Analysts Predict Upside Potential for Dimensional US Marketwide Value ETF

Recent analysis of the Dimensional US Marketwide Value ETF (Symbol: DFUV) shows promising prospects based on underlying stock valuations.

ETF Channel has evaluated the trading prices of ETF holdings against the average analyst’s 12-month target prices. The findings suggest that the implied target price for DFUV is $48.76 per unit. With the ETF currently priced around $43.19, this indicates a potential upside of 12.90% based on the average expectations of analysts for the constituent stocks.

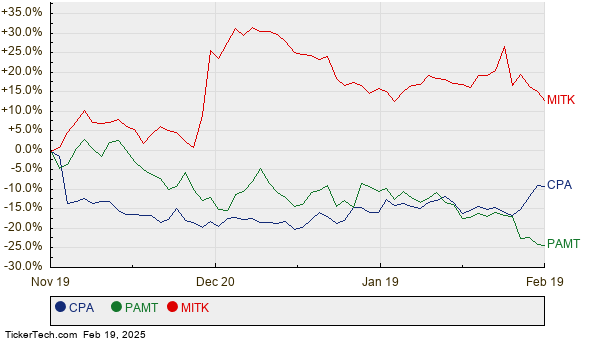

Among DFUV’s significant holdings, three stocks exhibit noteworthy upside potential: Copa Holdings S.A. (Symbol: CPA), PAMT Corp (Symbol: PAMT), and Mitek Systems, Inc. (Symbol: MITK). Currently, CPA trades at $97.37, yet analysts predict a target price of $147.27, representing a substantial 51.25% increase. PAMT shares, priced at $14.05, may rise to an average target of $19.00, indicating a 35.23% upside. Lastly, MITK, trading at $9.79, shows a target price of $13.10, suggesting an increase of 33.81%. The chart below compares the price performance of these stocks over the past year:

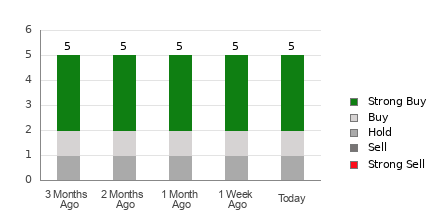

Below is a summary of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Dimensional US Marketwide Value ETF | DFUV | $43.19 | $48.76 | 12.90% |

| Copa Holdings S.A. | CPA | $97.37 | $147.27 | 51.25% |

| PAMT Corp | PAMT | $14.05 | $19.00 | 35.23% |

| Mitek Systems, Inc. | MITK | $9.79 | $13.10 | 33.81% |

These findings raise critical questions: Are analysts too optimistic about these stocks’ potential for growth in the coming year? A high price target can signify confidence, but it also presents the risk of adjustments if circumstances shift. Investors may need to conduct further research to determine the validity of these targets in light of current company and market developments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• CYRN market cap history

• META YTD Return

• QJX Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.