Microsoft Corp. (NASDAQ: MSFT) has seen its stock rise over 15% in 2025, despite a recent decline in technology shares, but remains down approximately 12% from its 52-week high of $537 set in late October. Analysts remain optimistic, although short interest has increased by 27% over the last month, adding pressure on the stock, which currently sits around $473 per share with resistance noted at $493.

Investors are cautious due to concerns regarding Microsoft’s AI ambitions and its Copilot solution’s adoption. Microsoft trades at 37 times forward earnings, perceived as slightly above historical averages, and faces heightened competition, particularly from OpenAI, which could impact future growth. Additionally, the company’s entrenched position in enterprise solutions creates significant switching costs for customers, reinforcing its competitive edge in the market.

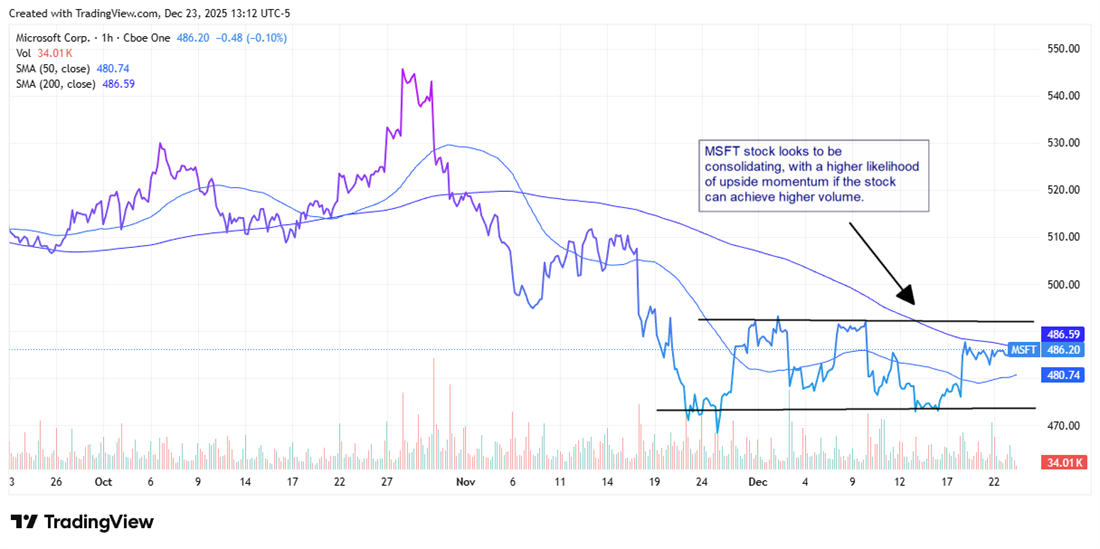

Recent indicators suggest a potential turning point for MSFT stock; however, trading volumes have been low. A notable upward movement could be triggered by a Santa Claus rally, but investors are advised to monitor performance into the new year to assess sustainability.