DigitalOcean DOCN is gearing up to unveil its fourth-quarter 2023 performance on Feb 21.

Expectations are high, with DigitalOcean eyeing revenues of $178 million for the quarter.

The Zacks Consensus Estimate places fourth-quarter revenues at $178.26 million, indicating a 9.36% annual growth.

The company foresees earning per share in the range of 36-37 cents.

Analysts predict fourth-quarter earnings to be 37 cents per share, marking a 32.14% year-over-year increase.

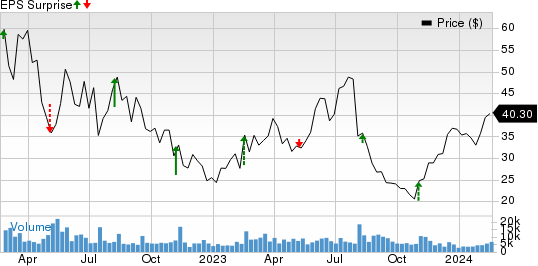

Understanding DigitalOcean Holdings, Inc.’s Price and EPS Performance

DigitalOcean Holdings, Inc. price-eps-surprise | DigitalOcean Holdings, Inc. Quote

DOCN has outperformed the Zacks Consensus Estimate for earnings in three of the last four quarters, with an average surprise of 19.04%.

Let’s assess the factors that have possibly influenced the upcoming earnings release.

Key Factors to Consider

DigitalOcean’s fourth-quarter performance is anticipated to have been fueled by its robust product portfolio and the strong demand for its IaaS and PaaS offerings.

The company’s increased investments in product and infrastructure enhancements might have acted as a driver for its financials, coupled with the introduction of innovative services like Managed Kafka, premium general-purpose droplets, and scalable storage for databases.

Digital Ocean’s growing demand for AI-related services following its integration of Paperspace’s AI/ML capabilities is also expected to have bolstered its revenue growth during the quarter under review.

Furthermore, the company’s effective customer acquisition and graduation model, leading to a steady rise in average monthly revenue per customer, is likely to have contributed to overall revenue growth.

Evaluating Our Model

According to the Zacks model, the combination of positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) augments the likelihood of an earnings beat. However, this is not the case here.

DigitalOcean has an Earnings ESP of 0.00% and a Zacks Rank #3.

Let’s explore other stocks that show potential for beating earnings estimates in their upcoming releases:

Inseego INSG has an Earnings ESP of +4.17% and a Zacks Rank #2.

Inseego shares have surged by 54.2% year to date, and it is set to reveal its fourth-quarter 2023 results on Feb 21.

Vertiv VRT has an Earnings ESP of +1.90% and is currently assigned a Zacks Rank of 2.

VRT shares have risen by 31.1% year to date, and the company is scheduled to report its fourth-quarter 2023 results on Feb 21.

NVIDIA NVDA has an Earnings ESP of +3.67% and holds a Zacks Rank #2.

NVIDIA’s shares have seen an uptick of 46.6% year to date, and NVDA is expected to report its fourth-quarter fiscal 2024 results on Feb 21.

Stay informed about upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Highlights Top Semiconductor Stock

At just 1/9,000th the size of NVIDIA, which has surged over 800% since being recommended, this new leading chip stock has enormous potential for growth.

With strong earnings growth and an expanding customer base, it’s poised to satisfy the soaring demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

Access This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Inseego (INSG) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

DigitalOcean Holdings, Inc. (DOCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.