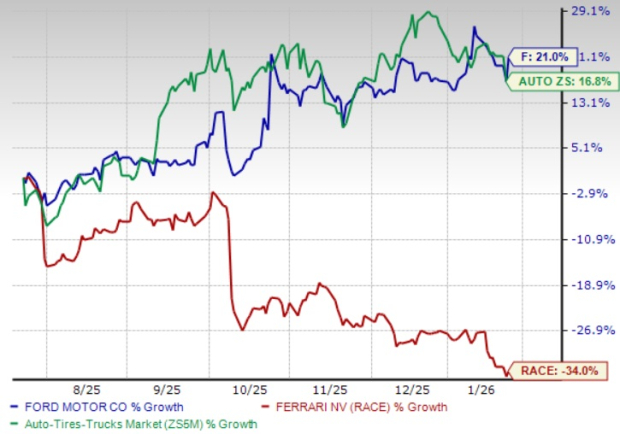

Key data from Keith Kaplan’s recent insights on stock market patterns: On January 28, 2026, expected seasonal trading opportunities will unfold, leveraging historical price behavior of stocks. Kaplan revealed during his “Prediction 2026” event that his team utilized TradeSmith Seasonality software to analyze over 2.2 quintillion data points, enabling them to identify historical trends that have shown an 83% accuracy rate in predicting market movements. This approach emphasizes optimal “green zones,” where stocks like Tesla (TSLA) and Eli Lilly (LLY) have recorded significant average returns—7.8% for TSLA and 5.6% for LLY in specific trading windows.

Since the past 15 years, the S&P 500 has consistently demonstrated a 100% increase between June 29 and July 21, yielding an average return of 3.2%. The analysis suggests that mastering these cyclical patterns can dramatically outperform average market returns, with historical results revealing total returns of 857% over 18 years, more than twice that of the S&P 500. Given the current market conditions, Kaplan underscores the importance of being prepared as these patterns emerge.