Diageo Faces Stagnation Amid Shifting Consumer Trends

Diageo (DEO), the well-known producer of spirits such as Johnnie Walker, Guinness, and Tanqueray, has struggled with stagnant sales growth. This lack of progress over the last three years raises concerns about its future.

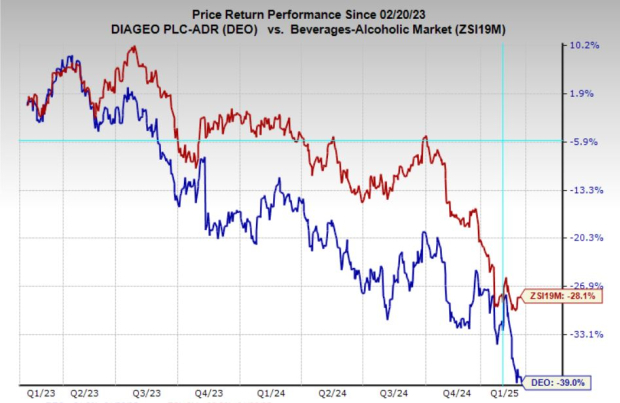

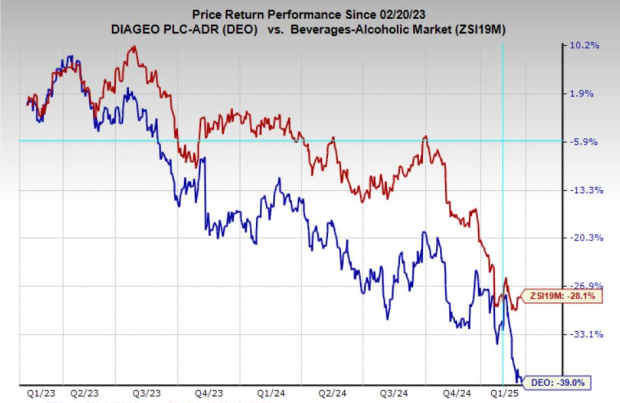

Compounding these issues, the company’s earnings estimates have declined over the past year. Analysts are projecting a Zacks Rank #5 (Strong Sell) rating for DEO stock, signifying a downward trend. In fact, DEO has underperformed compared to competitors and the overall market, prompting alarm regarding its short-term outlook.

Image Source: Zacks Investment Research

Sales Struggles and Falling Earnings Projections

Diageo has experienced limited growth in revenue over recent years. As illustrated in the revenue chart, sales have stagnated since 2021, and this lack of advancement is particularly alarming for a brand reliant on premium products and global outreach.

The disappointing revenue is now mirrored in Diageo’s earnings outlook. Analysts have collectively revised down their earnings predictions for this year by 4.2%, with a further decrease of 3.5% expected for next year.

With dwindling earnings estimates and a continuously underperforming stock price, Diageo may be navigating through structural obstacles that could hinder its potential for growth in the near future.

Image Source: Zacks Investment Research

Confronting Changing Drinking Habits

A significant challenge for Diageo comes from shifting drinking habits among younger consumers. Research indicates that this demographic is consuming less alcohol than older generations, posing a long-term risk for alcohol brands.

A 2023 Gallup survey reveals a notable decline: the proportion of adults under 35 who drink alcohol dropped from 72% in 2001-2003 to only 62% by 2021-2023. This trend highlights a shift towards healthier lifestyles and a greater inclination to try non-alcoholic beverages.

Is DEO Stock Worth Avoiding?

Given the slow sales growth, falling earnings predictions, and evolving consumer preferences, Diageo is currently facing notable hurdles. Although the company’s premium branding has been a strong point, the shift in drinking behaviors among younger consumers and growing competition from non-alcoholic alternatives may hinder long-term expansion.

Until there is a resurgence in sales growth or improvements in earnings outlook, investors may consider avoiding DEO stock in favor of more promising opportunities.

5 Stocks Set to Double

These stocks have been selected by Zacks experts as their top picks, expected to grow by +100% or more in 2024. Previous recommendations have seen remarkable increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks featured in this report are currently under the radar of Wall Street, presenting a timely entry opportunity.

Today, See These 5 Potential Home Runs >>

Free Stock Analysis Report on Diageo plc (DEO)

Click here to read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.