Deutsche Bank Upgrades Freeport-McMoRan to Buy Rating

Fintel reports that on March 6, 2025, Deutsche Bank raised its outlook for Freeport-McMoRan (SNSE:FCX) from Hold to Buy.

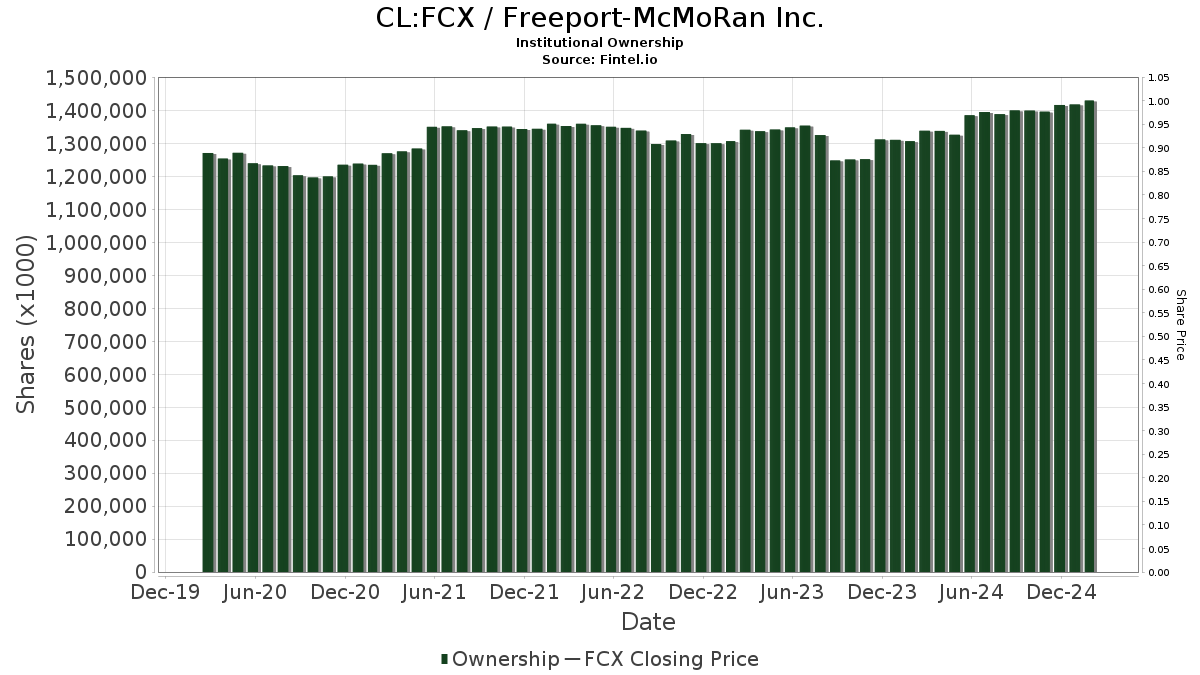

Fund Sentiment Overview

Currently, 2,417 funds and institutions hold positions in Freeport-McMoRan, a decrease of 83 owners or 3.32% from the previous quarter. The average portfolio weight for all funds invested in FCX is 0.34%, reflecting a significant increase of 1,574.14%. Over the past three months, total institutional shares owned rose by 2.59% to reach 1,430,391K shares.

Recent Activity of Major Shareholders

Capital Research Global Investors possesses 77,313K shares, accounting for 5.38% ownership of the company. Previously, the firm reported ownership of 83,406K shares, indicating a decrease of 7.88%. This firm reduced its portfolio allocation in FCX by 30.05% last quarter.

Fisher Asset Management owns 59,365K shares, representing 4.13% of the company. Its last filing noted a total of 59,409K shares, showing a decrease of 0.08%. The firm reduced its allocation in FCX by 25.99% over the previous quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares maintains 45,039K shares for a 3.13% ownership. In its previous report, the firm held 45,513K shares, marking a decrease of 1.05%, alongside a portfolio allocation reduction of 25.61% in FCX.

VFINX – Vanguard 500 Index Fund Investor Shares has 38,896K shares with 2.71% ownership. Previously, the firm reported owning 37,631K shares, indicating an increase of 3.25%. However, its portfolio allocation also dropped by 25.41% last quarter.

Price T Rowe Associates holds 31,886K shares, representing 2.22% ownership. Its previous report showed an ownership of 26,150K shares, an increase of 17.99%. Nonetheless, this firm also reduced its FCX portfolio allocation by 6.87% last quarter.

Fintel is recognized as one of the leading investing research platforms for individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and insider trading, among other insights. Our unique Stock picks are driven by advanced, backtested quantitative models designed to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.