A Savory Earnings Platter

Dine Brands Global, Inc. (DIN) recently unveiled their fourth-quarter fiscal 2023 results, showcasing a stellar performance. The numbers proved to be a delectable treat for investors as earnings outshined the Zacks Consensus Estimate while revenues hit the bullseye.

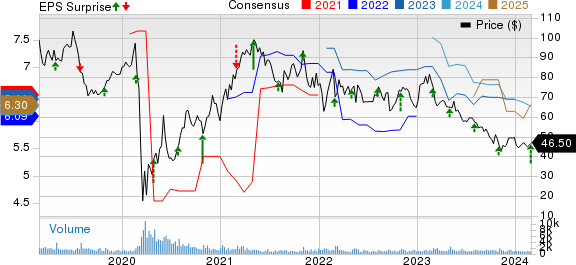

Adjusted earnings per share (EPS) knocked it out of the park at $1.40, surpassing the consensus estimate of $1.12, marking a substantial climb from the previous year’s figure of $1.34. The surge was fueled by a boost in segment profit, reduction in administrative expenses, and a strategic decrease in diluted shares through buybacks.

Total revenues for the quarter stood at $206.3 million, aligning perfectly with the Zacks Consensus Estimate. Despite a slight 0.8% dip from the prior year, the company managed to juggle challenges like refranchising a number of Applebee’s units and fluctuating same-restaurant sales growth at both Applebee’s and IHOP.

Brand Performances Under the Microscope

While Applebee’s witnessed a domestic system-wide decrease of 0.5% in comps, IHOP raised the bar with a 1.6% uptick in domestic system-wide comps, showcasing the brand’s resilience and popularity.

Costs, Profits, and Fiscal Fitness

The fiscal fourth quarter saw a commendable 4.5% drop in total cost of revenues to $107.9 million, as gross profits climbed by 4.1% year-over-year to $98.4 million. General and administrative expenses also witnessed a pleasing 14.1% downturn to $50.5 million, underlining the company’s prudent financial management.

Checking the Balance Sheet

As of Dec 31, 2023, cash and cash equivalents stood at $146 million while long-term debt totaled $1.28 billion. The company registered a healthy cash flow from operating activities, reflecting sound financial stewardship across the board.

Looking forward to 2024, Dine Brands anticipates a strong performance, with Applebee’s and IHOP gearing up for impressive domestic system-wide comparable same-restaurant sales performances along with careful management of expenses and capital expenditures.

Insights and Rankings

As per current rankings, DIN flaunts a Zacks Rank #3 (Hold), showcasing stability in its operational outlook. This steady positioning indicates the company’s sound financial standing and future growth potential, reassuring investors of a resilient brand image.

A Taste of Industry Peers

In the flavorful world of retail-wholesale, behemoths like McDonald’s Corporation and Yum China Holdings, Inc. have also displayed robust performances in their recent quarters, underlining a positive trend in the sector.

Brinker International, Inc. also joined the bandwagon by impressing investors with its second-quarter fiscal 2024 results, delivering a promising show in the competitive landscape of the hospitality industry.

Need more investment inspiration? Consider unleashing the power of ChatGPT Stock Report to gain insights into potential sky-high growth prospects in the Artificial Intelligence realm. The future beckons with exciting opportunities, and automation might just pave the way for miraculous outcomes.

Download Free ChatGPT Stock Report Right Now >>