DFNM ETF Enters Oversold Zone: What It Means for Investors

Shares of the DFNM ETF (Symbol: DFNM) are currently experiencing a significant downturn after trading as low as $47.86 each on Wednesday. The ETF has reached an oversold condition, a term defined by the Relative Strength Index (RSI), a tool that assesses stock momentum on a scale from zero to 100. An RSI reading below 30 indicates an oversold status.

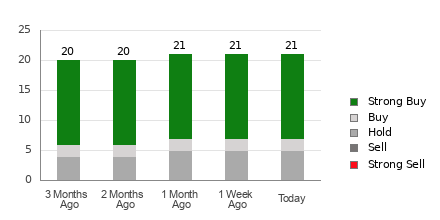

DFNM’s RSI has recently dipped to 28.7, starkly contrasting with the S&P 500’s robust RSI of 59.6. This situation might prompt bullish investors to view the lower RSI as an exhaustion of recent selling pressure, suggesting potential buying opportunities in the near future.

Reflecting on DFNM’s performance, the stock has a 52-week low of $46.10 and a high of $48.67, making the current share price of $47.86 relatively close to the low end of this range. Today’s trading shows DFNM shares down approximately 0.4%.

![]() Explore other oversold dividend stocks that could be of interest »

Explore other oversold dividend stocks that could be of interest »

Also see:

Apparel Stores Dividend Stocks

PBBI YTD Return

ADS YTD Return

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.