The aviation industry faced a tumultuous start in 2024 with a barrage of impactful events. From accidents in Japan to concerns with Boeing aircraft and the DOJ blocking a major merger, the sector was tested. Amidst this turbulence, Delta Air Lines (NYSE:DAL) emerged as a beacon of stability and strong performance.

Delta’s Earnings Insight

The first U.S. airline to report its 4th quarter and full year 2023 results, Delta Air Lines offered a mixed bag to investors. While the company boasted a strong financial performance, its guidance for 2024 fell short of market expectations, leading to a dip in stock prices.

Despite this setback, industry analysts remain optimistic about Delta’s future, citing several positive indicators from their recent earnings report. Delta’s market cap continues to outshine its peers, with robust earnings and a promising strategic outlook, cementing its position as a leader in the aviation industry.

Comparative Performance & Potential

A comparative analysis of Delta’s metrics for 2023 highlights its stellar performance, surpassing its U.S. competitors in both absolute profit and net income margin. With a GAAP net income of $4.609 billion, Delta outshone major rivals such as United, American, and Southwest.

As the industry grapples with challenges, Delta’s resolute financial standing and competitive position come to the fore. While short-term market reactions may sway, the long-term potential of Delta Air Lines in navigating industry headwinds remains a cause for confidence.

Delta Leads the Way in Airline Financials

Last year, Delta Air Lines (DAL) emerged as the top earner in the airline industry. The Atlanta-based carrier reported an adjusted non-GAAP profit of $4.020 billion for 2023. This revenue stream overshadowed that of its major counterparts, with United Airlines (UAL) posting $3.337 billion, American Airlines (AAL) $1.859 billion, and Southwest Airlines (LUV) $986 million.

Revenue and Profit Margins

Delta’s net income margin for 2023 stood at 7.9%, surpassing UAL’s 4.9%. In an industry characterized by a clear divide between financial haves and have nots, this highlights Delta’s superior financial performance. The breakdown of revenues and key cost numbers further delineates the airline’s competitive advantages.

Delta’s operating revenues totaled $58.048 billion, outshining UAL’s $53.717 billion, AAL’s $52.788 billion, and LUV’s $26.091 billion. The revenue comparison sheds light on the distinct strategies and financial performance across these key industry players.

Competitive Edge

While the big 3 airlines generate substantial revenue from their global route systems and premium cabins, Delta’s revenue per seat mile stands out. Furthermore, the analysis of “other revenue” paints a telling picture of Delta’s financial prowess. The company’s adeptness at tapping into non-transportation sources, such as loyalty and credit card programs, allows it to maintain robust revenue streams with higher margins. In essence, this revenue diversity positions Delta as a market leader in financial efficiency and innovation.

Cost Efficiency

Beyond revenue, Delta holds a distinctive position in cost management. While all major airlines incur similar employee-related expenses, Delta’s profit-sharing program, totaling $1.4 billion in 2023, reflects the company’s commitment to rewarding its workforce and fostering a strong company culture. Delta’s strategic investment in labor reflects its vision for sustained growth and operational excellence in an industry fraught with talent scarcity and increasing labor costs.

Moreover, Delta’s fuel efficiency and strategic hedging practices set it apart in fuel cost management. With a fuel efficiency 7% higher than its closest competitors, Delta’s proactive approach to fuel procurement underscores its financial acumen and operational resilience.

Strategic Triggers for Growth

Delta’s financial success is not merely a product of revenue and cost management; it reflects the company’s proactive stance in addressing industry challenges. By consistently running a reliable operation and pursuing innovative strategies, such as investment in employee welfare and fuel efficiency, Delta has positioned itself as a trailblazer in the airline industry.

As the aviation sector grapples with escalating labor costs and volatile fuel prices, Delta’s financial model serves as a beacon of resilience and forward-thinking strategy. The company’s ability to navigate industry headwinds while sustaining financial growth sets a compelling precedent for its competitors and underscores its pivotal role in the global airline landscape.

Delta’s Winning Strategy in the Aviation Industry

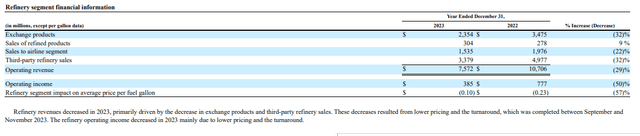

When it comes to fuel costs in the aviation industry, Delta Air Lines (DAL) stands out as a shining example of efficiency and innovation. In 2023, the company paid $11.069 billion – significantly less than its competitors, with AAL paying $12.251 billion and UAL paying $12.651 billion. Much of Delta’s success in this area is attributed to the strategic advantage it gains from owning a refinery near Philadelphia. This refinery brings about hundreds of millions of dollars in annual savings, primarily due to lower costs per gallon of jet fuel. What sets it apart is its specialization in maximizing jet fuel production, tailoring it to directly supply fuel to major northeast U.S. airports. Delta also engages in product exchange with petroleum companies to further drive down fuel costs across the U.S. Even in years when the refinery itself did not turn a profit, it consistently delivered cost savings for Delta, outperforming even Southwest’s fuel hedging strategy in 2023. The company’s high fuel efficiency and net fuel costs falling lower than its competitors by $1.5 billion speak volumes about its commendable fuel management efforts. Notably, Delta’s profit sharing nearly matched its fuel cost advantage, highlighting the impact of this strategy.

Delta’s impressive cost management raises significant questions for investors regarding the sustainability and potential expansion of the company’s revenue and cost advantages in the industry.

Flying High with a Global Network and Growth Potential

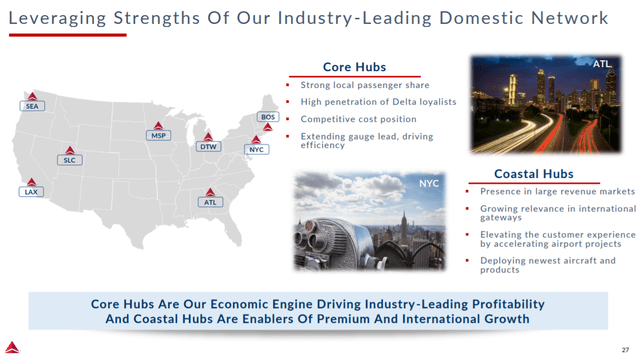

On the revenue side, Delta’s executives take pride in the company’s network, which they boldly assert to be the best in the industry. Examining the details further reinforces this claim. Delta boasts four core internal U.S. hubs located in Atlanta (the world’s largest hub at the world’s busiest airport), Detroit, Minneapolis/St. Paul, and Salt Lake City. In addition, the company operates four coastal hubs in New York City (with hubs at both LaGuardia and JFK), Boston, Los Angeles, and Seattle. Except for Seattle, Delta is the leading carrier in passengers carried and domestic revenue across all eight hub cities. The stability of these core hubs, dating back to at least the Delta/Northwest merger in 2009, is a testament to their role in driving Delta’s system profitability. The company’s New York City hub, a result of its Pan Am asset purchase and slot swap with US Airways, presents opportunities for optimizing slot usage and increasing aircraft size, suggesting a potential for revenue growth. Boston, a relatively new hub for Delta, has seen rapid expansion and discussions with Massport to enhance its facilities further. Los Angeles has witnessed steady growth, and Delta’s proactive approach to facility expansion aligns with its commitment to seizing revenue opportunities. Finally, the Seattle hub has emerged as a robust gateway to Asia, signaling high potential for revenue growth in the region.

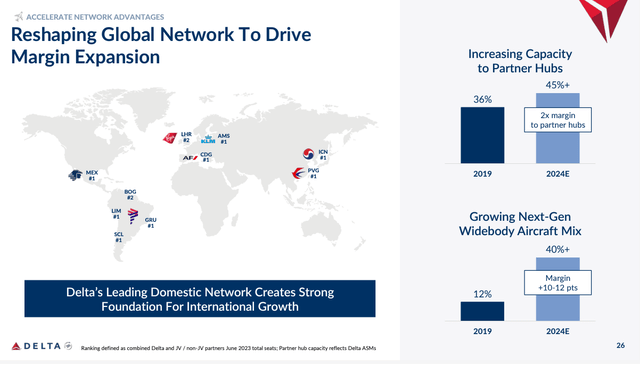

Delta’s strategic partnerships with foreign airlines further enhance its revenue-generating potential. The collaboration with Air France and Scandinavian Airlines (SAS) demonstrates a commitment to tapping into Northern Europe’s market and alleviating pressure on its Amsterdam hub with KLM. While adjustments in its Latin American ventures are expected, Delta’s joint venture with Latam positions it as a dominant carrier to South America. With Asia presenting the greatest potential for international growth, Delta’s strategic developments in Tokyo and a stronger relationship with Korean Airlines underscore its relentless pursuit of revenue expansion in the region.

Delta’s robust global network, coupled with its targeted growth strategies, position the company for sustained revenue expansion in key markets worldwide. As the aviation industry charts a path to recovery and growth post-pandemic, Delta’s strategic prowess sets a formidable foundation for capitalizing on emerging opportunities and maintaining its lead in the industry.

Delta Airlines Positioned for Aggressive International Growth

Delta Airlines, the largest foreign airline at Haneda, is set to escalate its international operations, expanding to South Korea’s Seoul hub and making significant inroads to Asia, even as it faces challenges with the current JPY/USD relationship affecting travel from Japan. Despite the obstacles, the airline is making significant strides in its global expansion.

High-Flying Fleet Expansion

Delta’s growth strategy is bolstered by its efficient fleet management. The retirement of older, fuel-inefficient aircraft like the Boeing 777-200ERs and -LRs has paved the way for the introduction of newer, more fuel-efficient Airbus A350-900s. The airline is also set to receive the latest A350-1000s, which promise increased capacity and range with a significantly reduced environmental footprint. These fleet upgrades position Delta to capitalize on growing international routes, particularly in the Asian market.

Delta’s strategic equity investments in five partner airlines further support its international aspirations and add robustness to its global network. Domestically, the airline remains committed to fleet modernization, with the activation of used 737-900ERs and the continued acquisition of new narrowbody aircraft from Airbus, signaling a multi-faceted approach to growth.

The capacity growth outlook for 2023 reflects a measured approach, aligning with broader industry trends, and is likely to create a conducive environment for stronger pricing.

Financial Fortitude and Prudent Investments

Delta’s emphasis on financial discipline has yielded a balanced and promising outlook. With capex at a moderate level compared to its peers, the airline has managed to significantly reduce its debt and generate substantial free cash flow, demonstrating a prudent approach to fleet spending.

The airline’s moderate debt maturities underscore its strong cash position, reflecting a robust financial footing. This, coupled with its strong revenue generation, positions Delta favorably for sustained growth and strategic investments in the coming years.

Diversified Revenue Streams Driving Growth

In addition to traditional transportation revenues, Delta is poised to harness non-transportation revenue streams to fuel further growth. By diversifying its income sources, the airline is positioning itself to navigate market dynamics effectively while capitalizing on emerging opportunities, ensuring a resilient revenue base.

The Future Shines Bright for Delta: A Leading Force in the Aviation Industry

Delta Air Lines, a global powerhouse in the aviation industry, is set to chart an upward trajectory in the coming years with a strategic focus on diversifying revenue streams and optimizing operational efficiency. This move is bolstered by the recent advancements in its contract maintenance services and prospects for increased cargo capacity.

Diversification: Cargo and Maintenance Services

Delta’s growth potential is not solely reliant on passenger revenues, as the company gears up to harness the burgeoning opportunities in the cargo segment. The airline is primed to leverage its more capable aircraft to carry additional freight in the bellies of its passenger planes, thereby expanding its revenue streams.

In a landmark development, Delta’s contract maintenance service revenues are expected to surge, underpinned by its engine maintenance contracts encompassing every engine type across its entire fleet. The recent acquisition of overhaul rights for the engine powering the A350-1000 aircraft underscores Delta’s commitment to fortifying its maintenance operations. This bold move is projected to inject billions of dollars in maintenance contract revenue over the next half-decade.

While Delta’s loyalty and credit card program revenues indicate continued growth, the real onus lies on its maintenance operations, which are poised for substantial expansion, surpassing the ceiling for potential growth in loyalty and credit card programs, despite the latter’s current industry-leading status.

Financial Prudence: Streamlined Operations and Cost Control

Delta has diligently absorbed the major labor cost increases anticipated across the industry. Moreover, the company is on track to optimize its non-fleet capital expenditures as its significant airport terminal projects near culmination. This disciplined approach to cost management augurs well for Delta’s cash flow and overall financial stability.

Despite previous attempts to divest a portion of its fuel procurement and exchange processes, Delta remains resolute in retaining the cost-saving benefits from its refinery strategy, thus ensuring resilience against upheavals in fuel prices and procurement volatility.

Navigating Macroeconomic Headwinds

While airline stocks are inherently subject to macroeconomic vagaries, Delta stands out as a beacon of stability and resilience, with a significantly lower susceptibility to macroeconomic factors compared to its low-cost carrier counterparts. This characteristic is poised to fortify Delta’s position in the face of economic uncertainties.

Notably, the recent uptick in crude oil prices, hovering above the $75 mark, is unlikely to deter Delta’s advancements, given the robust domestic production that is expected to counterbalance global instability, particularly in Middle East shipping routes. Strengthened by these market dynamics, Delta and other transportation companies are poised for a favorable operating environment.

Favorable Analyst Sentiment and Growth Outlook

Delta’s stock garners widespread acclaim among Wall Street and Seeking Alpha analysts, underscored by robust SA quant ratings. With an impressive price target of $53, the stock is projected to yield a substantial 30% upside, affirming analysts’ unwavering confidence in Delta’s growth trajectory.

In conclusion, Delta Air Lines emerges as a compelling buy within an industry characterized by volatility and unpredictability. The company’s steadfast commitment to operational excellence, revenue diversification, and prudent financial strategies cements its position as a stalwart in the aviation landscape. For investors seeking stability and growth prospects, Delta presents a compelling and dependable opportunity.