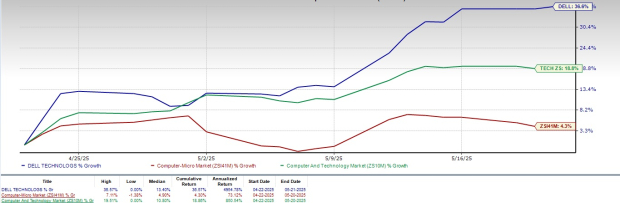

Dell Technologies Soars 36.6% Amid AI-Driven Growth Strategies

Dell Technologies (DELL) shares have increased by 36.6% over the past month, significantly surpassing the Zacks Computer and Technology sector’s growth of 18.8% and the Zacks Computer – Micro Computers industry’s rise of 4.3%. This robust performance is largely attributed to DELL’s expanding product lineup and strong partnerships.

The company offers vital hardware and services through its infrastructure solutions, which are designed to support cloud environments. DELL is transforming contemporary data centers by implementing disaggregated infrastructure solutions that meld storage, cyber resilience, software, and automation.

To meet the changing needs of on-premises, cloud, and edge environments, DELL enables organizations to efficiently manage and safeguard workloads with advanced storage systems like PowerProtect Data Domain and PowerScale, fortified by AI-driven ransomware detection capabilities.

Additionally, its automated Private Cloud and NativeEdge offerings simplify deployment and management, allowing for quick provisioning and consistent oversight across diverse infrastructures. DELL’s comprehensive strategy makes modern data centers agile, secure, and prepared for upcoming challenges.

Recent Performance Highlights

Image Source: Zacks Investment Research

Impact of DELL’s Expanding Portfolio

Dell Technologies continues to see growth fueled by its expanding portfolio. Recent major upgrades to its AI Factory have introduced energy-efficient infrastructure and advanced cooling solutions aimed at accelerating enterprise AI deployments across edge, data centers, and cloud environments.

The increasing demand for AI servers, spurred by ongoing digital transformation and a greater focus on generative AI applications, is benefiting Dell Technologies. In the fourth quarter of fiscal 2025, DELL reported $1.7 billion in new orders for AI-optimized servers, shipping $2.1 billion worth during the same period. The AI server backlog remains strong at $4.1 billion.

Dell’s PowerEdge supports the NVIDIA (NVDA) Blackwell Ultra platform, which includes the upcoming NVIDIA HGX B300 NVL16, NVIDIA GB300 NVL72, and NVIDIA RTX PRO 6000 Blackwell Server Edition.

Growth Through Expanded Clientele

DELL benefits from a diverse partner base that includes NVIDIA, Worley, Microsoft, Meta Platforms (META), Advanced Micro Devices (AMD), and Imbue. In May 2025, Dell Technologies announced key advancements through its collaboration with NVIDIA to boost enterprise AI adoption. These advancements comprise next-generation PowerEdge servers, improved AI data platforms, integrated software solutions, and new managed services for more efficient AI deployment.

In addition, Dell Technologies joined forces with Meta Platforms to simplify the deployment of Meta’s Llama 2 models for customers using Dell’s AI-optimized products. Furthermore, in February 2025, Dell expanded its AI for Telecom program through a partnership with Advanced Micro Devices to develop AI solutions for real-time telecom network monitoring and management, utilizing Dell PowerEdge XE7745 servers powered by AMD EPYC processors.

Positive Outlook for Q1 FY26

Dell Technologies’ innovative portfolio and growing AI focus are significant growth factors moving forward. For the first quarter of fiscal 2026, the company anticipates revenues between $22.5 billion and $23.5 billion, with a midpoint of $23 billion reflecting a 3% year-over-year increase.

The Zacks Consensus Estimate for Dell Technologies’ revenues in the first quarter of fiscal 2026 stands at $23.1 billion, suggesting a year-over-year growth of 3.85%. Non-GAAP earnings are forecasted to be around $1.65 per share (+/- 10 cents), indicating a midpoint growth of 25%. The consensus estimate for earnings is set at $1.48 per share, which has risen by a penny in the last 30 days, marking a year-over-year growth of 42.12%.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

Undervalued DELL Shares

According to its Value Score of B, Dell Technologies shares are currently trading at a significant discount, with a forward 12-month P/E ratio of 0.77X compared to the Computer and Technology sector’s average of 6.14X.

Challenges Ahead

Despite its impressive portfolio and growing partnerships, DELL faces challenges. The broader PC market’s recovery has been slower than anticipated, with customers delaying purchases as they assess AI-enabled PCs and prepare for the Windows 10 end-of-life.

Profitability has also been impacted by heightened competition and cautious corporate spending on PCs and storage IT. The increasing competition in the AI data center sector could further strain gross margins in the near term. Additionally, investor sentiment is affected by rising trade tensions, which could lead to increased costs. DELL holds a Zacks Rank #3 (Hold), indicating it may be prudent to wait for a more favorable entry point in the market.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.