Cybersecurity Market Growth: A Valuable Investment Opportunity

Cybersecurity is increasingly gaining attention as an essential market segment. While technology headlines often spotlight other industries and gold captures the limelight, cybersecurity remains crucial to the functioning of the modern economy. Investors are increasingly aware of its potential.

According to Grand View Research, the global cybersecurity market was valued at $245.62 billion last year. Projections indicate that by 2030, this sector could expand to generate revenues of $500.7 billion, reflecting a compound annual growth rate (CAGR) of 12.9%. This growth is fueled by the rise of e-commerce platforms, the proliferation of smart devices, and the widespread adoption of cloud computing.

Notably, Josh Brown from Ritholtz Wealth Management has underscored the importance of cybersecurity stocks, indicating that enterprises are unlikely to cut their spending in this area. While this assertion may be somewhat hyperbolic, the reality is that weak digital security can lead to severe consequences. Therefore, companies have compelling reasons to invest in robust cybersecurity measures.

Investor sentiments reflect this view, with Stephanie Link of Hightower Advisors spotlighting Palo Alto Networks Inc PANW as a prime opportunity amidst challenging economic conditions, including tariffs imposed during President Donald Trump’s administration. With its next-gen security offerings growing at a pace of 30% annually, Palo Alto appears well-equipped to navigate economic turbulence.

However, the sector and Palo Alto Networks Stock face challenges. The tariffs have created instability, leading to concerns for some cybersecurity firms. Although Palo Alto has adapted by shifting manufacturing to Texas, other economic factors—like rising gold prices—pose risks, particularly concerning client retention.

Moreover, Palo Alto has signaled intentions to reduce future spending on artificial intelligence, another crucial area of technology. If economic pressures persist, it’s unrealistic to assume that cybersecurity will remain entirely insulated from market fluctuations.

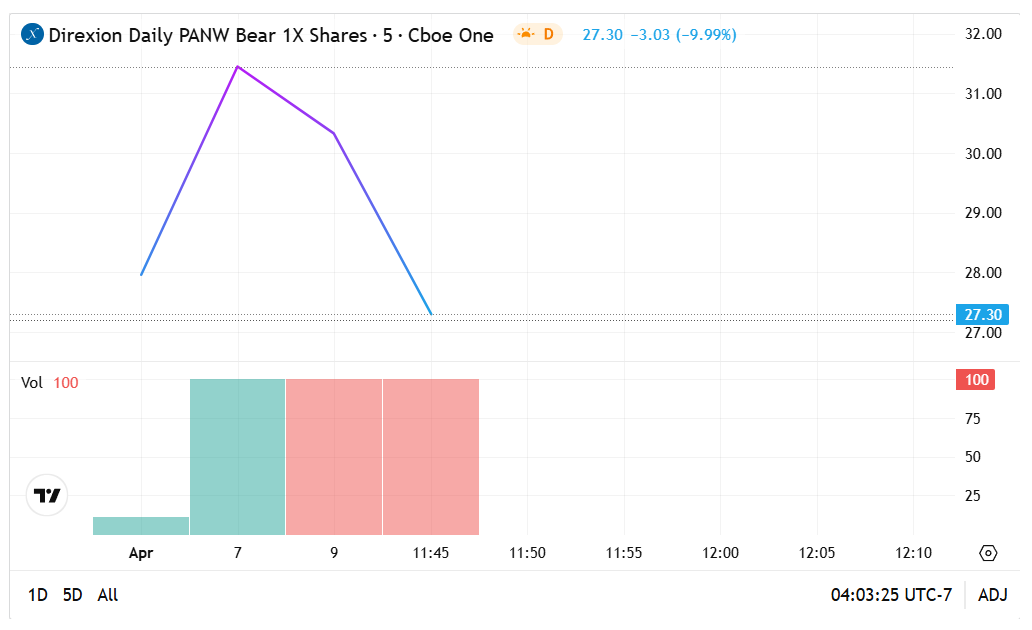

Leveraged ETFs: Investment Avenues Against this backdrop, investors contemplating long or short positions on PANW Stock may find opportunities in two leveraged ETFs: Direxion Daily PANW Bull 2X Shares PALU and Direxion Daily PANW Bear 1X Shares PALD.

As the names imply, these funds aim to achieve daily performance results of 200% and 100% of the inverse of the performance of PANW Stock, before fees and expenses.

Investors may favor PALU and PALD for their straightforward structures. For those looking to leverage positions on PANW or short the stock, traditional options may complicate the process with multi-leg transactions. In contrast, Direxion’s ETFs trade like any other public security.

Nonetheless, risks are inherent in trading PALU and PALD, which potential investors should understand. Both leveraged and inverse funds can exhibit significant volatility. Additionally, they are designed for short-term exposure, with longer holdings risking performance distortions from daily compounding.

Insights on the PALU ETF Essentially a newcomer with its launch in late March, technical analysis for the PALU ETF is limited. Its inception coincided with challenging market conditions, potentially skewing perceptions of the fund’s performance.

- Despite rough timing, the 2X ETF has shown resilience by rising from the $15 level and appears to be forming a cup and handle pattern, which may suggest bullish prospects.

The PALD ETF Similarly launched in late March, the PALD ETF lacks substantial historical data as well.

- This inverse fund appears to have had a favorable launch period, but its price movement suggests it may be forming a head and shoulders pattern, indicating potential downside risk.

Featured image by wastedgeneration from Pixabay.