Key Points

-

Netflix surpassed 325 million paid memberships, reporting 18% revenue growth in Q4 2025.

-

Despite strong earnings, Netflix shares fell 5% post-announcement due to investor concerns over its $72 billion acquisition bid for Warner Bros.

-

Netflix plans to finance the acquisition through $42.2 billion in bridge loans and expects to increase its content budget in 2026.

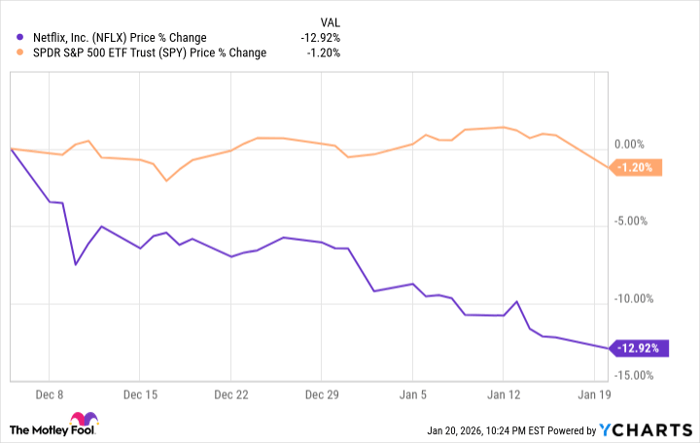

Netflix (NASDAQ: NFLX) released its fourth-quarter 2025 results, revealing a global audience nearing 1 billion and a total of 96 billion hours viewed in the second half of the year, marking a 2% increase year-over-year. Despite beating estimates with a 25% operating margin and 30% growth in operating income, investor anxiety over the impending acquisition of Warner Bros. from Warner Bros. Discovery (NASDAQ: WBD) led to a 5% drop in stock price in after-market trading.

Netflix’s proposed all-cash bid for Warner Bros. values the deal at $27.75 per share, equating to an equity value of $72 billion. To facilitate the acquisition, the company has secured $42.2 billion in bridge loans and plans to pause share buybacks. Analysts express skepticism about the deal, highlighting that Netflix’s acquisition price is substantially higher than its overall content budget for 2025, raising concerns about the financial implications of the purchase alongside its ongoing content expenditures.