Dell Technologies Share Prices Dive, Yet AI Demand Persists

Dell Technologies (DELL) is currently trading at a significant discount, as indicated by its Value Score of B. The stock has a forward 12-month P/E ratio of 11.51X, in stark contrast to the Computer and Technology sector’s average of 23.15X.

P/E Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

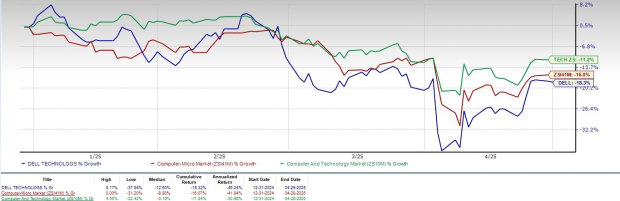

Despite this potential value, DELL’s shares have dropped 18.3% year-to-date, underperforming the Zacks Computer and Technology sector’s decline of 11.2% and the Zacks Computer – Micro Computers industry’s fall of 16%.

Year-to-Date DELL Stock Price Performance

Image Source: Zacks Investment Research

This decline is primarily linked to broader market weaknesses. Investor sentiment has deteriorated due to rising trade tensions, causing fears of higher costs. Additionally, DELL faces ongoing challenges from a weak consumer segment in the PC market, as cautious spending from enterprises and large customers has raised concerns among investors.

Positive Developments Amid Challenges

Amid these overall market conditions, Dell Technologies is capitalizing on rising demand for artificial intelligence (AI) servers. This surge is fueled by ongoing digital transformation and increased interest in generative AI applications. The company’s PowerEdge XE9680L AI-optimized server has gained traction, contributing to strong enterprise demand.

In the fourth quarter of fiscal 2025, DELL saw an increase of $1.7 billion in AI-optimized server orders. The company shipped $2.1 billion worth of AI servers during this period, which kept its AI server backlog robust at $4.1 billion.

To build on this positive trend, DELL unveiled advancements in its server, storage, and data protection portfolios in April 2025. These improvements aim to modernize data centers and meet the increasing demands of AI and cybersecurity.

The Dell PowerEdge portfolio also provides support for the NVIDIA NVDA Blackwell Ultra platform, which includes upcoming models like the NVIDIA HGX B300 NVL16 and the NVIDIA RTX PRO 6000 Blackwell Server Edition.

Expanding Partnerships Drive Growth

DELL is experiencing growth thanks to an expanding partner network, which includes companies like NVIDIA, Microsoft, and Meta Platforms (META). The expansion of Dell’s AI Factory portfolio with new AI PCs, infrastructure, and services enhances its capabilities in various enterprise markets.

In March 2025, Dell Technologies and NVIDIA strengthened their collaboration within the AI Factory, focusing on accelerating enterprise AI adoption.

Furthermore, Dell partnered with Meta Platforms in February 2025 to facilitate the deployment of Llama 2 models on-premises, utilizing Dell’s AI-optimized offerings.

In a separate initiative, DELL collaborated with Advanced Micro Devices to enhance real-time telecom network monitoring through AI solutions, leveraging Dell PowerEdge XE7745 servers with AMD EPYC processors.

Positive Outlook for Q126

Dell Technologies’ innovative offerings and expanding partner ecosystem are positioned as key growth drivers. For the first quarter of fiscal 2026, the company predicts revenues between $22.5 billion and $23.5 billion, with a projected midpoint of $23 billion indicating 3% year-over-year growth.

Furthermore, Dell expects a growth rate of 6% for the combined Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG), with ISG anticipated to increase in the low-teens while CSG remains flat.

The Zacks Consensus Estimate for Dell’s first-quarter fiscal 2026 revenue stands at $23.16 billion, translating to a growth estimate of 4.13% year over year.

For non-GAAP earnings, the expectation is $1.65 per share (±$0.10), signifying 25% growth at the midpoint. The consensus estimate for earnings is $1.68 per share, unchanged over the past month.

Dell Technologies Inc. Stock Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

DELL has consistently exceeded Zacks Consensus Estimates for earnings over the last four quarters, averaging a surprise of 5.13%.

Investor Considerations for DELL Shares

Given DELL’s strong portfolio and growing partnerships, long-term investors may find the stock appealing. The company projects long-term revenue growth at a CAGR of between 3% and 4%. Meanwhile, ISG is expected to see 6-8% growth, while CSG aims for 2-3%. Earnings are anticipated to grow at a CAGR exceeding 8%, supported by gross margin expansion and effective cost management.

Nonetheless, short-term challenges exist, primarily due to a weak PC market and a complex macroeconomic landscape. Increased competition in the AI data center realm along with a higher proportion of AI-optimized servers may temporarily impact gross margin expansion.

Currently, DELL holds a Zacks Rank #3 (Hold), indicating that investors might consider waiting for a more advantageous entry point to buy the stock.