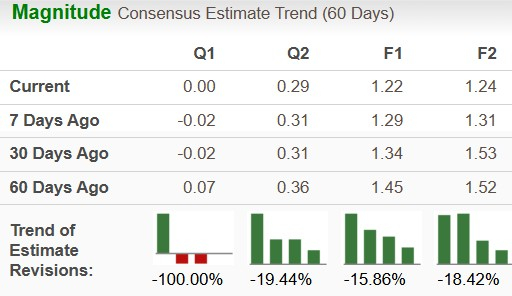

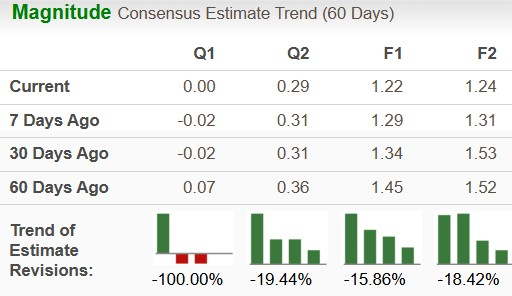

Ford F plans to release its first-quarter 2025 results on May 5, following the market close. According to the Zacks Consensus Estimate, the expected earnings per share (EPS) for this quarter is breakeven, while automotive revenues are projected at $35.5 billion.

Over the past week, the earnings estimate for the upcoming quarter has increased by 2 cents. In the same period last year, Ford reported an EPS of 49 cents. The current revenue estimate indicates an 11% decline from the year-ago quarter.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For the entire year of 2025, the Zacks Consensus Estimate for Ford’s automotive revenues stands at $162.3 billion, reflecting a 6% year-over-year decline. The full-year EPS is estimated to be $1.22, indicating a significant contraction of 33.7% compared to the previous year.

In the last four quarters, Ford has surpassed EPS estimates on two occasions, missed once, and matched the estimate in another instance. The average earnings surprise has been 1.21%.

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-EPS surprise | Ford Motor Company Quote

Q1 Earnings Insights for Ford

Current forecasting does not provide a clear expectation for an earnings beat for Ford in this quarter. A positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically suggests improved odds for earnings surprises. However, Ford holds an earnings ESP of 0.00% and a Zacks Rank #3.

Factors Influencing Ford’s Q1 Results

While many automakers have reported year-over-year increases in first-quarter sales, Ford experienced a 1.3% decline to 501,291 units in the quarter ahead of their earnings report. This decline is attributed mainly to rental fleet sales timing and the discontinuation of the Ford Edge and Transit Connect models. In contrast, retail sales rose by 5%, and sales of electrified vehicles, including electric and hybrid models, surged by 25.5%, totaling 73,623 units.

Tesla TSLA also saw a decrease in deliveries this quarter, with a 13% drop to 336,681 EVs. Meanwhile, General Motors (GM) sold 693,363 units, reflecting a year-over-year increase of 17%.

Ford has indicated that it plans to reduce sales of internal combustion engine vehicles compared to 2024. A shift in product mix and foreign exchange challenges are expected to pressure profits. Ford projected a breakeven adjusted EBITDA for the first quarter of 2025, sharply down from $2.7 billion in Q1 2024 and $2.1 billion in Q4 2024, primarily due to lower volumes, a 20% production cut, and ongoing plant launch activities.

The Zacks Consensus Estimate for revenues from the Ford Blue unit, which includes internal combustion engine and hybrid models, is $17.6 billion, representing a 19% year-over-year decrease. The EBIT estimate for this segment is $275 million, down from $905 million in the prior year.

For the Ford Model E unit, focusing on electric vehicles, the revenue estimate is $1.5 billion, a significant rise from $115 million in the same period last year. However, the anticipated loss before interest and taxes is set at $1.17 billion, slightly improved from $1.32 billion a year ago.

Revenues from the Ford Pro unit, which includes commercial vehicles and services, are expected to reach $16.2 billion, signaling a decline of 10%. The EBIT estimate for this sector stands at $1.5 billion, down from $3 billion recorded in Q1 2024.

Ford’s Stock Performance & Valuation

Year-to-date, Ford’s shares have increased by 1.1%, outperforming the broader industry. In comparison, Tesla’s shares have dropped by 30%, and General Motors has seen a 15% decline in the same timeframe.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, Ford’s stock remains relatively inexpensive, trading at a forward price-to-sales ratio of 0.24, significantly lower than the industry average of 2.37. The company holds a Value Score of A, while Tesla’s forward price-to-sales multiple stands at 8.57, with General Motors at 0.25.

Ford’s P/S Compared to GM & Tesla

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strategies for Investing in Ford Before Q1 Earnings

Ford is currently navigating significant challenges. Increasing losses in the electric vehicle sector, weakened performance in internal combustion engines, and potential auto tariffs could adversely impact margins and earnings. The 2025 outlook appears bleak, not taking tariffs into account, with full-year adjusted EBIT estimated between $7 billion and $8.5 billion, down from $10.2 billion in 2024. Alongside warranty costs and promotional incentives, these factors may further squeeze profitability. However, there are still potential opportunities on the horizon.

# Ford Pro Positioned for Future Growth Amid Financial Challenges

Ford Pro’s robust order books and rising demand paint a favorable picture for the future of its segment. Despite the 2025 EBIT guidance indicating a decline year-over-year, Ford Pro remains a significant profit contributor for the company. Furthermore, Ford’s dividend yield is approximately 6%, attracting attention from investors seeking income. The firm aims for a payout ratio between 40-50% of free cash flow, emphasizing its commitment to returning value to shareholders.

## Strong Liquidity Supports Future Operations

At the end of 2024, Ford’s liquidity position is solid, with $28 billion in cash and around $47 billion in total liquidity. This strong financial buffer provides the company with the necessary flexibility to navigate operational challenges.

Although current conditions suggest holding Ford stock may be prudent, investing before upcoming results may not be wise. It is advisable to await management’s insights on tariffs and updated 2025 forecasts to fully understand their potential impact.

## Zacks Research Identifies Top Growth Stock

In another noteworthy update, Zacks’ Research Chief has spotlighted one stock that is most likely to double in value. According to experts, this stock is among the most innovative financial firms, boasting a rapidly growing customer base of over 50 million and offering a variety of advanced solutions.

This top pick potentially holds significant upside, especially considering the performance of past Zacks recommendations, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

For those interested in stocks with high growth potential, downloading Zacks Investment Research’s latest report could prove beneficial.