iShares Core Dividend Growth ETF Forecast Shows Significant Upside Potential

In our analysis at ETF Channel, we examined the underlying holdings of various ETFs to assess their projected performance. Specifically, for the iShares Core Dividend Growth ETF (Symbol: DGRO), we calculated the weighted average implied analyst target price, which stands at $71.03 per unit.

Currently, DGRO is trading at approximately $62.60 per unit. This indicates that analysts expect a potential upside of 13.47%, based on the average target prices for its underlying holdings. Among these holdings, three companies stand out with significant expected gains: Cactus Inc (Symbol: WHD), Enpro Inc (Symbol: NPO), and CSW Industrials Inc (Symbol: CSWI).

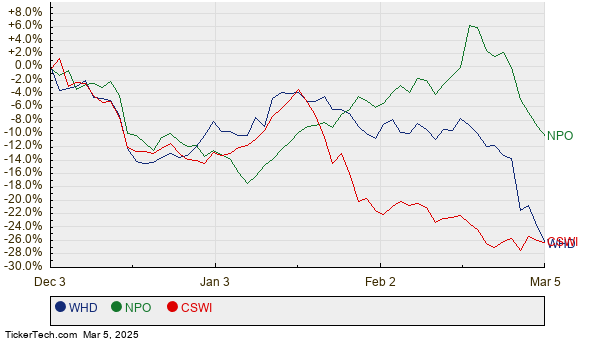

For instance, WHD has a recent trading price of $48.54 per share, while analysts have set an average target of $63.00 per share, reflecting a potential upside of 29.79%. Similarly, NPO is currently priced at $174.75, with a target increase of 27.32% to an average of $222.50 per share. Lastly, CSWI has a recent price of $301.81 and an average analyst target of $381.20, equating to a potential upside of 26.30%. Below is a twelve-month price history chart comparing the stock performance of WHD, NPO, and CSWI:

Here is a summary table highlighting the current analyst target prices for the stocks discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend Growth ETF | DGRO | $62.60 | $71.03 | 13.47% |

| Cactus Inc | WHD | $48.54 | $63.00 | 29.79% |

| Enpro Inc | NPO | $174.75 | $222.50 | 27.32% |

| CSW Industrials Inc | CSWI | $301.81 | $381.20 | 26.30% |

Investors may wonder if analysts’ targets are realistic or overly optimistic regarding these stocks’ future trading prices within the next twelve months. Understanding whether the provided reasoning behind these targets is solid or outdated due to recent industry shifts is crucial. A high target relative to the current trading price reflects optimism but may also signal the potential for downward adjustments if the targets are based on previous data. These considerations warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding SWBK

• KXI Dividend History

• EFNL Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.