Snowflake Set to Report Strong Q1 Results Amid Expanding Growth

Snowflake (SNOW) is scheduled to report its first-quarter fiscal 2026 results on May 21.

Financial Expectations

The Zacks Consensus Estimate for revenue is about $1 billion, showing a year-over-year growth of 21.13%. In terms of earnings, the consensus is set at 22 cents per share, remaining unchanged over the past month, indicating a 57.14% increase from the previous year.

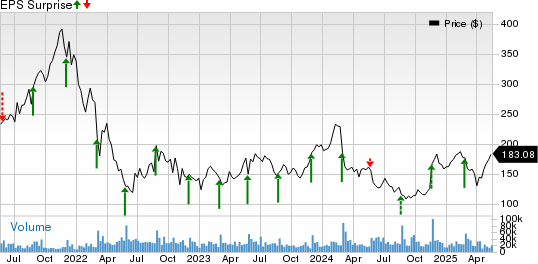

Historically, Snowflake has surpassed the Zacks Consensus Estimate in three of the past four quarters. The average earnings surprise during this period stands at 28.04%.

Snowflake Inc. Price and EPS Surprise

Snowflake Inc. price-EPS surprise | Snowflake Inc. Quote

Key Factors Influencing Q1 Results

Snowflake’s first-quarter performance is expected to benefit from an expanding customer base and a robust partner network. The company has achieved a net revenue retention rate of 126% as of January 31, 2025. Notably, the number of customers generating over $1 million in product revenue rose from 455 to 580 during the same period.

As of January 31, 2025, the total customer count reached 11,159, up from 9,384 a year earlier. Among them, 745 are listed in the Forbes Global 2000 and constituted 45% of the company’s fiscal 2025 revenues of $3.6 billion—an annual increase of 29%.

For the first quarter of fiscal 2026, Snowflake anticipates product revenues between $955 million and $960 million, reflecting year-over-year growth between 21% and 22%.

Investments in AI Driving Engagement

Snowflake’s focus on artificial intelligence (AI) and machine learning, particularly through initiatives like Cortex AI and collaborations with OpenAI and Anthropic, continues to enhance customer engagement. Over 4,000 clients utilize Snowflake’s AI and ML technology weekly, likely benefiting the upcoming quarter’s performance.

Stock Performance Overview

Year-to-date, Snowflake shares have increased by 18.5%, outperforming the Zacks Computer and Technology sector, which has seen a 1.4% drop, and the Zacks Internet Software industry, up by 7.2%. This notable performance can be attributed to a solid product portfolio and strategic partnerships.

Valuation Context

Despite its growth, SNOW shares carry a Value Score of F, indicating that the stock is relatively overvalued. The forward 12-month Price/Sales ratio stands at 12.81X, significantly higher than the sector average of 6.18X.

Strategic Portfolio Expansions

Snowflake’s growing product offerings include Apache Iceberg, Hybrid tables, and the Cortex Large Language Model. In April 2025, the company enhanced its AI Data Cloud by integrating core capabilities with Apache Iceberg tables, leading to improved query performance and advanced security features.

Partnerships Fueling Growth

Snowflake’s extensive partner network features companies like Microsoft (MSFT), Amazon (AMZN), and NVIDIA (NVDA), which have been key drivers of growth. A recently expanded partnership with Microsoft aims to integrate OpenAI models into Snowflake’s Cortex AI, fostering AI-driven app development. Additionally, partnerships with NVIDIA and Amazon’s AWS platform enhance product integrations and industry-specific solutions.

Investment Outlook for SNOW

While Snowflake benefits from a superior partner network and growing client base, competitive pressures and rising costs pose challenges. The company anticipates a tough year-over-year revenue comparison in the upcoming quarter due to the effects of the previous leap year.

Moreover, Snowflake estimates a $15 million impact on its non-GAAP operating margin from annual sales-related events, adding to the concerns regarding its stretched valuation.

Currently, SNOW holds a Zacks Rank #3 (Hold), suggesting that investors might consider waiting for a more favorable entry point.