Directors’ Insider Buys: John H. Stone Invests in Cummins, Inc.

Directors of companies often have valuable insights about their businesses. When they choose to invest their own money by purchasing stock, it typically signifies their belief in the company’s future profitability. This analysis examines significant insider buys by company directors over the past six months, including a notable $332.1K investment by John H. Stone, a Director at Cummins, Inc. (Symbol: CMI).

| Purchased | Insider | Title | Shares | Price/Share | Value |

|---|---|---|---|---|---|

| 05/16/2025 | John H. Stone | Director | 1,000 | $332.08 | $332,079.90 |

Stone’s average purchase price stands at $332.08 per share. On Monday, investors could acquire shares of Cummins, Inc. at a cost below this, with prices dropping to as low as $328.17 per share. At the time of this report, Cummins shares were trading at $336.41, reflecting a 0.6% increase on the day.

The chart below illustrates the one-year performance of CMI shares against their 200-day moving average:

CMI’s stock has experienced a 52-week range from a low of $260.0189 to a high of $387.90, with the last trade price noted at $336.41.

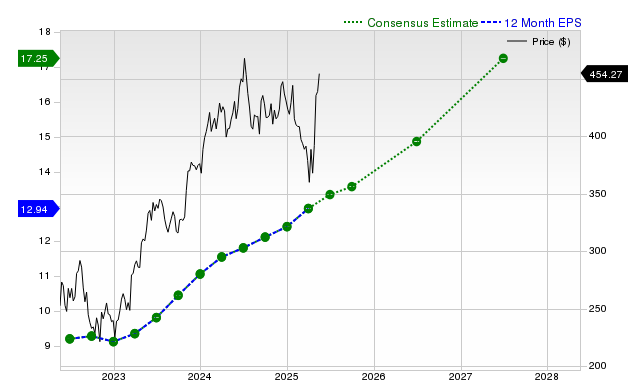

Currently, Cummins, Inc. pays an annualized dividend of $7.28 per share, distributed in quarterly installments. The next ex-dividend date is set for 05/23/2025. Below is a long-term dividend history chart for CMI, which may assist in evaluating the sustainability of the recent dividend yield of approximately 2.2%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.