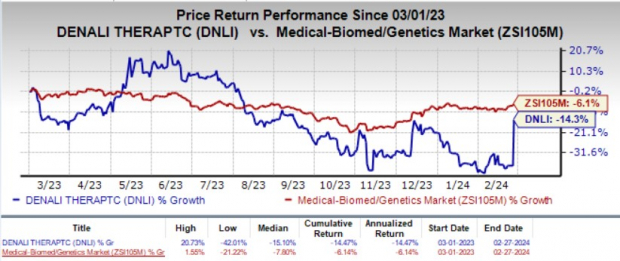

Denali Therapeutics weathered a storm in the fourth quarter of 2023, incurring a loss of 86 cents per share, wider than the Zacks Consensus Estimate. The absence of a marketed product meant no revenues were recognized in the quarter, contributing to the financial miss, with collaboration revenues failing to materialize. However, the market responded unexpectedly, propelling DNLI’s stock up by an impressive 38.3% in the latest trading period. What drove this surge was the company’s successful raise of $500 million through a securities purchase agreement, bolting up its cash reserves and investor confidence.

Venturing deeper into the financial landscape, research and development expenses surged in the quarter, with a notable 17% rise linked to advancing ETV:IDS and eIF2B programs. The gains didn’t stop there, as general and administrative expenses also ticked up by 6%. Denali’s year-end cash, cash equivalents, and marketable securities tally saw a slight dip, resting at $1.03 billion as of December 31, compared to $1.12 billion as of September 30.

A Year in Review

Total collaboration revenues for 2023 hit $330.5 million, marking a significant jump from the previous year. However, this missed both the Zacks Consensus Estimate and Denali’s internal projections. The loss per share for the full year came in slightly wider than expected but marked a tangible improvement from the figure recorded in the prior year.

Looking Ahead to 2024

Denali is setting its sights on managing operating expenses in 2024, aiming for alignment with prior-year figures. The strategic portfolio prioritization is at the heart of this financial navigation plan.

Exploring the Pipeline

The journey ahead for Denali is guided by two late-stage programs – DNL310 for MPS II and DNL343 for ALS. The detailed evaluation of DNL310 through clinical trials is a focal point, with a critical COMPASS study nearing completion. Similarly, DNL343’s advancement into a pivotal phase II/III study for ALS treatment signals progress and potential breakthroughs on the horizon.

Collaborative efforts between Denali and market partners like Biogen and Sanofi underscore a commitment to driving innovation forward. While facing setbacks in some endeavors, the companies remain resolute in their quest to unlock new treatments and therapies, with ongoing trials and studies painting a promising future.

Insights into Stocks and Rankings

Denali’s current Zacks Rank stands at #3 (Hold), reflecting a cautious industry sentiment. For those seeking a more dynamic option in the drug/biotech sector, Puma Biotechnology emerges as a strong candidate with a Zacks Rank #1 (Strong Buy). The shift in consensus estimates for Puma Biotech showcases market confidence and the stock’s upward trajectory over the past year.

As Denali embarks on a new chapter post-Q4 turbulence, the focus on pipeline progression and financial prudence sets the stage for a compelling narrative. Amidst industry challenges and global uncertainties, the resilience of companies like Denali and their resolve to innovate remain beacons of hope in a dynamic market landscape.

Puma Biotechnology Inc: Riding the Semiconductor Wave

Analysis of Earnings Growth

Puma Biotechnology Inc (PBYI) has proven its mettle in the market by outperforming earnings estimates in three of the last four quarters, with just one minor hiccup. The company has consistently surprised investors with an average of a whopping 76.55% earnings beat. Such stellar performance is a testament to PBYI’s financial acumen and strategic growth trajectory.

The Semiconductor Sector: A Blossoming Titan

The semiconductor industry is like a flourishing garden on a sunny day. While the tech world giants, like NVIDIA, cast long shadows, there are smaller players, like Puma Biotechnology Inc, diligently blooming with potential. Unlike their larger counterparts, these hidden gems have immense room for growth and are poised to make a significant impact on the market.

The semiconductor sector is set to feed the insatiable appetite for Artificial Intelligence, Machine Learning, and the Internet of Things. With strong earnings growth and an expanding customer base, PBYI has positioned itself to capitalize on this escalating demand.

As history has shown, the semiconductor industry is no stranger to rapid evolution. Over the years, global semiconductor manufacturing has experienced exponential growth, with projections soaring from $452 billion in 2021 to a staggering $803 billion by 2028. Puma Biotechnology Inc stands at the threshold of this technological revolution, ready to ride the semiconductor wave to greater heights.

See This Stock Now for Free >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.